Ireland

Contactless growth soars

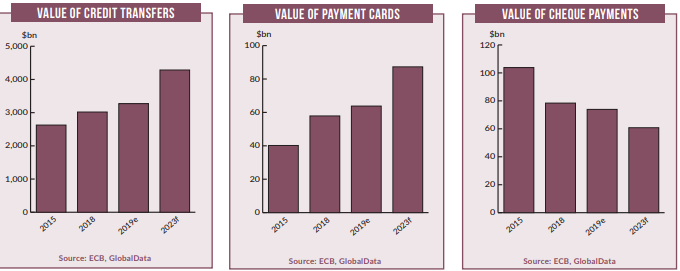

Although cash accounts for 43.7% of total payment transaction volume in 2019, Irish consumers are increasingly using their payment cards to make purchases. This is highlighted by the fact that card payments volume recorded a significant compound annual growth rate (CAGR) of 19.7% between 2015 and 2019.

This can be attributed to government and banking sector efforts to drive card usage, including the e-Day initiative, higher contactless payment limits, charges on ATM withdrawals, and growing acceptance of payment cards among retailers.

The launch of digital financial services providers such as N26 and Revolut has seen Irish consumers increasingly turn towards low-cost channels such as mobile and internet banking, resulting in increased use of electronic payments.

The launch of digital financial services providers such as N26 and Revolut has seen Irish consumers increasingly turn towards low-cost channels such as mobile and internet banking, resulting in increased use of electronic payments.

Contactless card usage has also seen healthy growth in the past few years, with the vast majority of contactless users seeing these cards as helpful. Indeed, widespread adoption of contactless payments – backed by strong contactless infrastructure – is anticipated to further drive electronic payments.

A wide range of alternative payment brands (covering e-commerce and mobile proximity payments) are available, including the likes of Apple Pay and Google Pay. However, there are some notable areas of weakness in the market. The mobile proximity payments market in particular remains still underdeveloped.

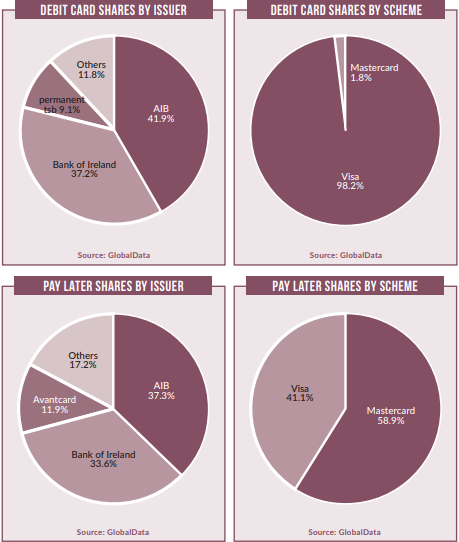

Debits cards are the most used card type for payments

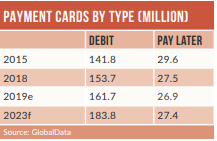

Debit cards remain the preferred payment card in Ireland, accounting for 80.2% of card payment transaction value in 2019. The high adoption of debit cards is supported by the country’s strong banked population, as well as the proliferation of bank accounts issuing debit cards as standard.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

In addition, the continued shift away from cash payments in favor of debit cards resulted in a significant increase in the frequency of debit card payments, which nearly doubled from 111.3 times per card per year in 2015 to 211.0 in 2019 – far more than credit cards. Banks also offer reward points on debit cards, which helps boost usage.

Contactless payments grew in popularity

Contactless payments are rapidly growing in Ireland, with all of the major banks now offering contactless cards. According to Banking & Payments Federation Ireland’s (BPFI’s) Payments Monitor report, in H2 2018 the number of contactless payments rose 60% year on year to 195 million, valued at over €2.5bn ($2.86bn). There were around 4.6 million contactless debit cards and 1.3 million contactless credit cards in Ireland as of H2 2018. To further boost uptake, the government increased the contactless payment limit from $17.18 to $34.37 in October 2015.

E-commerce growth will support the payment market

The e-commerce market registered robust growth, increasing from $6.68bn in 2015 to $9.51bn in 2019 at a CAGR of 9.2%. This growth was largely driven by growing internet and smartphone penetration.

