The fintech industry has grown tremendously over the past few years at a breakneck pace that has only been accelerated by Covid-19. With 2022 at the door, Verdict spoke with fintech industry experts to get their predictions on what to expect in the year to come.

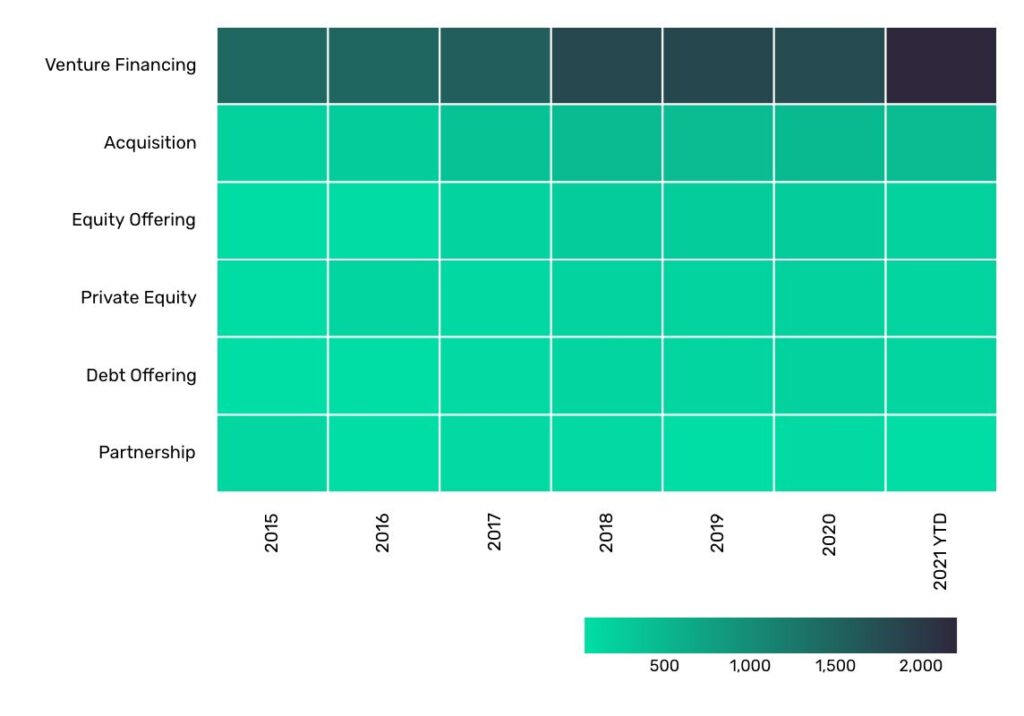

Fintech companies, who operate in the space between the financial and technology realms, have surged in the past six years. Data from GlobalData’s Technology Intelligence Centre highlights that there have been 2,202 deals worth a total of $81.02bn to date in 2021 in the financial services industry, up from 1,449 deals worth $17.85bn in 2015.

The coronavirus arguably accelerated the growth of the sector. There’s no secret to why that is. During the pandemic, the demand for digital payment solutions grew from both people and businesses. Fintech companies are simply supplying to this demand – and as the predictions below will outline, they are poised to do so in a big way.

The general public abandoning physical cash is a clear sign of the digitalisation of money. In Norway, only 4% of all transactions were cash-based in 2020. In the UK, that figure was 17%, down from 70% in 2010.

Some of the fintech experts offering their predictions to Verdict – such as Square’s Kaushalya Somasundaram – have not only seen this evolution first hand, but are confident that it will continue long into the next year and beyond.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFintech predictions about more than cash

The move towards the cashless society is inimitably linked to shoppers migrating in droves to online stores. Ecommerce has grown extremely popular during the coronavirus crisis. Unsurprisingly, several fintech experts Verdict has spoken with for these 2022 predictions believe this trend is only set to grow.

