Anna Milne selects the key findings and takeaways of one of the industry’s most comprehensive overviews of the payments industry, with additional comments from Citibank, DBS, Standard Chartered and ANZ

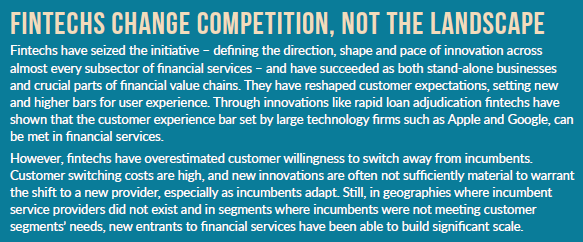

A dramatic shift from physical to virtual commerce; the inevitable dominance of the so-called large tech companies; the growing power of merchants to influence the payments ecosystem and increasing consumer empowerment all threaten the livelihood of traditional payment institutions, according to the World Economic Forum’s report on the future of fintech.

Yet the banks still retain the dominant customer share. And, crucially, the fintechs misunderstood consumer appetite for switching and have only succeeded in emerging markets without much of a financial services footprint.

These things considered, how will the landscape evolve- will there be further divergence or increased collaboration? The report takes into account the various factors influencing the payments path of progression, and while we cannot say yet what the future holds, there are some top tips not to be ignored.

REGIONAL VARIATIONS

Highlighting the factors leading to regional variations in financial services models, the World Economic Forum has come up with three archetypes across three different regions:

In Europe, Regulatory focus on consumer protection and open data drives the development of platform ecosystems across many verticals, resulting in pressure for incumbents. Example – MiFID: The European Markets in Financial Services Directive is designed to introduce more transparency to capital markets; trade execution firms must show clear evidence of “best execution”.

In China, an ecosystem based on mobile connectivity and the absence of major consumer-focused bank services along with regulation that for the most part encourages innovation have enabled large tech organisations to build significant market share. Example – Alipay: In the absence of a mature payments system, the Alipay mobile payment app now owns over 50% of the $5.5trn Chinese mobile payments sector, with tech giant Tencent as its only major competitor.

In the US, a mature financial ecosystem in combination with unclear regulatory direction means that changes to the current ecosystem will be gradual. Example – Nacha: The Automated Clearing House (ACH) network is moving to same-day payments, but progress remains slow compared to other countries, such as the UK, which adopted real-time payments in 2008.

LARGE TECHS

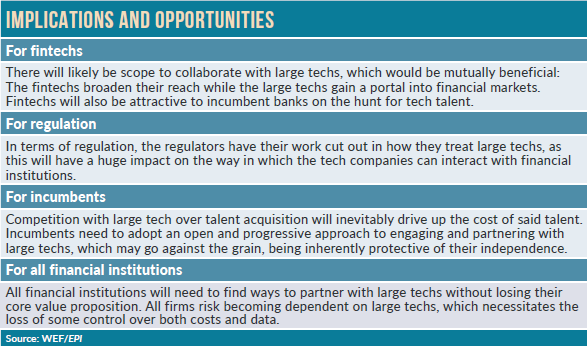

The report alludes to the inevitable dominance of what it calls the “large techs” – Amazon Web Services (AWS), Alibaba, Apple, Google, WeChat, Facebook – leading to all firms becoming dependent on these large techs or else falling behind.

AWS already has a variety of financial services firms – from JPMorgan to startups such as Xignite – using its data processing and storage services.

DBS BANK

Chew Yung Jin, senior vice president and head of card products, DBS Bank, explained how the bank maintains a pioneering approach to problem-solving.

This is the bank where the CIO is the only ‘tech’ person in his team. “We took eight people out of their day jobs – across cards, deposits, marketing, operations – and sent them to work on this problem,” the problem being, to create a payment product for children, to educate them in the way of digital financial services.

DBS Bank won a total of eight awards at the annual Cards and Electronic Payments International (CEPI) Summit and Awards on 7 September, including the Institutional Leadership Award.

POTENTIAL END STATES

The report gives three potential so-called end states for payments. It specifies cash displacement, regional disparity and pressure on payments businesses’ margins due to regulatory pressure and increased competition as hallmarks of disruption in the last decade.

