This year witnessed the arrival of two major worldwide m-payment (mobile payment) players to the UAE – Samsung Pay and Apple Pay. These add to the emerging number of m-payment solutions already present in the market such as Beam Wallet, Etisalat Wallet and NBD Pay.

These developments come as a result of the local market conditions becoming highly conducive to m-payments adoption over the past three years.

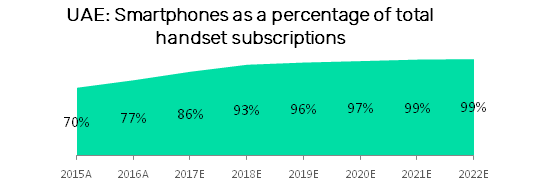

First, the country enjoys a high level of smartphones adoption which is enabling the use of m-wallet and m-commerce apps. Smartphones represented, indeed, 77% of total handset subscriptions in 2016.

Second, GlobalData estimates payment card penetration to have already reached 155% of the UAE population in 2016. This reflects the existing appetite and friendly environment for electronic payments, which m-payment players in the country can capitalize upon.

Additionally, a large and growing retail PoS (Point of Sale) terminals network is increasingly enabling merchants to accept m-payments at their physical stores.

Furthermore, there is a clear and dedicated regulatory framework conducive to m-payments development in the UAE. The Central Bank of the UAE issued in 2017 a licensing procedure for all digital payment service providers, defining four distinct types of digital payment service provider (PSP) licenses – retail PSP, micropayments PSP, government PSP and non-issuing PSP.

For more, click here