A tsunami of digital payments is approaching. Global e-commerce will see a compound annual growth rate (CAGR) of 12% between 2021 and 2025 according to GlobalData projections – higher still in rapidly expanding markets across South America and Asia. Merchants are looking beyond their home countries to tap into growing cash flows, with the value of cross-border payments predicted to reach $250 trillion by 2027. And, with finance app downloads reaching over 4 billion in 2020, the way that money changes hands and the technology used to underpin transactions is evolving too.

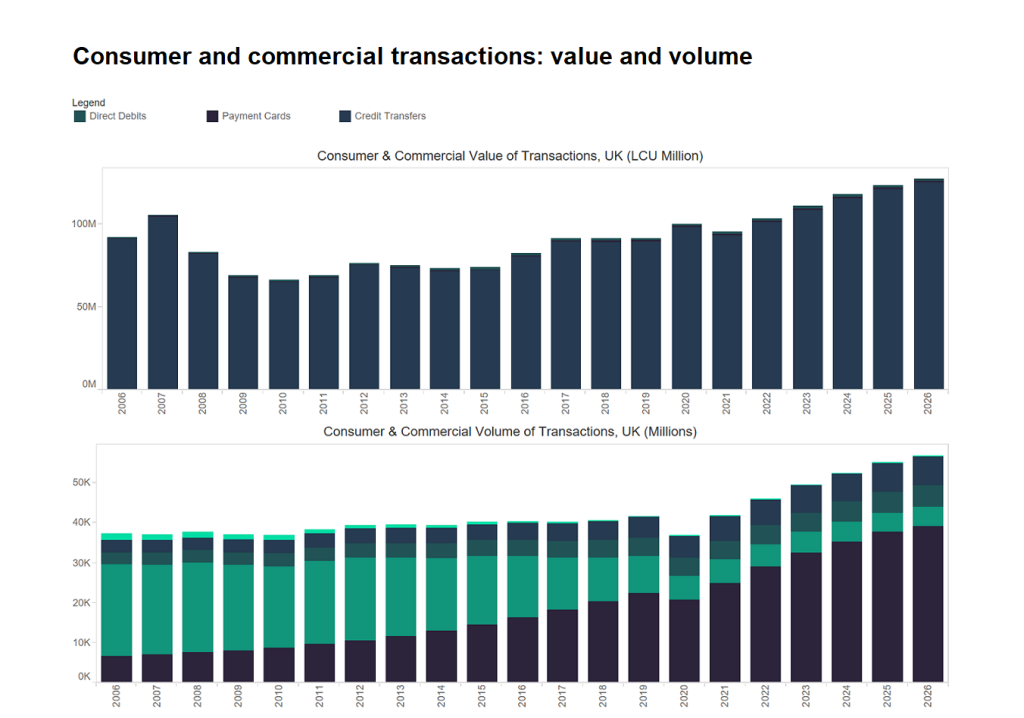

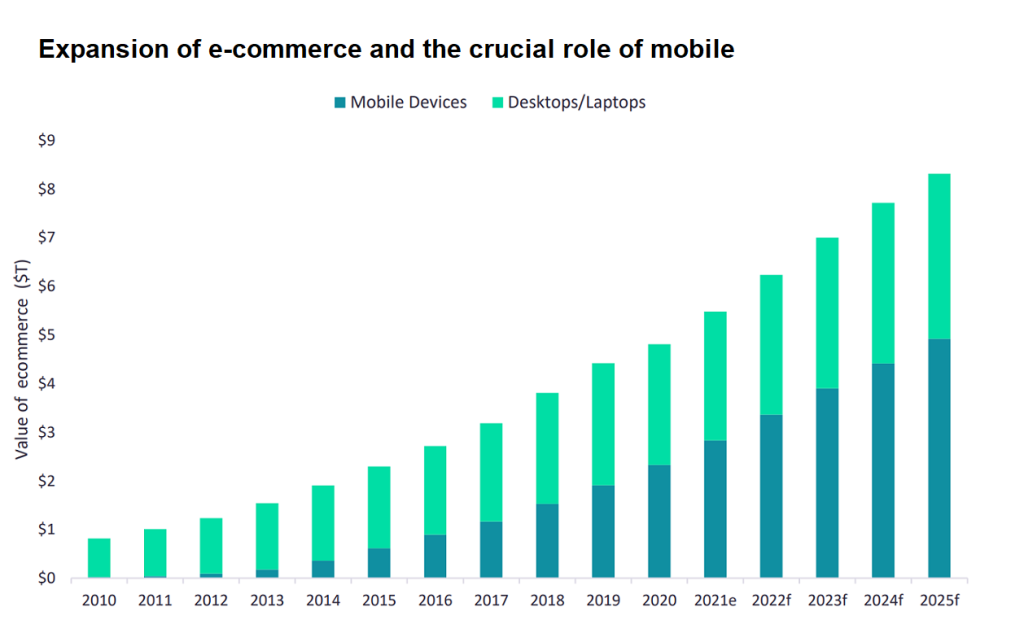

Payment habits have changed forever. GlobalData analysis points to cash and cheque transaction values decreasing between 3% and 8% respectively between 2016 and 2026. The drop will be more than made up for by credit transfers, direct debits and payment cards, with average annual growth in the latter forecast to reach 13% over the same period. The revolution in what people pay with extends to how they are paying. Mobile e-commerce was valued at virtually zero in 2010. But by 2021 it had overtaken laptops as the most important component of e-commerce, with a transaction value of nearly $3tn. By 2025, this could reach $5tn.

As payment habits have changed, they have diversified. In some areas, cash continues to dominate; the mobile revolution has yet to take off in the 750 million-strong market represented by the Philippines, Indonesia, Pakistan and Bangladesh. In others, habits are changing but barriers still stand in the way. Japan’s government, for example, is promoting cashless payments, and hopes to double the current 35% rate of card-based transactions by 2025. But consumer behaviour, lengthy onboarding processes and high payment acceptance costs mean card and mobile payments lag far behind the region’s other economic giants. Country-specific payment ecosystems are springing up, like Alipay in China and Rupay in India, used every day by billions of potential customers. While many of these are mobile-first, each utilises subtly different processes and rules. And this is against the backdrop of regulatory and currency volatility – think South Korean capital controls and Argentinian hyperinflation.

In short, there is a paradox in the world of payments: by globalising, it has become more local than ever. Merchants must understand the technological trends driving localised payment systems, and ongoing evolution in the systems themselves, to ensure they prosper.

Tech-driven change

Technology has caused a long-term shift in the payment landscape. There have been myriad regulatory and behavioural catalysts – but, based on GlobalData research, a few stand out for their ongoing contribution towards the emergence of a fluid, localised global payment system.

Start with mobile wallets. Globally, the value of mobile wallet transactions rose at a whopping 190% CAGR between 2013 and 2017. Growth will taper in the coming years, but projections still point to a CAGR of 22% from 2021 to 2025. This would take mobile wallet transactions to a valuation of $140tn by the mid-2020s.

