Payment apps have always had much higher fraud rates than traditional payment methods, and the Covid-19 pandemic is giving app fraud added momentum.

Apps fraud is a relatively unsophisticated deception, but it is extremely effective due to the way in which it is delivered.

Fraudsters gain access to an individual’s information, usually via a hacked email account, and then present themselves as a company with whom the hacked account owner is already doing business.

From there, the con artist will ask for a payment to be made to a bank account that is supposedly held by the legitimate company they are pretending to be.

While this may sound like it would set alarm bells off if you were to receive such a request, the scammers are cunning enough to bide their time and wait for the most opportune moment in which to strike.

Fraud rates three to four times higher than for traditional methods

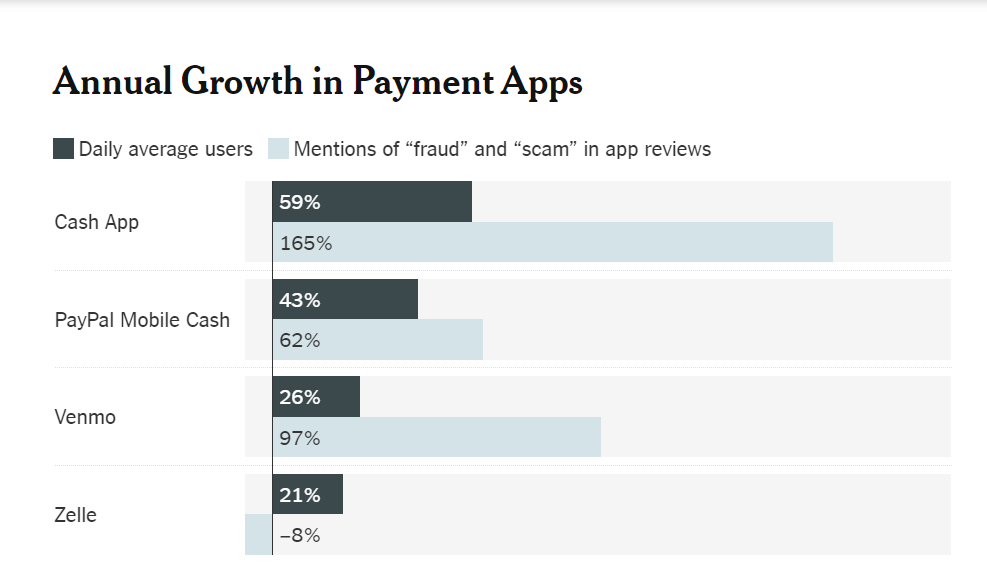

Recently, people have flocked to instant payment apps like Cash App, PayPal’s Venmo and Zelle as they have wanted to avoid retail bank branches and online commerce has become more ingrained.

To encourage that shift, the payment apps have added services like debit cards and routing numbers so that they work more like traditional banks.

But many people are unaware of how vulnerable they can be to losses when they use these services in place of banks.

Payment apps have long had fraud rates that are three to four times higher than traditional payment methods such as credit and debit cards, according to data from the security firms Sift and Chargeback Gurus.

Driving the surge is the apps’ ease of use

The fraud appears to have surged in recent months as more people use the apps.

At Venmo, daily users have grown by 26% since last year, while the number of customer reviews mentioning the words fraud or scam has risen nearly four times as fast, according to an analysis of data from Apptopia, a firm that tracks mobile services.

Source: Apptopia

People need just an email address to create a Cash App account and a phone number to make a Venmo account.

That simplicity has made it seamless for thieves to set up accounts and to send requests for money to other users, something that was not possible with traditional bank payments.

Speed invites fraud

The apps’ instantaneous transactions — compared to the two or three days needed for a standard bank transfer — have also meant that Venmo and Cash App have less time to detect whether a transaction is fraudulent.

“Fast payments equals fast fraud,” said Frank McKenna, the chief fraud strategist for the security firm PointPredictive. The apps, which are sometimes known as peer-to-peer payments services, “are super convenient for customers but that also makes them ripe targets,” he said.