The US’s most popular mobile wallet, Apple Pay, announced it is dropping its Apple Pay Later instalment loan scheme, which launched in March 2023 as an addition to the country’s competitive buy now pay later (BNPL) landscape. Instead, Apple will continue offering BNPL loans at Apple Pay-accepting checkouts in the US through the third-party provider Affirm.

GlobalData’s E-commerce Analytics

Although the US is the biggest BNPL market by value globally, GlobalData’s E-commerce Analytics shows that BNPL payments only account for 5.8% of the US ecommerce market.

The BNPL market has seen steady growth globally since the emergence of Klarna and Afterpay in the 2010s, but providers’ operating models are being challenged now more than ever. Firstly, the 5.25 percentage-point raise of the Fed funds rate since March 2022 has made the financing of these loans more expensive.

The increasing cost of living during this period shrunk disposable incomes and resulted in higher default rates and a general slowdown in spending. Most recently, the Consumer Financial Protection Bureau issued a rule to extend the Truth in Lending Act to BNPL services, to align consumer protection measures with existing credit card regulations.

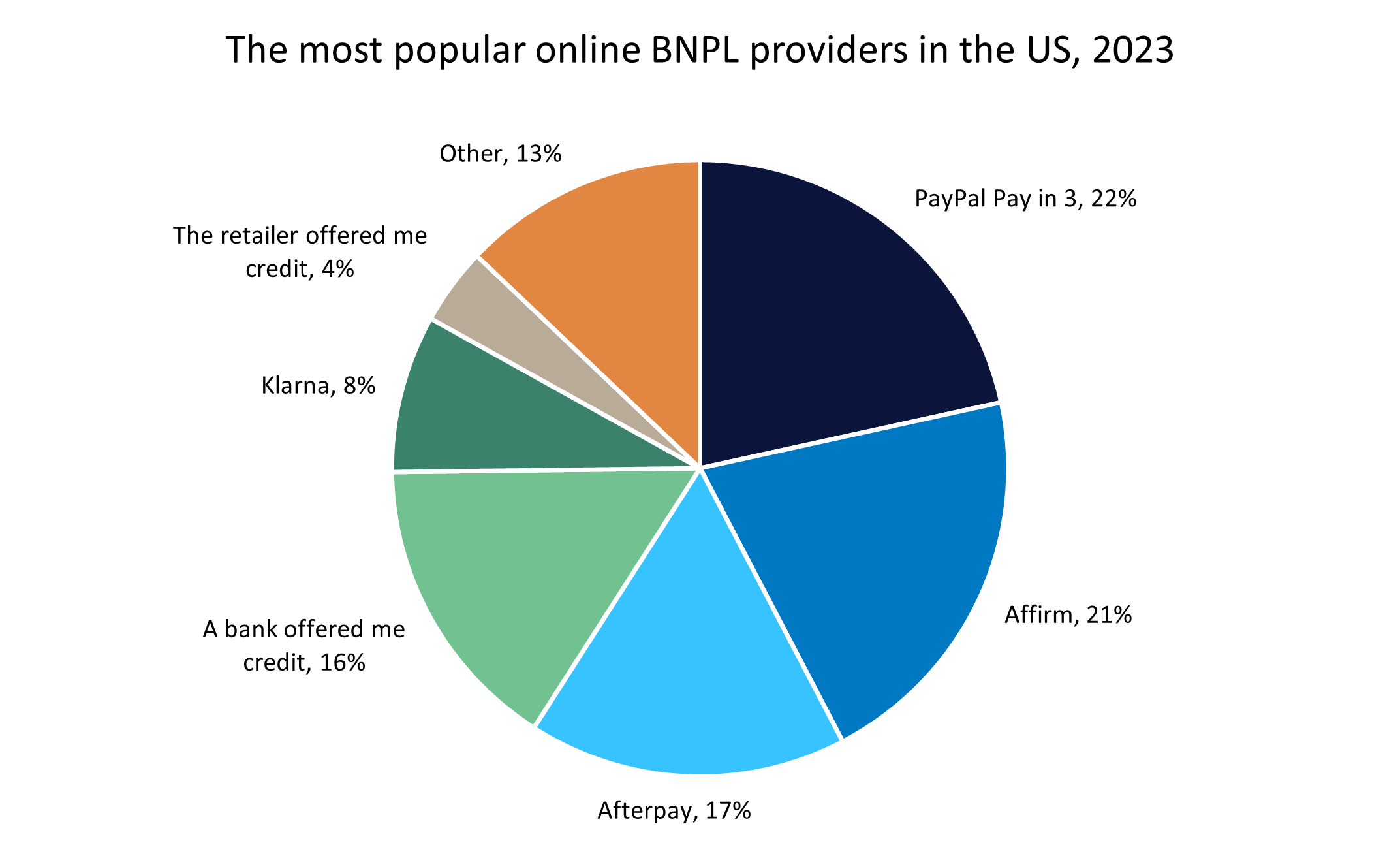

Compliance costs therefore will add to the issue of already thinning margins of BNPL operators who continue to compete in the US’s fragmented BNPL market. Just over a year after Apple Pay Later’s launch, Apple found itself in position whereby it was unlikely to generate meaningful profits from offering instalment loans in this market environment, and it will now instead embed a well-known provider’s BNPL product to maintain Apple Pay’s competitive edge in the US mobile wallet landscape. Affirm is the preferred BNPL provider of choice for 21% of Americans, just 1pp behind the leading PayPal Pay in 3 solution and closely followed by Afterpay with 17%, as per GlobalData’s Buy Now Pay Later Analytics 2023.

Source: GlobalData’s Buy Now Pay Later Analytics 2023

As more consolidation can be expected among BNPL firms against the current market backdrop in the US, Apple found new ways through Apple Pay for keeping current users in and bringing new ones into its ecosystem. Besides Affirm’s integration arriving with the next update in October 2024, iPhone users will now be able to send and receive Apple Cash in real time by the tap of two phones. The Tap to Cash function will facilitate peer-to-peer (P2P) payments on the spot through NFC technology, without the need to exchange any information.

GlobalData’s P2P Payments Analytics 2023

Despite the use case’s limitation of having to be physically present, the service will be welcomed by Americans, whose top considerations for sending money are speed, simplicity, and a trusted brand, according to GlobalData’s P2P Payments Analytics 2023. Apple’s rapid exit from the BNPL market to focus on the ecosystem-strengthening functions of Apple Pay is therefore in line with the company’s wider strategy.

Blandina Hanna Szalay is an analyst in banking & payments at GlobalData