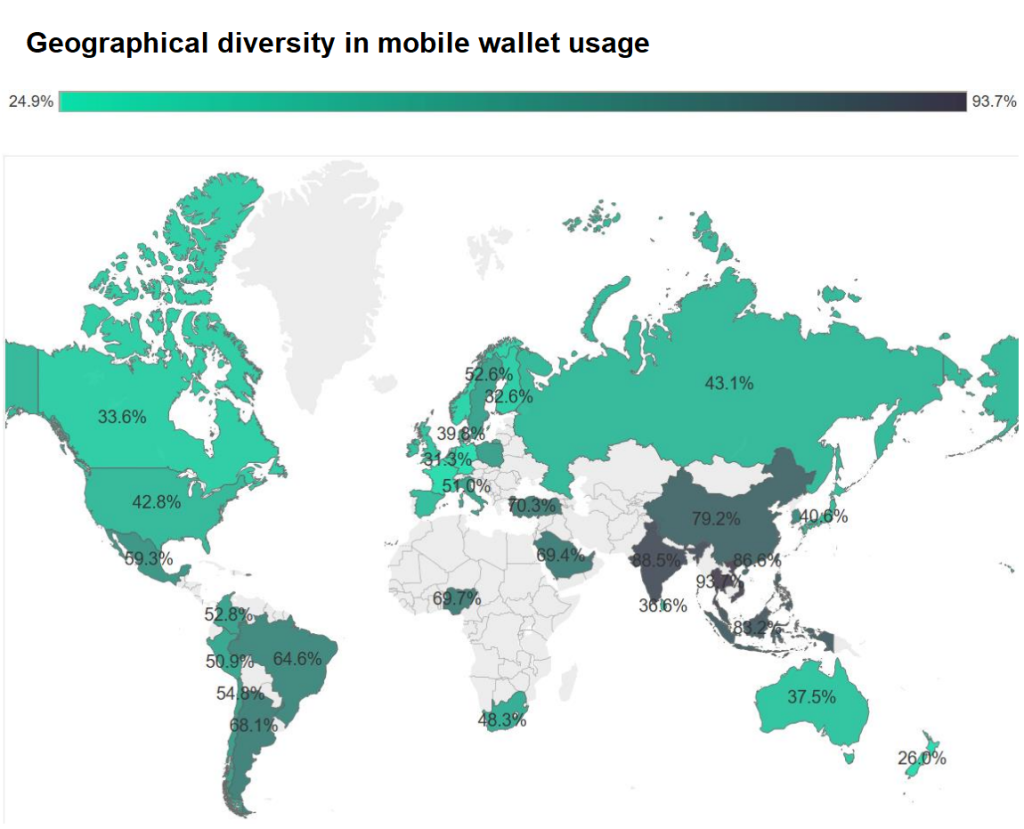

However, the gulf between high-growth markets and developed ones is stark: nearly 90% of Chinese consumers used a mobile wallet in the past 12 months, compared with just over two-fifths in the USA. And, while adoption in Western Europe and North America is sure to ramp up, the technology underpinning it will diverge. Popular mobile payment services in India (Paytm and PhonePe) and China (WeChat Pay and Alipay) have successfully deployed mobile P2P and m-commerce systems to utilise national real-time payment systems. But the current leading Western payment services are aiming for the proximity payment markets first, with a view to developing m-commerce and P2P functionality later. For brands, there is no such thing as a one-size-fits-all solution.

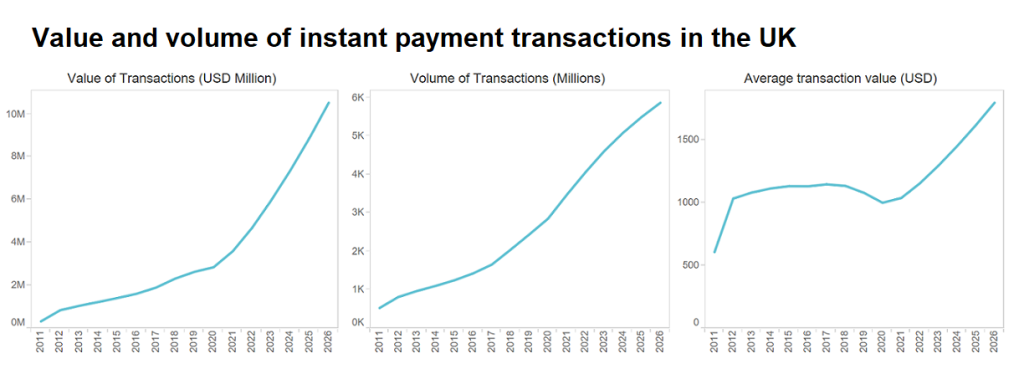

Another example is the rise of instant payments. Credited from one bank to another without the use of intermediaries, these allow payments to take place in seconds – and are rapidly increasing in volume and value.

Once again there are geographical distinctions. GlobalData analysis suggests India and China are responsible for 73% of global instant payments volume transactions, with India’s 25.5 billion transactions leading the way. Schemes are emerging to promote integration of instant payments technology, but the pace is divergent and the scope is narrow. The EU’s TIPS scheme provides consumers with instant payments transactions within the eurozone, but is currently only denominated in Euros. In 2021, many ASEAN countries passed an agreement to link their instant payments platforms to enable cross-border transactions, and more are likely to join over the coming decade. But processes differ from place to place, and merchants need to respond accordingly.

