Gone are the days where parents would pull out cash for their children’s pocket money. In our increasingly cashless society, Briony Richter speaks to gohenry chief marketing officer Tom Mansbridge about the importance of teaching the next generation to be financially savvy

Today, we tap and go, or swipe, and the payments we make are completely invisible.

The next generation now face the prospect of a potentially cashless society, with coins, notes and cheques predicted to disappear. It is hard to imagine giving Bitcoin as a form of pocket money, but what comes after cash remains to be seen. It is understandable, therefore, that there needs to be a place where children can learn about money digitally, now that they rarely see it.

Launched in the UK in 2012, gohenry is a digital money app for children aged between six and 18. The company believes in the traditional values of earning money and learning to save, with the addition of modern technology to equip children with the necessary tools to prepare them for the current financial environment. Apart from becoming familiar with modern banking, using gohenry can instil crucial budgeting habits in children that will help them to become financially confident in the future.

Speaking to CI, CMO Tom Mansbridge describes how the gohenry journey began. “gohenry was founded by a group of parents who, whilst watching their kids play a school football match one day, started talking about the lack of financial tools available for families, to help kids and teens learn good money management in the increasingly cashless society,” he explains.

“Out of this conversation stemmed their idea: to create a practical solution to give young people confidence in using and understanding digital money whilst under their parents’ guidance.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

