While many mobile operators around the world are under pressure as people make fewer phone calls and the competition on data pricing being increasingly stiff − Kenya won’t have it. Even though it has been more than a decade since mobile money came onto the scene in East Africa – mobile money in Kenya is far from old news.

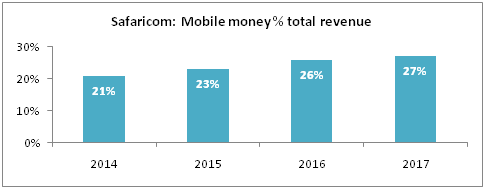

For Safaricom, Kenya’s by far biggest mobile operator, mobile money revenues accounted for 27% of total revenues by year-end 2017, and reached 28% as of May 2018.

However, Safaricom has continued to develop its digital services by expanding far beyond traditional telecoms territory in order to drive mobile money usage. Late last year the company launched its own e-commerce platform, Masoko, that also features Safaricom’s M-Pesa mobile money service as the main payment method.

The operator has been keen to establish a foothold in a potentially high-value market segment in this middle-income economy before international giants such as Amazon enter the market.

On another front, Safaricom is currently in the trial stages of a social media/chat platform app which, of course, also incorportates the company’s highly successful money transfer service, according to GlobalData, a London-based research firm.