Low consumer awareness and poor payment infrastructure have contributed to the prevalence of cash in Azerbaijan, which is hindering the development of the country’s financial system

Azerbaijan is a cash-based society, due mainly to the high unbanked population which accounted for 62% of the total population in 2016.

The government has taken several initiatives to increase awareness of non-cash payments through financial literacy programs, higher cash-withdrawal fees, and new regulations limiting cash transactions among individuals and businesses.

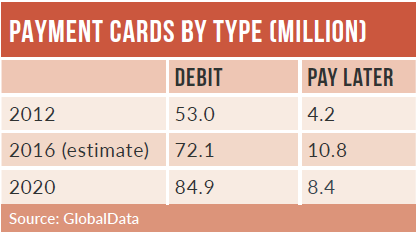

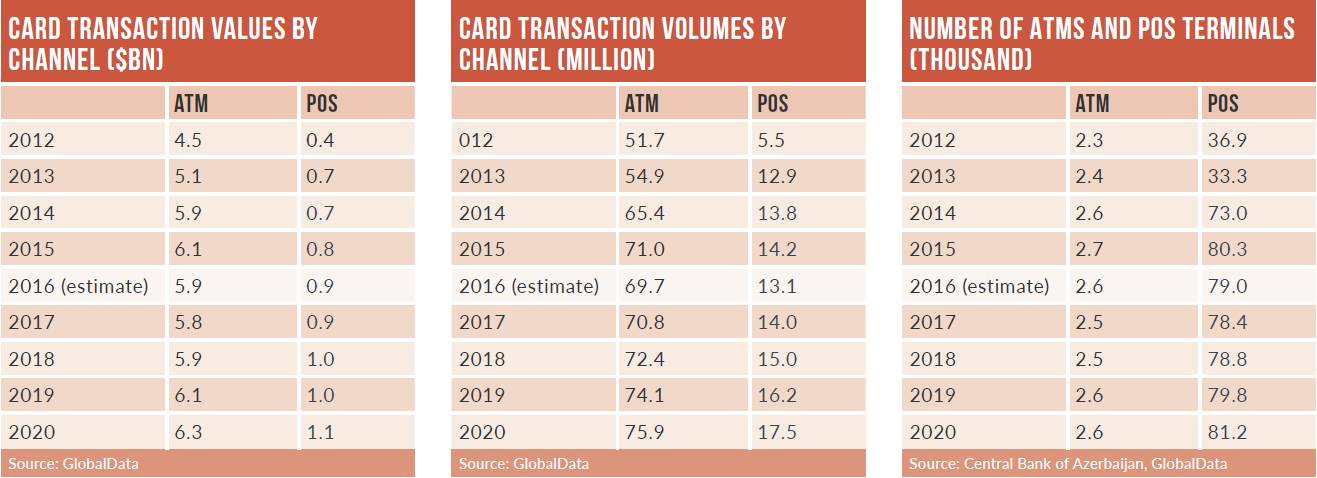

Payment cards gradually gained prominence in Azerbaijan between 2012 and 2016, due to sustained government efforts and banks’ and scheme providers’ marketing strategies to promote their use. The government launched an e-government site in 2013, enabling citizens to pay utility and tax bills, and customs payments online.

The Central Bank of the Republic of Azerbaijan has focused on financial inclusion to bring the large unbanked population into the financial mainstream. It has run various workshops and promotional campaigns in association with banks and scheme providers to develop card payments.

National postal service provider Azeri Post has also played a key role in promoting use of payment cards. In April 2010 Azeri Post was granted a license by the central bank to offer financial services such as postal accounts, money transfers and savings, and to issue postal cheques and debit and credit cards. Azeri Post signed an agreement with MilliKart on June 15, 2010 to issue payment cards.

As a result, the country’s banked population gradually increased between 2012 and 2016. According to World Bank statistics, the percentage of individuals with an account at a bank or other type of financial institution grew from 19.8% in 2012 to 38.0% in 2016.

The primary use of debit cards is for distributing payroll and social benefits. According to central bank statistics, the number of social cards stood at 2.6 million, and salary debit cards stood at 1.5 million as of December 2016.

The primary use of debit cards is for distributing payroll and social benefits. According to central bank statistics, the number of social cards stood at 2.6 million, and salary debit cards stood at 1.5 million as of December 2016.

The government distributes benefits such as pensions and social insurance through banks under the State Social Protection Fund (SSPF). This has encouraged banks to offer social cards, and all major banks now offer cards to senior citizens to enable them to withdraw pensions. According to the SSPF, there were 3.2 million beneficiaries registered as of March 1, 2016.

Pay later card penetration in Azerbaijan was 6.7 per 100 individuals in 2016, which is low compared to peers Turkey (75.5), Russia (20.3), Poland (16.0), Romania (13.5), Kazakhstan (13.4) and Ukraine (6.6).

The low penetration rate is a result of low levels of financial literacy in the country. The high cost of lending, which generally varies from 10% to 35%, has also affected credit card market growth. The availability of overdraft facilities on bank accounts has further decreased the need for separate credit cards in Azerbaijan.