Social media marketing is becoming a common strategy to engage with the younger Generation Z cohort. The daily use of social media is higher among those aged 18–24 in comparison to other cohorts, according to GlobalData’s 2020 Banking and Payments Survey, with over 70% of respondents globally in this age group saying that they use or view social media daily.

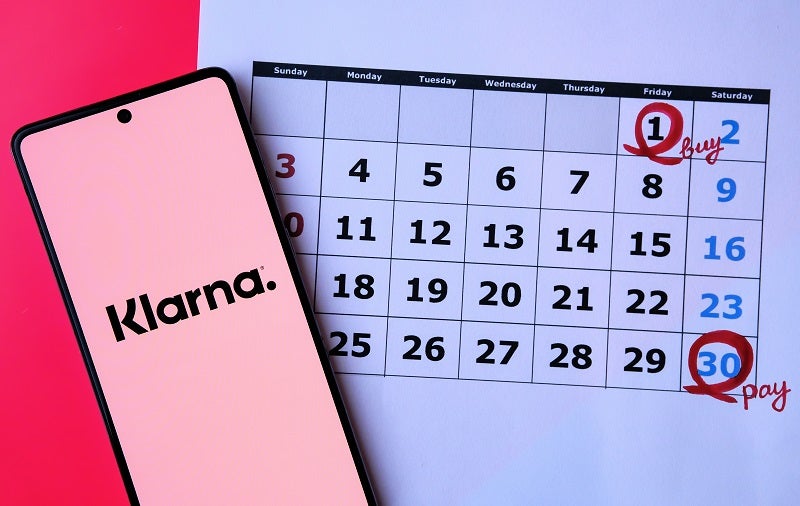

This extensive use of social media has allowed Buy Now, Pay Later (BNPL) firms such as Klarna to promote their services through influencers with a large following; Klarna has, in turn, now created an influencer council to help promote BNPL through a much more transparent, safer strategy. In our view, this is a highly delayed response to the issues that the BNPL sector faces and, in some ways, seems too late.

Research undertaken by Klarna found that just under a third of consumers who have seen an influencer or celebrity giving financial guidance have acted upon it, rising to 53% when Gen Z were asked in the UK.

In the past year, BNPL firms have been heavily featured in the financial press due to concerns around the lack of regulation and an increasing fear of such services being a “debt trap”. However, the popularity of Klarna has soared, and the firm is considered Europe’s highest-valued private fintech at $10.6bn (£7.6bn) as more consumers are drawn towards the appeal of this interest-free, cost-spreading, and convenient payment option.

Influencer council

Realising the popularity of social media marketing has helped Klarna understand the need for additional guidelines and clarity on the style of advertising it allows its paid influencers to carry out.

Therefore, it has announced an influencer council, which will aim to provide the highest amount of clarity and transparency for consumers, brands, influencers, and advertising bodies by developing a whitepaper of guidelines through a toolkit that influencers can use across social media platforms.

In our view, the implementation of such councils is considerably delayed, as the presence of social media and the attraction of BNPL through social media have likely been ongoing since the earlier days of Klarna’s existence. Before the implementation, a number of influencers were reportedly feeling guilty about advertising Klarna’s BNPL services to young consumers; this type of media attention could therefore have driven the move.

In addition, the Advertising Standards Agency had already previously investigated four Instagram posts by influencers who stated that the services provided by Klarna were “mood-lifting.”

As time goes on, the dangers and concerns of BNPL seem to be increasing, so in our view, the launch of the council is essentially a form of damage control rather than a new and innovative implementation as Klarna portrays. The rising concerns around this sector suggest that much more needs to be done to protect younger consumers from debt traps.

As the research suggested earlier, younger social media-driven consumers are likely to listen to influencers, so it’s possible the guidelines from the council will have some positive effect. Overall, however, the delay in transparency is concerning, and it’s likely that by now, BNPL services have become too popular and convenient for consumers to take a sudden interest in rules and guidelines over social media.

The backlash towards the BNPL sector suggests a potential ‘in’ for credit cards once more. Retail banks can leverage their financial expertise and promote BNPL services through credit cards in a much safer and transparent way to the younger cohort, many of whom might have previously seen Klarna as an easier and safer option.

There is also the risk that merchants will back away: they are unlikely to get rid of BNPL but could avoid Klarna if any continued association with the firm results in reputational damage.