Online shopping events such as Black Friday and Cyber Monday have also helped boost e-commerce sales. Credit cards are the most widely used payment method for online transactions, followed by debit cards. However, alternative payment solutions such as PayPal, Visa Checkout, Google Pay, and Masterpass are increasingly being used for online purchases.

The Irish prepaid card market is on the rise, with support from non-banking companies

The prepaid card market recorded CAGRs of 8.0% and 6.9% in terms of number of cards in circulation and transaction value between 2015 and 2019. This trend is anticipated to continue over four year period to 2023. Banks in Ireland focus on the debit and credit cards while non-bank rivals such as SWIRL and An Post focus on the prepaid card market.

Ireland-based prepaid card company SWIRL offers three variants: SWIRL Mastercard, SWIRL Gift Card, and SWIRL FX Card.

Mexico

Convenience stores key to payment system

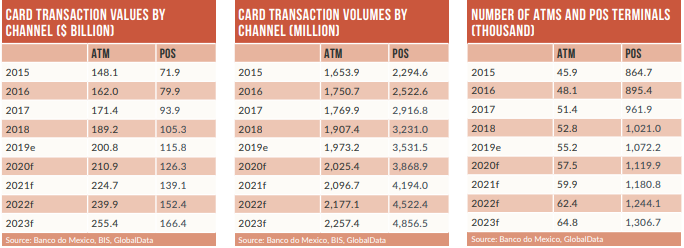

Cash dominates the payments landscape in Mexico, accounting for 88.8% of overall payment transaction volume in 2019. But with the government and the central bank promoting electronic payments, growing consumer awareness, and a gradual rise in the acceptance of payment cards, Mexicans are gradually shifting towards electronic payments.

The central bank and financial institutions have taken a number of steps to boost financial inclusion, such as insurance coverage on deposit accounts, low-cost bank accounts, and electronic disbursement of social benefits.

To increase merchant acceptance, the central bank has capped interchange fees on debit and credit card transactions, while banks are reducing their merchant discount rates.

While debit cards have higher penetration, they are mostly used for ATM cash withdrawals. Credit and charge cards are used more frequently for payments. The gradual adoption of contactless technology, a strong e-commerce market, and the launch of the CoDi payment system will further push electronic payments in Mexico.

Digital accounts are driving card adoption

The uptake of digital bank accounts is on the rise in Mexico, with all major banks offering these accounts. This in turn helps boost card adoption and usage. BBVA enables individuals to open a basic digital account via its mobile banking app within eight minutes. Account holders receive a free debit card on request.

Introduced in mid-2016, the bank had 1.7 million digital account holders by the end of March 2019. In a move to increase this number further, BBVA partnered with Uber in July 2019, offering bank accounts for unbanked drivers that can be opened via the Uber app. Account holders are also offered a Driver Partner Mastercard debit card.

Targeting the unbanked segment

One of the key challenges keeping cash on top in the Mexican economy is the large unbanked population. In order to expand their reach to this huge untapped market, banks offer services via agent networks, which mostly consist of convenience stores. For instance, Santander offers banking services via 25,275 service points across a range of convenience stores. These stores also facilitate payments for e-commerce purchases and utility bills. By the end of 2018 the number of banking agents in the country stood at 44,809 – an increase of 4% compared to the previous year.

Rising e-commerce will support the payments industry

Mexico is among the largest e-commerce markets in Latin America. The market recorded significant growth during the four year period to 2019, supported by rising internet and smartphone penetration, improving consumer confidence, and a growing number of retailers entering the online space. H&M, Maskota, and Liverpool are among the recent entrants.

In addition, improving logistics and the availability of alterative payment solutions such as PayPal, Samsung Pay, and Masterpass will further support growth in the Mexican e-commerce market.

In addition, improving logistics and the availability of alterative payment solutions such as PayPal, Samsung Pay, and Masterpass will further support growth in the Mexican e-commerce market.