Other fintech predictions include the massive growth of the buy-now-pay-later (BNPL) sector. The BNPL industry has enjoyed explosive growth over the past few years. The global sector is expected to be worth $166bn by 2023, according to GlobalData’s thematic research.

Swedish Klarna provides the clearest example of the sector’s growth. In June 2021, it became Europe’s most valuable privately-owned tech company following a $639m funding round that took its valuation to $45.6bn. That was up from the $31bn valuation the fintech had achieved in March following a $1bn funding round.

A similar push towards more digital services can be seen in the world of banking. Open banking, the catch-all term for a way to share financial data between organisations, has also grown during Covid-19. Several of the experts offering their fintech predictions believe the industry is only set to grow from here.

Although, some fintech predictions, like those offered by Ivan Zhiznevskiy, CEO of 3S Money, include sentiments that the industry has lost its way in the pursuit of unsustainable unicorn valuations. Instead, he’s hoping that 2022 will be the year the industry focuses on getting back to basis. He has levied similar attacks in the past.

Whether or not you believe fintech deals have ballooned out of proportion, most predictions make it clear that this sector will continue to influence industries and the general public for years to come. Hopefully, these fintech predictions will help you stay abreast of what’s to come.

Kaushalya Somasundaram, head of UK payments partnerships and industry relations, Square

The fintech industry has continued to evolve this past year in both flexibility and inclusion, and even more so since the onset of the Covid-19 pandemic. In 2021, we found that the number of businesses accepting payments through cashless methods, such as online, nearly doubled from the year prior. Digital payment tools not only allowed an increase in scalability, but also facilitated financial inclusion by helping more businesses to continue playing an active role in the economy, even during the pandemic.

In 2022, businesses are set to continue the contactless trend, offering their customers safety, speed and convenience; whilst also finding new ways to grow and reach new audiences. We also expect businesses to pursue an accelerated drive towards digital fintech initiatives and tools in order to access new revenue streams. Our recent Future of Retail report uncovered that 71% of retailers are looking to inventory management technology to improve supply chain efficiency, demonstrating a continued investment on solutions through technology.

If the past few years have taught us anything, it is that an innovative and open mindset, coupled with the right digital tools can help businesses regardless of their size or industry to continue their growth, even in uncertain times.

Jaimini Pattani, senior analyst financial services division, GlobalData

In fintech, we have seen new trends conquer the financial services world, from AI to open banking and financial literacy to financial well-being. Financial services providers have been quick to adapt to the changes in consumer behaviour driven by lifestyle changes from the pandemic, and fintechs have managed to leverage technology to conduct banking activities. As a result, we will likely see some trends rapidly evolve further in 2022. Two trends on the rise are BNPL integration and enhanced personalisation through changes in open banking.

Let’s start with. BNPL integration. The BNPL market has boomed in the past year or so, with the likes of Klarna and Afterpay taking the markets by storm and launching super-app style services and banking products. Towards the end of 2021, UK banks such as Monzo and Virgin Money have been seen to incorporate such services into their retail banking offerings but through different business models. For example, the Monzo offering, unlike Klarna, can affect credit reports, thus making banking options less attractive to consumers.

However, it is apparent that regulation in the BNPL is tightening and the crackdown is likely to increase further in 2022. With regulation tightening, we will likely see other banks replicate BNPL concepts and enhance their services to meet consumer demand, especially in ecommerce.

So, in 2022, we expect to see banks take on more BNPL firms to increase revenues and adapt to customer preferences around fees and interest payments.

Personalisation through open banking is another important trend to keep an eye on. Open banking has been a much talked about topic with consumers across the globe using open banking products in their everyday lives. Open banking is how banks share financial data and services to get enhanced insights into customer behaviour to provide more personalised services and real-time insight to help people spend and save smarter.

