India has overtaken China’s weighting in the MSCI All-Country World Index as strong economic growth has seen investors flock in. While China’s efforts to prop up the economy are set to bear fruit, further driving up share prices, this will not be enough to stop India from racing ahead.

In September, India’s share in the MSCI index increased to 2.33%, overshadowing China’s 2.06%. The country now ranks sixth, after France, Canada, the UK, Japan, and the US. This has come as little surprise: India’s economic growth has outpaced China’s over the course of 2024 and is forecast to continue doing so.

GlobalData Macroeconomic Outlook Report

According to GlobalData’s Macroeconomic Outlook Report: Global (Q3 2024 Update), China’s economic growth for 2024 is projected at 4.7%, compared to 7% in India. Propelled by strong economic performance, India’s flagship index, the NIFTY 50, has risen by 20.5% (as of September 30) as foreign and local investors have been looking to capitalise on growth.

In comparison, China’s Shanghai Composite Stock Market Index has increased by just 3.8% over the same period. But even this growth reflects a recent recovery in market sentiment in response to recent stimulus measures, which have seen the index rise by 13% over the past week.

A drop in interest rates, lower bank reserve requirements, and lower rates for existing mortgages are set to spur economic growth and lift investors’ sentiments. However, China continues to face significant structural challenges, while recent reforms in India to improve ease of doing business and attract foreign investors have set the parameters for strong, sustainable long-term growth.

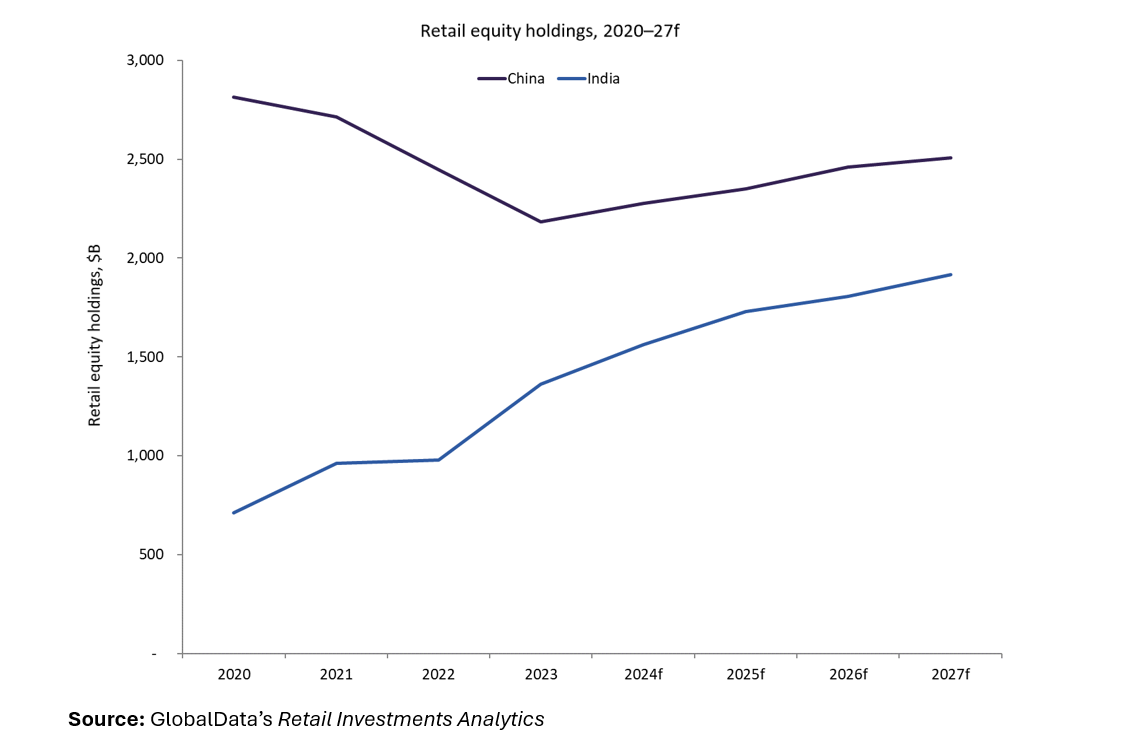

Data from GlobalData’s Retail Investments Analytics mirrors this trend. Chinese retail equity holdings declined between 2020 and 2023. In contrast, holdings in India have experienced strong growth. While total holdings in China still exceed those in India, this will change over the next decade if the latter continues on its growth trajectory.

Secondary Sources: Financial Times (2024) India overtakes China in world’s biggest investable stock benchmark [accessed September 2024]

Heike van den Hoevel is Principal Wealth Management Analyst, GlobalData