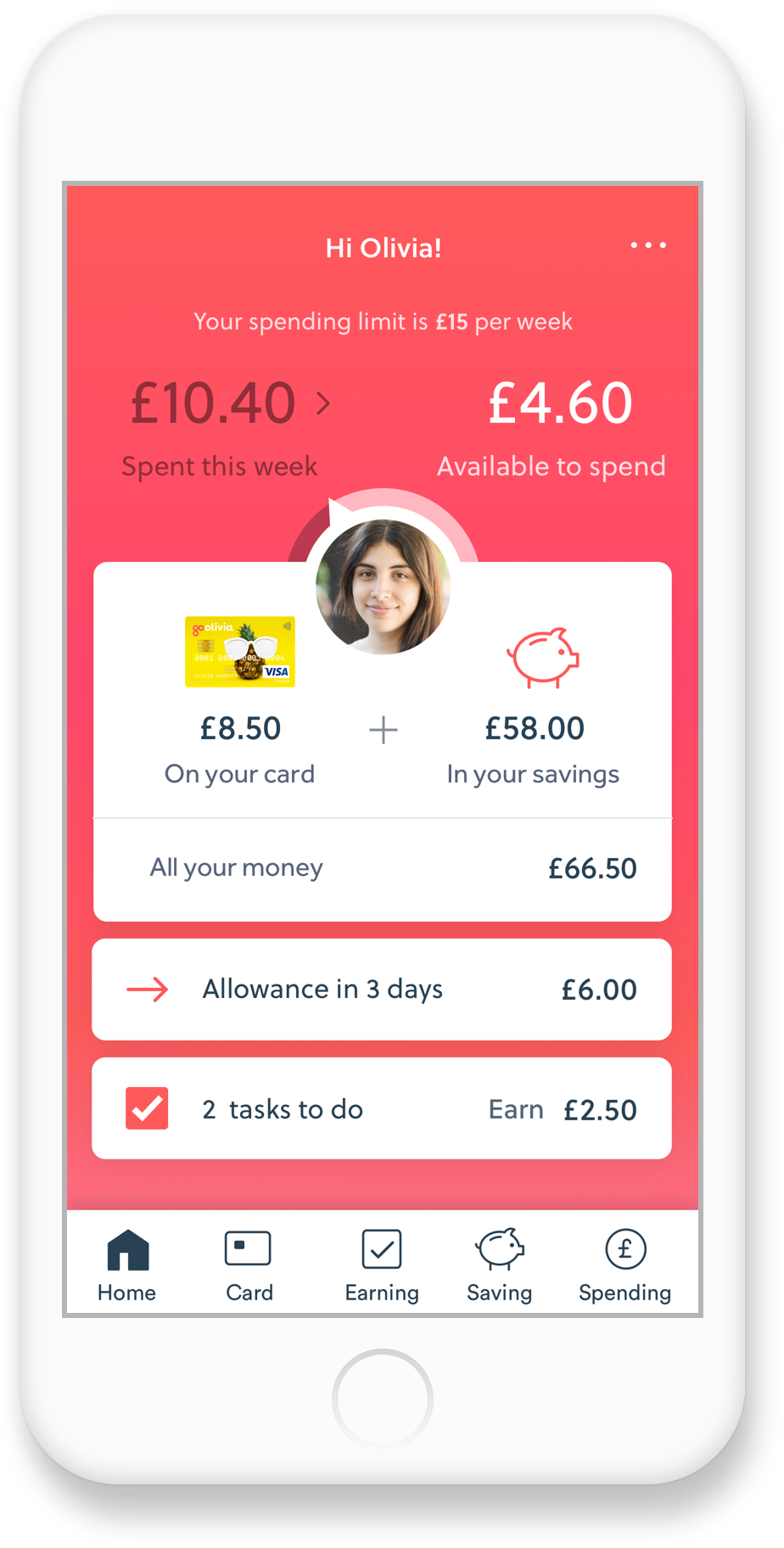

The gohenry app is not just a digital piggy bank to collect pocket money, it includes a variety of other nifty features. Children work on chores or other tasks that they have agreed with their parents; once the tasks are complete, the child’s card is topped up from a parent-funded wallet account.

Furthermore, parents can help their children set their own savings goals. Instead of just telling children to save up for something, the app shows them how to do it, enabling children develop an understanding of how to earn money, and how much they can spend thereafter.

For gohenry, it is all about getting children to understand financial matters, enabling them to enter the digital banking environment at an early stage.

Asked how important it is to start educating children early about having a bank account, Mansbridge says: “We believe this is very important. If we can empower children aged 6-18 to take control of their financial decisions by using a gohenry app with parental controls, we believe this will teach them the importance of taking responsibility for their money management in later life. Experiencing money early on and in a safe environment is the best way to form great habits for later life – it’s also fun!”

He continues: “gohenry provides kids a strong introduction in how to manage their money by giving them the feeling of responsibility. The app allows them to create different saving goals and earn money towards them by completing regular tasks, set by their parents. Children using the app can see their weekly earning, saving and spending in graphical, easy-to-understand formats, helping them to always know how much they have left to spend.”

Security

Some parents might tremble at the thought of their six-year-old having a debit card;

however, parents retain complete control over their children’s cards. Just as parents teach their children how to walk, read and swim, there is a growing need for children to better understand how to manage money. gohenry allows parents to teach children the value of money while watching over what is spent, and how it is spent, at all times.

“Parents can send weekly pocket money allowance payments straight to their children’s gohenry account, make one-off transfers towards a savings goal, or set chores for their children to earn extra money,” Mansbridge explains.

“gohenry also allows parents to set spending rules and limits for their children, and have full transparency over how and where they are spending their money. Parents receive instant, real-time notifications when their child spends using their card, detailing the location and the amount spent.”

The parents have to be fully involved to add money to the account, while the security within the app puts parents at ease that there is no chance of spending more than is in the account.

For example, parents can monitor exactly what their children buy, and if they do not agree with a purchase they can change the limitations within the app to restrict any further purchases. gohenry allows parents to sign up for a month free of charge to allow them to figure out if it is right for them.

After that, the app comes with a reasonable subscription fee of $3.99 per child per month. The cards are sent out free of charge. Services that parents and children receive with the plan include:

- There are no overdrafts, so no there is fear of spending over the account’s balance;

- A free gohenry card is sent to the customer for their children to use, and

- Loading the gohenry parent account is free.

ATM withdrawals and use of the card abroad incur additional charges, however as parents receive real-time notifications, they will never be in the dark about charges. The maximum amount that may be held in a primary account is $6,000.

Looking forward

Currently, gohenry has a continually growing community of over 500,000 active users across the UK, made up of both adults and children using the account.

Parents using gohenry regularly praise the app for its ability to support children in becoming more actively responsible with money.

Referring to more specific examples of gohenry user responses, Mansbridge says:

“Every day we receive inspiring feedback from parents, with stories about how gohenry has helped them by educating their children and changing their behaviour, such as: ‘The option to add tasks for extra pennies is a great tool to keep my kids happy to do chores – it teaches them to be more responsible with their money,’ and ‘having the gohenry card gives peace of mind that they will not be stuck without cash in an emergency, I can remotely top up their card.'”

gohenry launched in all 50 US states earlier this year, giving millions more children the opportunity to become financially savvy in a digital environment. The digital revolution is transforming how we interact with money.

Heading to a local branch for advice or to conduct a simple banking task is a thing of the past. Getting children into good financial habits for the current banking landscape will make a huge difference to them in later life.