The 2021 GlobalData Financial Consumer survey data shows that consumers are willing to share data if it holds out the possibility of better money management and better personalisation. Since the pandemic, consumers expect a certain level of personalisation from the services they use. F

rom Amazon to Netflix, and a vast number of other brands, they are all used to ‘because you watched/bought X, we thought you might like to watch/buy Y.’, and thus there is now the need for this to translate across to banking products and services. The next most significant trend we are likely to see is banks further leveraging open banking for a better real-time, personalised service to drive more competition in the market through collaboration between the larger legacy banks and fintech’s.

Francesco Simoneschi, CEO and co-founder, TrueLayer

Francesco Simoneschi, CEO and co-founder, TrueLayer

2022 will see open banking continue its disruption of traditional payment methods. Amazon’s decision to stop accepting Visa credit cards in the UK is more than a negotiation tactic, it’s further evidence that in a world of instant payments and borderless commerce, cards have reached their expiry date. For years, they have been retrofitted into online checkouts, creating an invisible web of hidden costs and unwieldy payment structures.

The commercial impact of this inefficiency also cannot be overstated when it comes to the customer experience. How often have you tried to buy something only for the card to not be accepted – whether through mistyping details or a fraud block? The risk of customer drop-off at the checkout is high and impactful.

Ecommerce is creating huge demand for experiences that are quicker and more cost effective. Account to account payments through open banking are the necessary next step in that evolution, moving money at a fraction of the cost to the merchant and more securely and more conveniently for the customer. In 2022, more merchants will implement these payments into their checkouts, taking open banking out of the world of fintech and into the mainstream, replacing cards as the primary payment option.

Michael Vanaselja, founder and CEO, Keebo

Michael Vanaselja, founder and CEO, Keebo

One of the most important and valuable changes for fintech in 2022 will be personalisation. Across other industries we have seen personalisation becoming more widespread for consumers. However, I think it takes longer for fintech to get to the same place, e.g. because of the importance of customer protection and regulation. We’re at a stage now where real human experience will start to transform the industry. At Keebo, our focus is to make accessing credit and credit building personal, relevant and meaningful for people by using their unique open banking data to deliver it a better a more personalised experience.

Neha Mittal, interim CEO of Divido

In 2022, the big story for retail finance will continue to be the global regulatory reform of the BNPL space. Over the course of this year, the Financial Conduct Authority (FCA) has actively been driving its agenda through a series of announcements and proposals designed to shake up the unregulated BNPL market. Regulation is coming and it brings plans for ‘delivering better outcomes in consumer credit’.

The proposed changes mean that any BNPL finance product not currently within scope of the Consumer Credit Act (CCA), credit provided for a period of less than 12 months and with 0% APR, will be regulated. At Divido, we welcome these changes.

Straight up, companies will have to put the customer first, as requirements to increase focus on consumer outcomes and needs, especially those in vulnerable circumstances, becomes the order of the day, through the FCA’s proposed Consumer Duty.

Established lenders could take back the advantage from the unregulated fintechs, where they already have years of experience operating with high standards of consumer protection. This has the potential to change the game. Where new market entrants have forged ahead, taking advantage of a regulation-free market, they will now have to wrestle with regulatory reform, which could come as a major set-back – especially for the smaller firms.

Further, profitability will come under pressure – especially for business models based largely on affiliate marketing. At Divido we see large retailers seeking responsible lending, whilst maintaining control of customer data and brand experience. They care deeply about brand association.

The impact of regulatory change on the business models of the new market entrants in the BNPL space will be profound.

Maria Palmieri, head of public Policy, Yapily

The number of open banking adopters is set to increase. Covid made it abundantly clear that SMEs need real-time insight into their financial position to forecast cash flow and consumers need greater oversight of their personal finances to stay in good financial shape. It’s predicted that 71% of SMEs along with 64% of adults are expected to be open banking adopters by 2022, and by 2024 users worldwide will reach 63.8 million. But this is only the beginning. The true opportunity is open finance which we’ll slowly but surely see unfold next year.

