The Central Bank of Nigeria (CBN) has established a QR code payments framework to be used as a standard in the country.

The nationwide framework is an important part of the bank’s overall mandate to keep the Nigerian financial system stable and safe, the CBN said.

The scheme will help promote electronic payment adoption and foster payments system innovation.

The central bank is monitoring and directing payments players during transactions to ensure that the systems are fully interoperable. These participants included acquirers, issuers, processors, switches, and others.

Ironing out technical issues

The goal is to identify and solve any issues that may exist in the standard that has been created for transacting payments by way of mobile phones.

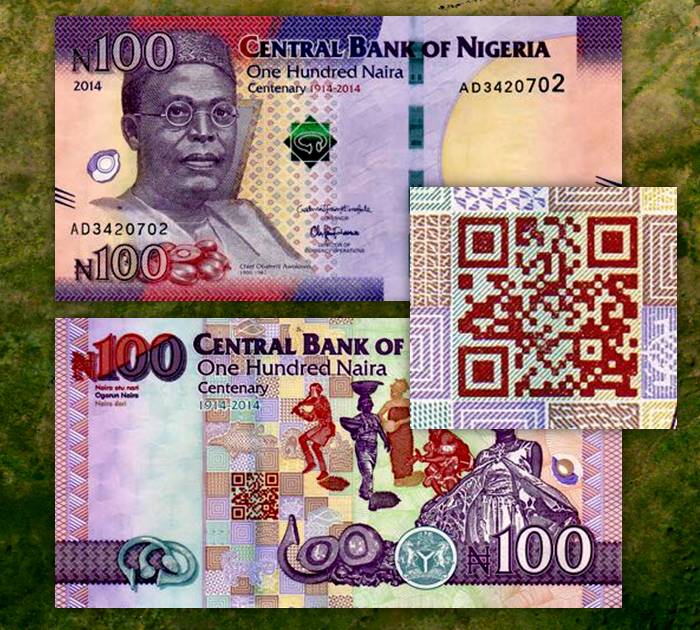

The CBN explained that the quick response codes can be used to present, capture, and transmit payment information across the complete transaction infrastructure.

The technology enables smartphone and mobile device-based payments, in addition to offering a pathway by which to promote electronic payments for small and micro-sized enterprises.

The new QR code payments framework offers regulatory guidance to ensure that the right barcode standards are adopted for payments services.

Creating uniform standards across the country

The government hope to unify standards in the country, create a more secure option for completing purchases using phones, and set up a service that is not specific to certain device models, banks or payment card services.

Nigeria is far from the first country to use, guide and regulate these square barcodes for the purpose of completing mobile payment transactions. Many national banking systems have relied on this option due to the simplicity and affordability of the barcode generation and use.

These scans can be completed using any smartphone with a camera and the right scanner app.