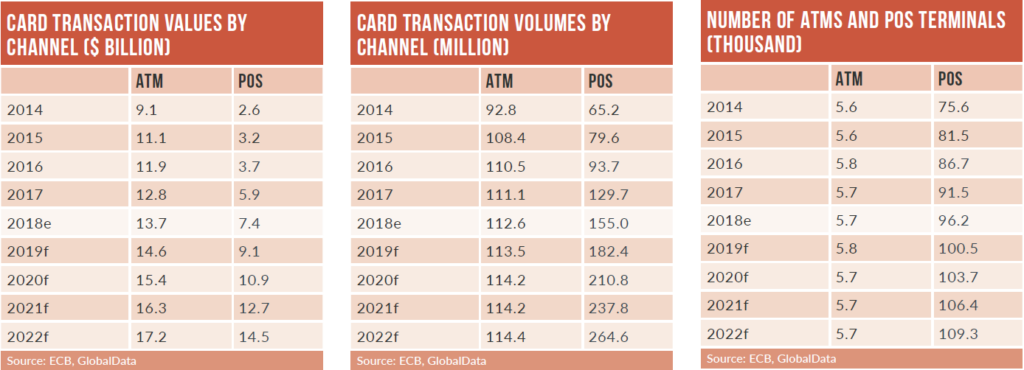

Consumers in Bulgaria remain predominantly reliant on cash, and payment cards are mainly used to withdraw cash from ATMs.

In 2018, cash accounted for 78.8% of the total payment transaction volume, with consumers frequently using it for day-to-day, low-value transactions. This is mainly a result of poor payment infrastructure, limited public awareness of electronic payments, and low merchant acceptance.

However, government initiatives, including ensuring universal access to basic bank accounts, and migrating payment cards to EMV standards, coupled with banks’ and payment companies’ promotional strategies, led to the payment card transaction volume and value recording robust CAGRs during 2014-2018 – a trend that is set to continue to 2022.

The gradual adoption of contactless payments – supported by a rising number of contactless terminals, increased investment in POS infrastructure, new payment solutions, and growth in e-commerce – will also support payment card market growth in Bulgaria.

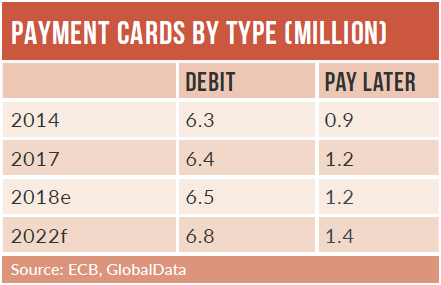

Almost every Bulgarian holds a debit card. This can be attributed to financial inclusion initiatives by the central bank, financial institutions and non-profit organisations.

In September 2016, the central Bulgarian National Bank introduced regulation to provide access to basic bank accounts to all individuals. The accounts must provide deposits, cash withdrawals, direct debits, a debit card and internet banking. As a result, debit cards are the preferred card type, accounting for 75.6% of the total card payments value in 2018.

Bulgarian consumers are increasingly adopting contactless payments. Contactless cards – first introduced in the country by First Investment Bank in 2011 – are now offered by all major Bulgarian banks, while, Visa and Mastercard also offer payWave and PayPass respectively.

According to Mastercard, as of August 2018, 49% of card-based payments at retail outlets in the country were made using a contactless card, meaning every other transaction is contactless.

Bulgaria’s e-commerce market is small, with spend per capita of $80.80 – the lowest among its peers. However, with rises in internet penetration and the popularity of online shopping among millennials, the e-commerce market is expected to record a CAGR of 10.7% between 2018 and 2022.

Cash on delivery remains the preferred e-commerce payment tool in Bulgaria. Other popular methods include credit cards, virtual cards and alternative solutions such as PayPal and paysafecard.

The credit and charge card market is still developing, accounting for 12.3% of the card transaction value in 2018, due largely to the debt-averse nature of Bulgarians. Credit card penetration is also low, at only 17 cards per 100 individuals in 2018.