The high unbanked population offers huge potential for prepaid card market growth

The prepaid card market, although nascent, grew at a moderate pace, recording a CAGR of 6.3% in terms of transaction value between 2015 and 2019. The high unbanked population, the disbursement of social welfare via prepaid cards, and the availability of remittance cards drove the overall prepaid card market. Targeted at unbanked online shoppers, Amazon partnered with Banorte to launch a Mastercard-branded prepaid card in Mexico called Amazon Rechargeable in March 2018. The card is offered free of charge with no monthly fees, and can be funded in cash at over 25,000 stores, including Oxxo, Farmacias del Ahorro, Telecomm, 7-Eleven, and Farmacias Guadalajara. The card can be used for both online and in-store payments.

Indonesia

Common standard for QR codes drives growth

Accounting for 98.1% of total transaction volume in Indonesia in 2019, cash remains the predominant payment instrument – especially among the rural population. This is mainly due to the high unbanked population, inadequate banking infrastructure, limited public awareness of electronic payments, and low acceptance of payment cards at merchant outlets.

However, the government has undertaken various initiatives including the introduction of a National Strategy for Financial Inclusion, the appointment of banking correspondents in rural areas, the migration of payment cards to EMV standards, a merchant discount rate cap, compulsory use of electronic methods for toll road payments, the launch of the National Payment Gateway (NPG), and the introduction of the interoperable QR Code Indonesian Standard (QRIS).

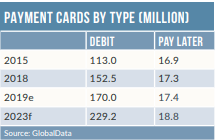

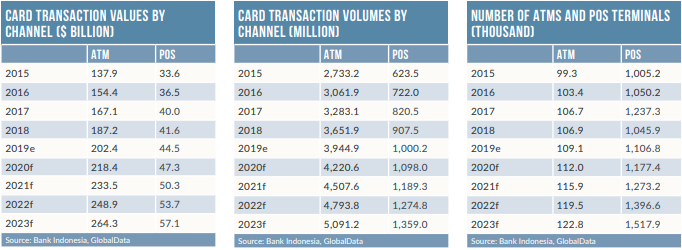

Consequently, the number of payment cards in circulation, transaction volume, and transaction value recorded robust compound annual growth rates (CAGRs) during the four years to 2019. This trend is anticipated to continue over the next four years to 2023.

The emergence of digital-only banks, alternative payment methods, contactless technology, and growth in the e-commerce market are all anticipated to support Indonesian payment card market growth going forward.

Credit card use continues to grow

Credit and charge cards account for a smaller proportion of overall payment cards in circulation. This is primarily due to strict government regulation with regards to credit card eligibility. And effective from February 2018, Bank Indonesia (the country’s central bank) mandated that all credit card issuers must submit transaction details to the tax office to curb tax evasion in the country.

Despite lower penetration, consumers are increasingly using credit cards for payments – mainly due to value-added benefits such as reward points and discounts. In addition, the cap on credit card interest rates has aided growth in the market.

E-commerce growing strongly

E-commerce registered significant growth, rising from IDR66.5tn ($4.6bn) in 2015 to $16.6bn in 2019 at a CAGR of 37.6%. Growing internet penetration, rising foreign investment, benefits such as discounts, and the convenience offered by online shopping are the key drivers.

QR code technology is also playing a role, enabling consumers to make payments by scanning QR codes displayed on merchants’ websites. In addition, shopping events during festivals as well as major shopping days such as Harbolnas, Singles’ Day, and Tokopedia Anniversary have also boosted e-commerce sales.

QRIS will push payment acceptance among smaller merchants

In August 2019, to increase acceptance of electronic payments among merchants, the central bank launched QRIS, a common standard for QR code payments. This is designed to work across all electronic money apps, electronic wallets, and mobile banking services.

The new standard will enable customers to use any QR code-based service to make payments at any merchant, thus boosting electronic and mobile payments. National QRIS implementation will come into effect from 1 January 2020. To promote this, a host of payment service providers are now offering QR code payment solutions to merchants and consumers.

Prepaid cards are offered targeting various customer needs

Prepaid card transaction value grew from $367.2m in 2015 to $4.8bn in 2019 at a CAGR of 89.8%. Growth of prepaid cards has been supported by the high unbanked rural population in the country.

As consumers are gradually using prepaid cards to conduct daily transactions, card issuers are looking to increase their customer bases. To serve travelers, Citilink Indonesia collaborated with Bank Mandiri in October 2017 to launch a co-branded e-money card.

The card is exclusively offered to Citilink Indonesia passengers and can be used to pay for travel purchases including flight tickets and meals.