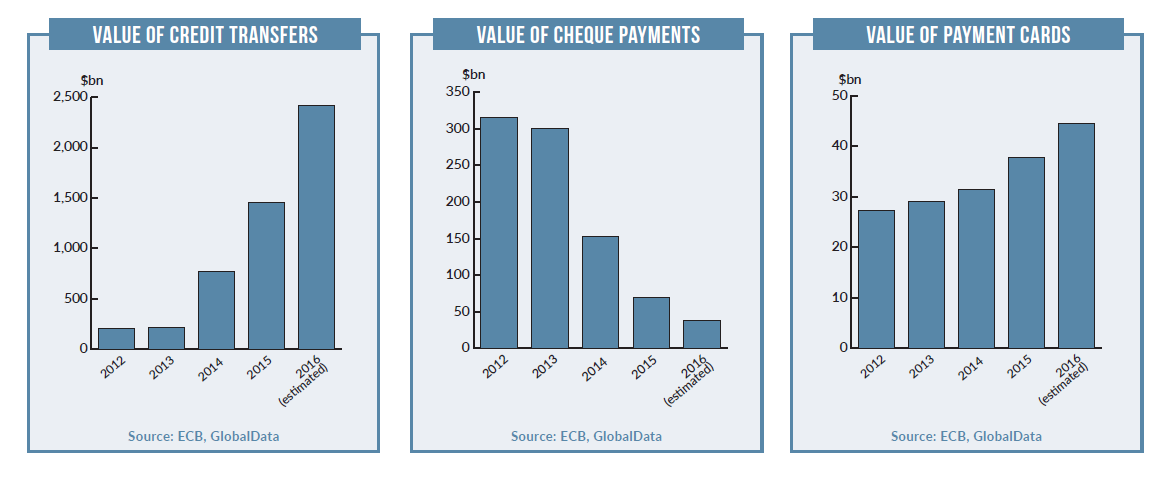

Cash has been a preferred instrument for Irish consumer payments,

accounting for 55.7% of the total payment transaction volume

in 2016. However, its use is expected to decrease as electronic

payments grow, although credit card growth remains sluggish

Irish government initiatives to encourage the use of card payments, a surge in consumer and retailer uptake of contactless payments, and strong preference for emerging payments such as digital and mobile wallets are all expected to reduce cash’s share in favour of electronic payments in Ireland over the forecast period.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

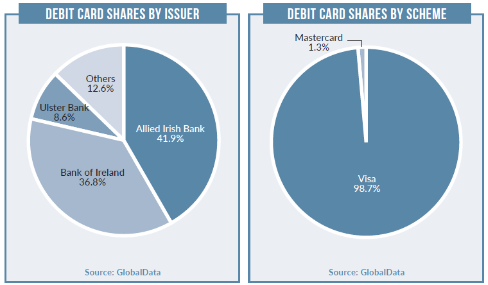

Debit cards remain the preferred payment card among Irish consumers, accounting for 81.6% of the payment card transaction value in 2016. Rising consumer use of debit cards for low-value transactions, the growing banked population, the government’s launch of the National Payments Plan to encourage use of electronic instruments such as debit cards over cheques, the removal of stamp duty on ATM transactions, and the lowering of interchange fees to a minimal 0.1% were key factors supporting use of debit cards. High interest rates on credit cards and the ready availability of overdraft facilities also shifted consumer preference towards debt-free financial products.