I predict regulators will work more closely with national governments to come to a consolidated approach to implement open finance, so the ecosystem can deliver and capitalise on the opportunities it can bring. The CMA is also set to publish an update on the future framework for open finance at the start of the year. Hopefully, we will start to see more and more third-party providers educate consumers and businesses on the benefits it can bring and help abolish misconceptions behind too much data sharing. And we’ll see this unfold globally. Joe Biden’s 2021 Executive Order is a clear example of the industry moving in the right direction.

We’re also going to see an explosion of new payment use cases in 2022. New players are coming to the market at speed and competition is fierce. Europe must move fast and push forward quickly with initiatives, like the European Payments Initiative and the proposed digital wallet, to stay ahead of the game.

The use of open banking in lending decisions is another trend to watch out for next year. New lending providers are taking the industry by storm using the initiative to better their services – more than 17 million people have now used BNPL. Ease of access to credit means more affordability and creditworthiness checks which can be done seamlessly.

Ivan Zhiznevskiy, CEO, 3S Money

Ivan Zhiznevskiy, CEO, 3S Money

Investment in fintech was at an all-time high in 2021. We’ve witnessed frankly ridiculous figures – stand out examples include TrueLayer’s $1bn valuation and Varo Bank’s $510m Series E funding. Both are shocking. All this epic growth in investment has caused fintechs to lose focus, with many transfixed on bagging all the investor cash they can to achieve ‘unicorn status’. What I’d like to see in 2022 is fintech’s demonstrating business profitability by providing genuine value so that their customers start paying for their services. Not investors. They cannot continue to feed into start-ups forever.

The impact of COP26 will also play a huge role in the landscape next year. The UK government is demanding banks and financial institutions police customers, to ensure no one is servicing anyone involved in fossil fuels. While a great idea in theory, it means more compliance, more policing functions and, ultimately, customers will suffer. Instead of focusing on lobbying groups and fossil fuel companies directly, the government is outsourcing their pledges. And its banks and financial institutions who are going to pay the price. More questions mean less trust with customers.

Daniel Kjellén, CEO and founder, Tink

Daniel Kjellén, CEO and founder, Tink

Open banking is at an exciting crossroads. We’re seeing the market go from building PSD2 compliant APIs to exploring the many use cases of open data. This means there is huge potential for innovation as previously closed data sets become available to be utilised for new purposes for the benefit of businesses and consumers.

One of the most interesting open banking use cases is the ability to enable lenders to get a fairer and more holistic understanding of an individual’s financial position. This will help them make more informed choices about credit decisions, opening up credit to more people, and enhancing risk management by making it easier to detect possible risk factors from data insights.

Finally, the green agenda is only going to become more important. I firmly believe consumers and businesses want to do more to meet their environmental and social obligations. The key question is how do we empower them to do that? The financial services industry does have a solution. It can build better products that offer everything from greener loans and mortgages to checking accounts with carbon-tracking features built into mobile apps. By harnessing data, banks and fintechs can become the agents of positive environmental change.

Rolands Mesters, co-founder and CEO, Nordigen

Rolands Mesters, co-founder and CEO, Nordigen

In the UK, open banking has reached four million users in the three years since its inception. In 2022, I predict the user count will double across all countries, and reach eight million in the UK. Open banking allows free movement of customer financial data, provides opportunities to financial service providers, and offers autonomy to end users.

The growth of open banking has been accelerated by a natural shift to digital, modernisation of the financial sector, and the pandemic. Customers are making more payments and purchases online rather than in person, making physical bank cards almost obsolete and solutions like BNPL are leading the way for open banking.

I believe open banking will continue to develop in 2022, and I believe someone will launch the first free open banking payments platform to facilitate the growth of open banking. The uptake of open banking will level the playing field for fintech startups and increase financial inclusion for users, resulting in a better overall experience for all participants of the fintech industry.

James Allum, VP and head of Europe, Payoneer

James Allum, VP and head of Europe, Payoneer

The battle lines are being drawn between open banking and cryptocurrencies – the debate is set to heat up further in 2022. More companies will turn to new compliance and regulation technologies to keep customers safe and improve their customer experience.