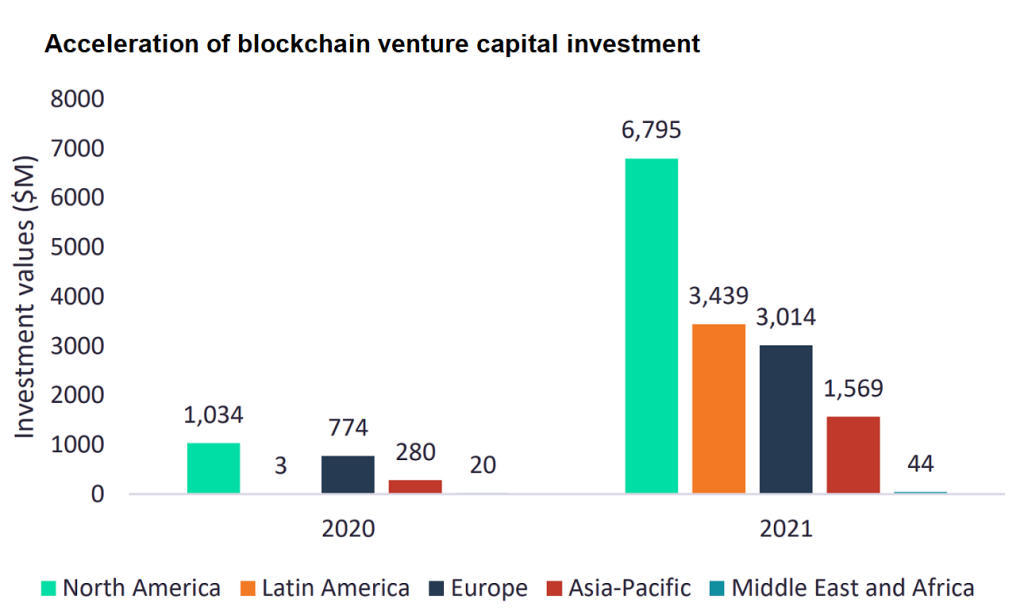

Rising technologies will create further upheaval in the years ahead. Blockchain is one example. Cryptocurrencies and non-fungible tokens – although currently in the doldrums – offer completely novel ways to transact, and venture capital has poured in accordingly.

Disruptive technology could radically alter common understandings of payment infrastructure in the years to come. But the long-term impact of such technologies remains uncertain. The time and cost associated with implementation into payment services now presents merchants with a headache.

Globalised payments, localised systems

New payment ecosystems are developing all the time – cash in Bangladesh, mobile wallets in China, blockchain venture capital in the US and the global boom in the buy now pay later (BNPL) market (valued by GlobalData at $142bn in 2021 with a predicted CAGR of 33.3% between 2021 and 2026). Understanding these ecosystems, and meeting their requirements, will be vital for merchants who want ride the rising tide of payments.