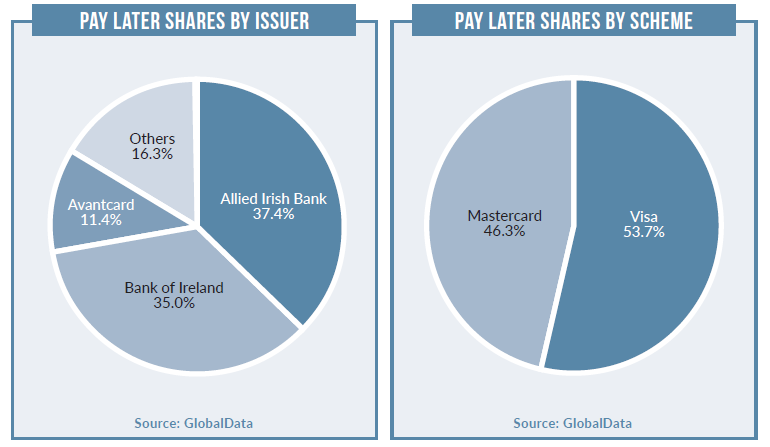

Overall, the credit cards market registered a sluggish CAGR of 0.59% between 2012 and 2016 in terms of transaction value. As bank lending slowed during the eurozone crisis, Irish consumers began to limit credit card spending. Banks also applied more stringent lending requirements, which increased the adoption of debit cards, as consumers preferred to spend only what they had.

International Queries

International merchant acquirers are entering the Irish payment cards market through partnerships and acquisitions. US-based acquirer First Data, with Allied Irish Banks, entered into a partnership with China UnionPay (CUP) in June 2014, to become the first merchant acquirer in Ireland to provide payment acceptance services for CUP debit and credit cards.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn August 2014, Evo Payments, a leading merchant acquirer in North America and Europe, partnered with Bank of Ireland to expand its merchant acquiring business in Ireland. The services are marketed through Bank of Ireland Payment Acceptance, which is primarily responsible for offering payment card solutions to Irish merchants.

E-Commerce Growth

E-commerce in Ireland posted a CAGR of 11.77%, growing from $7.7bn (€7.3bn) in 2012 to $12bn in 2016. Rises in online and smartphone penetration, the number of online shoppers and the availability of payment gateways supported e-commerce’s growth in the country. Leading e-commerce websites in Ireland include Linwoods Health Foods, James Whelan Butchers and McElhinney’s Ballybofey Donegal.

In addition, global giants eBay, Apple, Zynga.com and Amazon have presences in the country. Although payment cards were the most preferred mode of e-commerce payment, accounting for 75.4% of online payments in 2016, emerging methods such as digital and mobile wallets are gaining prominence in e-commerce.

Overall, digital and mobile wallets and carrier billing accounted for 24.2% of the total e-commerce transaction value in 2016, up from 12.8% in 2012. Several international operators, including Masterpass, PayPal and Single Click, are expanding into Ireland to benefit from the lucrative market.

POS Installations

The number of POS terminals in Ireland rose from 152,144 in 2012 to 159,375 in 2016, at a CAGR of 1.17%. This was supported by an increase in the number of installations at smaller retail outlets, enabling growth in card-based payments.

POS terminal numbers are expected to increase further in the near future, to reach 169,840 in 2020, as the number of retailers installing contactless POS terminals rises. The growing payment cards market has encouraged several mPOS solution providers to enter the Irish market. For instance, Payleven launched a low-cost mPOS terminal for $67.30 in March 2015.

In October 2014, online payment solution provider Paysafe partnered with Irish mPOS solution provider Handpoint to introduce mPOS terminals. The terminals are compatible with Android and iOS smartphones and tablets, and can be linked via Bluetooth.

Demand for Prepaid

A wide range of prepaid card variants are issued on the Visa and Mastercard networks in Ireland. Mastercard offers three types of prepaid card to Irish consumers, the Mastercard Everyday Money Prepaid Card, the Mastercard Gift Prepaid Card and the Mastercard Travel Prepaid Card.

While banks in Ireland focus on promoting debit and credit cards, nonbanking companies tend to focus on prepaid cards. In 2009, An Post issued the first Mastercard-branded prepaid card in association with airline Ryanair. An Post offers the PostFX Mastercard Currency Card, which is issued free of charge with no top-up charges. It can be loaded with UK pounds and US, Canadian or Australian dollars. In 2013, the Good Food Ireland Foundation offered a Mastercard-branded prepaid card, accepted at hotels, restaurants, cafes and pubs.