As they become more mature, fast-growing fintechs will shift from focusing on customer acquisition to improving their margins throughout their operations. The larger fintechs listed on public exchanges, e.g., Wise, Payoneer and PaySafe, will become more confident operating as a public company and more vocal about their ambitions.

Jed Rose, GM EMEA, Airwallex

Jed Rose, GM EMEA, Airwallex

Embedded finance is not a new concept, but the era of embedded finance has considerable momentum due to recent advances in the industry. This is being driven by many factors which will continue into 2022: changing consumer expectations as more people use online services, Covid-accelerated digital transformation, the rise of alternative financial services providers and more brands investing in their online presence due to tough market competition.

Like today’s consumers, businesses want and need a seamless payment experience. Embedded finance was designed to streamline the entire financial process for consumers, while also creating significant operational efficiency gains for businesses. With embedded finance, businesses can create a holistic experience for the end user and customers can easily send and receive money in near real-time while usually saving up to 80% in transfer costs versus fees charged by high street banks.

We’ll see more organisations switching to more efficient financial services in 2022, particularly as businesses prioritise customer experience and loyalty to maintain and grow market share.

Jamil Ahmed, director, Solace

As online shopping increases, so does payment processing volume. Consumer behaviour has already been changing over the past few years to more frequent use of payments cards, while the transaction amounts themselves be of smaller value. Covid only just accelerated that change further when physical stores also favoured cashless point of sale, adding to online shopping processing volume.

An identical impact to stock and order management is also being seen with shoppers checking out more frequently with shopping baskets containing less items, versus collecting up towards a single large checkout. All the intermediaries, from banks to e-commerce giants, that make a transaction possible need to meet these high demands of the modern hyper-consumer by upgrading systems to keep pace with the volume growth. In order to overcome a bombardment of online payments and orders, big retailers will have to enhance IT systems with event-driven architecture to ensure processing can be accurate and timely, to complete fulfilment that doesn’t disappoint consumers with errors or delays.

Ann Maya, general manager, Boomi

Ann Maya, general manager, Boomi

Taking the leap into mobile and remote friendly processes that impact employee and customer interactions will continue to make companies more competitive. Giving a better user experience is no longer a cosmetic benefit, it will make or break companies in every sector.

Dorel Blitz, VP Strategy & Business Development at Personetics

Dorel Blitz, VP Strategy & Business Development at Personetics

2021 has been defined by record-breaking growth. In the UK, investment into fintech hit £17.7bn in the first half of the year alone and globally, in the last three months, 33% of all total new unicorns have been fintech-focused. We’ve also seen a huge number of fintech IPOs as well as influential M&As. The growth opportunity for fintechs is greater than ever but has made market competition hotter, the challenge for fintechs this year has been standing out and prioritising customers.

I’ve long been a believer that fintech should make the world a better place but what’s been really unique about 2021 is the growth of ‘green fintechs’ or ‘fintechs for good’. Next year, I expect to see many more solutions that prioritise financial well-being and allow people to make more sustainable choices with their money, for example by showing the carbon footprint of their spending.

We’re going to see the fintech and banking world adopt the ‘Netflix effect in 2022’. Modern consumers want an experience where banks and fintechs can think on their behalf and like Netflix, provide automatic recommendations based on the individual. The burden of finance is increasingly moving away from the customer to the latest tech which can automate the ‘busy work’ of managing personal finances and actually help customers with their overall financial well-being. This development doesn’t hinge on a single technology but a combination of technologies together that use data to understand customers on a deeper scale.

I’m also excited to see how technology starts to democratise wealth management by helping people with their investments and trading. There are currently millions of underserved customers who don’t have the means for their own financial advisor who will benefit from a hybrid model where data is helping relationship managers make more informed decisions and open up wealth management to a larger audience – just like Robinhood has expanded retail investing.