Cash remains the most popular payment instrument in Argentina, accounting for 77.7% of the total payment transaction volume in 2019.

This is mainly a result of the high unbanked population, inadequate banking infrastructure, limited public awareness and low merchant acceptance.

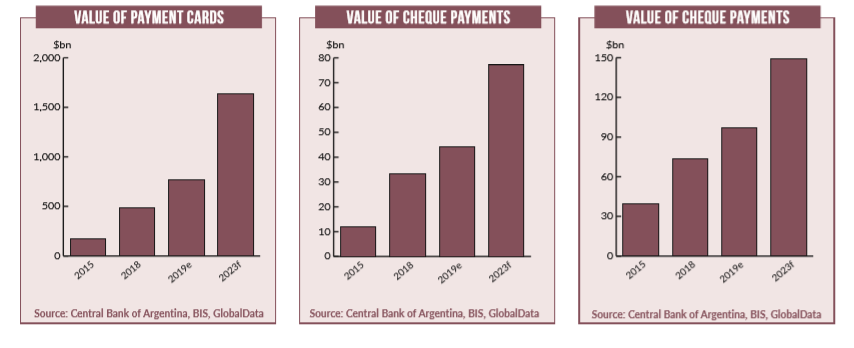

However, the government has encouraged the use of payment cards by promoting the use of payroll cards, lowering interchange fees and merchant service charges, and requiring merchants to install POS terminals. Rising investment in POS infrastructure, and the introductions of instant payments and digital-only banks will also push electronic payments.

Meanwhile, Covid-19 will hasten the growth of electronic payments in Argentina. Although the pandemic is expected to impact consumer spending, there will be a rise in payment card transactions at the expense of cash. An increased contactless payment limit and the growing popularity of e-commerce will further support payment card growth.

Debit card growth

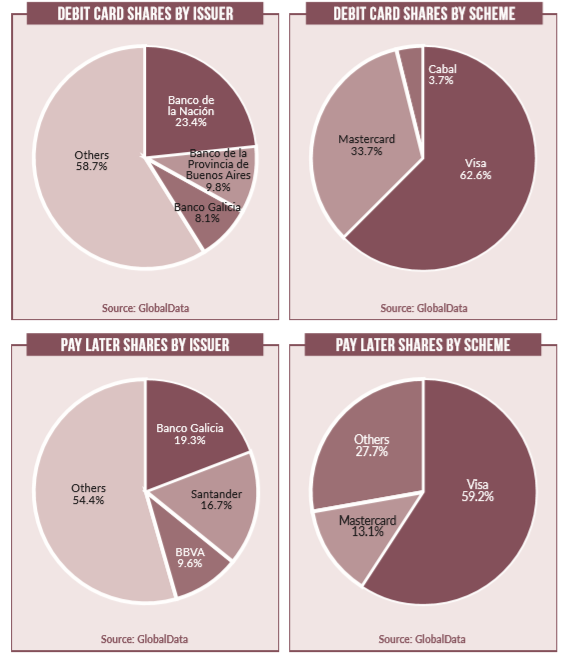

Debit card penetration in Argentina stood at 1.1 cards per individual in 2019. The government has been encouraging the adoption of debit cards by strongly promoting the use of payroll cards – all major banks now offer payroll accounts – as well as reducing interchange fees.

A mandatory wage account regulation was implemented by Banco Central de la República Argentina, requiring payroll, retirement, pension and social welfare funds to be credited into wage accounts.

Financial inclusion initiatives such as agent banking and fee-free basic banks accounts are also expected to drive banking and debit card penetration in Argentina.

Credit cards

Credit cards are favoured for payments, accounting for 65.1% of the total card payment transaction value in 2019.

Driving credit card transaction volume and value are Ahora plans, which enable card holders to purchase products in interest-free instalments. The government extended the Ahora programme until 30 June 2020, enabling credit card holders to purchase products in three, six, 12 or 18 interest-free instalments.

To promote the programme, effective from June 2019, the interest rate was reduced from 45% to 20%. Between January 2016 and April 2019, 114 million transactions worth ARS352bn ($5.9bn) were made under the programme.

E-commerce growth

E-commerce in Argentina recorded significant 46.8% CAGR between 2015 and 2019, to reach $4.8bn in 2019. Argentina is the third-largest e-commerce market in Latin America after Brazil ($27.2bn) and Mexico ($21.7bn).

Increasing internet and smartphone penetration, the proliferation of online retailers, and the availability of convenient payment options are key factors driving the Argentine e-commerce market.

To promote e-commerce, the Argentine Chamber of E-Commerce runs the Hot Sale event every May. During the 2019 threeday event, 434 brands participated and over 2 million products were sold.

Prepaid scope

The number of prepaid cards in circulation recorded a CAGR of 3.7% between 2015 and 2019, rising from 12.9 million in 2015 to 15.0 million in 2019.

Over half of the Argentinian adult population is unbanked, which remains the key driving factor behind prepaid card market growth.

All major banks now offer prepaid cards with the aim of providing easier financial access. Santander offers a rechargeable prepaid card that can be used for cash withdrawals as well as in-store and online purchases. The card can be loaded with funds via online banking.

POS adoption

The number of POS terminals in Argentina recorded a robust CAGR of 21.7%, rising from 433,283 in 2015 to 948,969 in 2019. This is a result of government measures including reduced interchange fees and merchant discount rates as well as mandatory acceptance of debit cards. These measures have pushed POS adoption among SMEs, particularly mPOS terminals.

In October 2018, Todo Pago partnered with BA Taxi, a government operated ridehailing app, to enable 7,000 taxi drivers to accept card-based payments via Todo Pago.