To specify further, consumers have come to expect payments to be free as a result of ‘hidden fees’ and schemes such as faster payment schemes, which are free to the end consumer.

The WEF states: “Several jurisdictions, including Europe, Canada and Australia, have either passed or are passing legislation limiting the fees charged on transactions, thus limiting the profitability for all intermediaries.

“Europe, specifically, is implementing the EU Interchange Fee Regulation (IFR), and weakening ‘honour all cards’ rules (which forbid merchants from being selective over card acceptance), making high-fee credit cards unattractive for merchants to accept.”

Fintechs are also moving into forex, according to the report, lowering revenues that financial institutions can earn in this area. Apple Pay, Bitcoin and Uber are given as epitomes of the changes in the system.

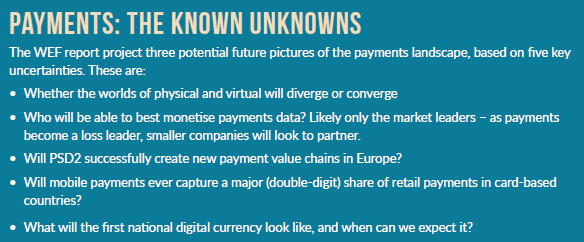

Interestingly enough, the Forum states categorically that mobile payments remain compromised in card-based markets, as they “have not sufficiently exceeded the functionality of pre-existing solutions”.

As for alternative currencies, Bitcoin and the like, these “remain almost non-existent”. JP Morgan boss Jamie Dimon came out against bitcoin at an investor conference in New York in September saying it was “worse than tulip bulbs. It won’t end well. Currencies have legal support. It will blow up,” adding he would fire any trader in a second who traded in bitcoin.

Cash displacement, incidentally, has been driven in the main by the shift from bricks-and-mortar shopping to online, according to the report. The change in the space of just one year in the US on Black Friday illustrates this.

US E-COMMERCE

A great deal of e-commerce growth in the US in 2016 can be attributed to Amazon – 53% no less, according to Slice Intelligence – and this can be attributed in large part to the success of Amazon Prime, which now counts 80 million subscribers.

In November 2016, China’s physical retail market recorded its lowest level of growth in over a decade as it slowed to 10%, according to the Financial Times.

Singles Day, the online shopping phenomenon that kicks Black Friday into touch, was devised by Alibaba to “celebrate” singlehood, and falls on 11 November (11.11), signifying single status.

FRAGMENTATION

If the payments landscape continues to fragment, and payment apps continue to increase in number, tracking and budgeting apps may become more popular, and could be a focus for intermediaries with which to provide a service.

The real nut to crack is, however, data monetisation, and the report reiterates this over and again. It is not yet clear how exactly this can happen; it is the golden question. It does state, however, that “data streams will be significantly more valuable where they are granular (e.g. product-level data) and multidimensional (e.g. location data), making cooperation and partnerships critical to successful monetisation.”

The WEF predicts that payments institutions will focus on how their customers prefer to pay, rather than what the latest technology will enable, leading to regional solutions, based on culture.

Large merchants will become even larger and more powerful, says the report. A combination of their product-level payments data and their position to be able to influence consumer payment choice- especially in online transactions will grant them greater authority to negotiate lower fees and mould the direction of payments ecosystems.

Balaji Natarajan, head of payments and receivables, Asia, ANZ, made similar remarks at the Cards and Electronic Payments (CEPI) annual Summit and Awards in Singapore, early September. He said online retailers such as Amazon are in a brilliant position: “They have a complete end-to-end view of the customer, and have all that information about customer behaviour and preferences easily accessible and right in front of them. The banks don’t have that.”

Banks are looking to try to gain a better overall view of customers. At CEPI, Surabhi Agarwal, head of premium cards, Asia and EMEA, Citibank, explained what Citibank calls Contextual Commerce; this is the bank “embedding itself in the customer’s life”.

Partnering with LINE, Thailand’s premier mobile app and messaging platform, the bank was able to get a rich view of its customers – who apparently spend on average five hours a day using the service, but that is a different story – enabling it to design and grow a loyalty rewards programme based around the growing travel sector.

And JP Morgan has implemented a new customer management and analytics tool, to inform and enable cross-selling, “a little bit like how Amazon suggests what you might like to buy next”.