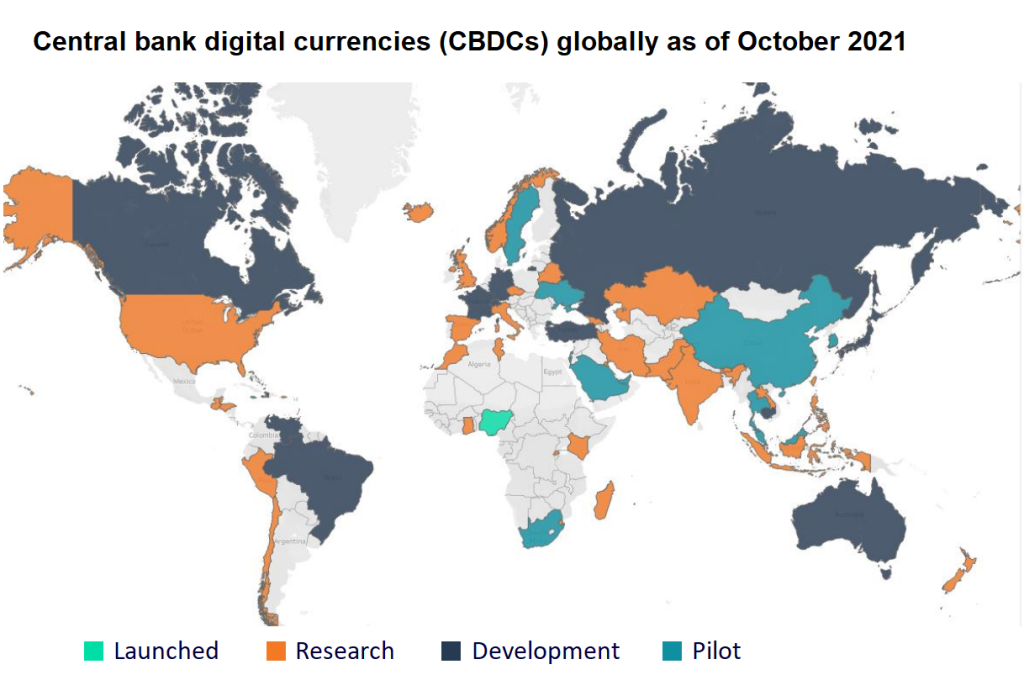

Merchants must familiarise themselves with the rules, regulations and payment preferences of regions they hope to do business in. Figure 3 highlights the rise of mobile wallets in Latin America and Asia – but businesses neglect variation within these payment landscapes at their peril. For example, WeChat Pay and Alipay have been widely adopted in China. But in Japan, Konbini, an alternative payment method (APM) allowing customers to use cash at online stores to settle online payments, is favoured by around 20% of customers. And recent developments in Latin America highlight how quickly payment preferences can shift. Brazil’s central bank launched PIX, an instant payment system, in November 2020 to give the country’s largely unbanked population the ability to make direct online transactions via personal identification keys. Within four months it had picked up 180 million users; Central Bank of Brazil data from December 2022 showed that key registrations had topped 550 million and were continuing to rise. Brands need payment solutions that are responsive to the constant flux of high-growth markets’ ecosystems. One emerging phenomenon, for example, is that of central bank digital currencies. Nigeria launched the e-Naira in October 2021, the world’s first example of such a currency. Pilots are gathering pace across Asia and Africa, and would revolutionise the ability of brands to reach the world’s 1.5 billion unbanked consumers directly via smartphone-based digital wallets.

And the importance of flexibility in response to regional discrepancies does not stop there. Year-on-year inflation hit 85.5% in Turkey and 92.4% in Argentina in October and November respectively. Daily fluctuations in the South Korean won can make exchanging it with other currencies unreliable. In such cases, businesses reliant on cross-border remittances can face real trouble, with the value of transactions crashing by the time they have been processed and cleared. Add to this the difficulties of predicting the future shape of payments amid technological flux. China’s crypto-crackdown in September 2021, for example, steered many traders towards decentralised platforms like UniSwap that are harder to regulate. It highlights how economic and legislative conditions can force customer preferences to evolve in unexpected new directions – with payment providers playing catchup all the time.

The Worldline way

Setting up a cross-border payment flow in one country is stressful enough. The prospect of doing so in multiple regions, while rolling with the punches of economic and legislative uncertainty, may put brands off altogether. How can merchants tackle the profusion of payment technologies, preferences, media and regulations that dominate the commercial landscape?

A few top tips can help. Establishing benchmarks for payment success from the outset of a new foreign venture is one sure piece of best practice. Transaction rates, for example, can operate as a useful performance indicator; if lower than anticipated, this may point to purchases running up against region-specific transaction rules and barriers. Tailoring initial cross-border operations to a single project or country – rather than tackling multiple fronts at once – is another wise move, getting the cash flowing and allowing potential pain points to be worked through. This provides a foothold for further expansion, familiarising brands with customer preferences and regulatory quirks before they overcommit and take on excess risk.

Another option is to collaborate with an expert partner. Worldline’s approach in South Korea – dominated by capital controls and currency volatility – is instructive. The firm provides a single full-service cross-border payment solution. This means swift access to all local cards and checkout processes, industry-leading approval rates via local acquiring, zero cross-border frees, cross-border remittance in over 20 major currencies and no need for setting up a local entity. In short, they grapple with the potential pitfalls of localisation on the merchants’ behalf – allowing brands to focus on reaching target customers and boosting their brand.

Whatever the future for payments in an increasingly globalised e-commerce environment, merchants needn’t let the thorny issue of localisation stand in the way of their benefitting. Click here to find out more about how Worldline can help you.