Cash remains the preferred payment instrument in Austria, accounting for 44.8% of the total payment transaction volume in 2018.

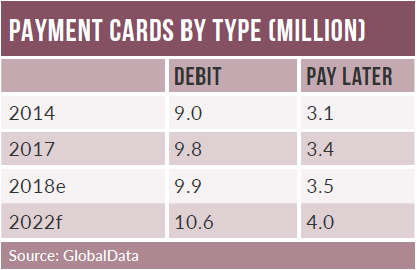

However, payment card use has grown in line with rising awareness of electronic payments and an increase in the banked population. Most Austrian consumers are now banked, and card penetration stood at 1.5 cards per individual in 2018.

Debit cards are the most popular card type, and are increasingly used for payments, as consumers gradually switch to debit cards for low-value transactions.

The credit and charge card market is relatively small in Austria, mostly as a result of debt-averse consumers. With the gradual adoption of contactless technology, growth in online payments, the emergence of alternative payment solutions and the introduction of digital-only banks, the payment card market is forecast to grow further over 2018-2022.

Debit cards are most popular card type, with every Austrian holding at least one. High banking penetration, the debt-averse nature of Austrian consumers and combined efforts by banks and government bodies to promote electronic payments and financial inclusion have led to their strong adoption.

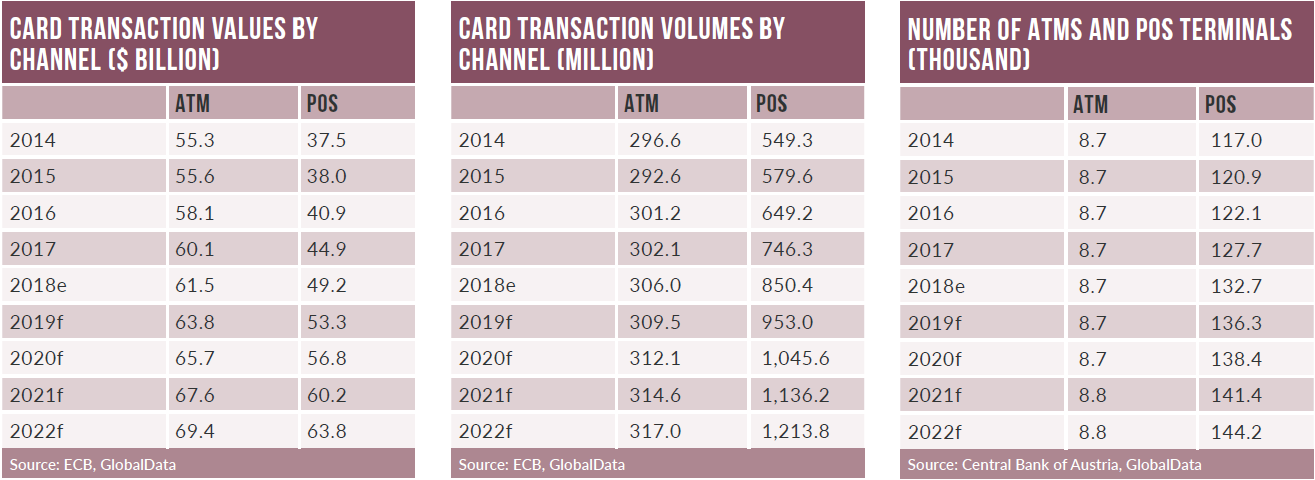

The frequency of debit card payments increased, registering a healthy CAGR of 8.2% to rise from 47.8 times per card in 2014 to 65.5 times in 2018. Meanwhile, the average transaction value for debit card payments fell from €49.10 ($56.28) in 2014 to $46.99 in 2018, suggesting that consumers are increasingly using debit cards for low-value payments.

Credit and charge cards are less popular in Austria, with penetration standing at 39.6 cards per 100 individuals in 2018. The credit and charge card transaction value accounted for 38% of the total payment transaction value in 2018. The debt-averse nature of consumers, as well as banks offering overdraft facilities on bank accounts, has limited the scope of credit card adoption in the country. Charge cards are preferred, as Austrians tend to settle total outstanding amounts in full to avoid falling into debt.

The Austrian e-commerce market grew from $7.4bn in 2014 to $11.3bn in 2018, at a CAGR of 10.9%. This can be attributed to rising confidence in e-commerce among both merchants and consumers. The availability of various payment options also helped to promote e-commerce purchases.

A number of banks and card issuers offer customised cards for online shopping. The availability of online payment solutions such as PayPal, paysafecard, Klarna and Masterpass has also supported growth.

The number of prepaid cards in circulation fell from 10.6 million in 2014 to 1.6 million in 2018; this was attributed to the closure of an Austrian e-money system in 2017. However, the number of prepaid cards is expected to record a CAGR of 5.3% over the four-year period to 2022.