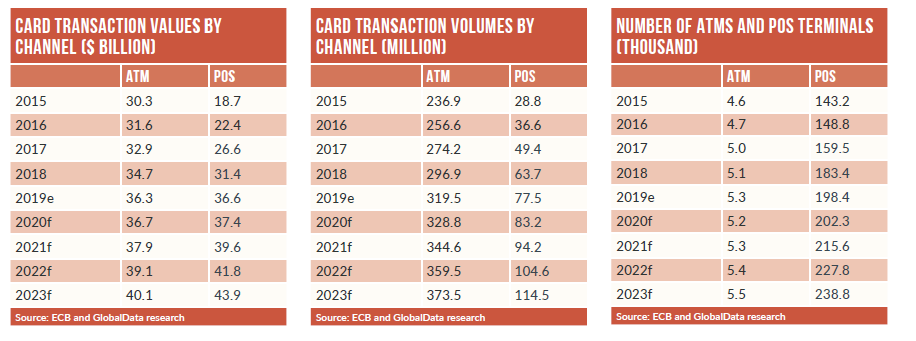

While cash still accounts for over half of payments, consumers are gradually embracing card-based purchases. This is mainly due to the convenience of electronic payments, improving payment infrastructure, and the availability of contactless technology.

The country’s payments market is considered to be fast-developing, as it is consistently witnessing a surge in new

technological innovations and the launch of various banking and payment services.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

This is further supported by government initiatives to improve banking penetration, increasing financial knowledge among citizens, and incentives such as discounts and cashback provided by banks to promote electronic payments.

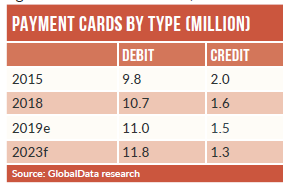

Consequently, the frequency of card use increased during the period 2015–19, rising from 66.4 times per card per year in 2015 to 118.0 in 2019, with this figure set to rise to 136.0 by 2023.

Debit cards are the most popular card type, and are also increasingly being used for payments as consumers are gradually switching to debit cards for low-value transactions.

The recent outbreak of the coronavirus across the world has made electronic payments (like contactless cards and

mobile wallets) and online shopping more appealing in the country, as it allows consumers to avoid close social contact

and thus help prevent the spread of the virus.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHowever, a growing number of individuals becoming unemployed will result in declining consumer disposable income, which in turn will push consumer spending down, affecting the payments industry.

Debit cards, preferred payment card type

Debit cards are by far the preferred card type for payments, accounting for 87.1% of total transaction value at the POS in 2019. This can be attributed to the country’s growing banked population.

In line with the EU’s regulation relating to a citizen’s right to a basic bank account, banks in the country now offer payment accounts with basic features.

Meanwhile, digital-only banks such as Revolut and Hello bank! are also driving competition in the banking space, thus

helping to boost debit card holding and usage. As of July 2019, Revolut had 90,000 users in the country.

Credit cards strong growth pre-Covid crisis

Credit and charge cards are at a nascent stage of development in the country. Collectively they accounted for a mere

12.9% of total payment card transaction value in 2019.

Amid Covid-19, e-commerce grows strong

The Czech Republic’s e-commerce market registered robust 2015-2019 compound annual growth rate (CAGR) of 17.6%, increasing from CZK81.0bn ($3.58bn) in 2015 to $6.84bn in 2019 due to growing internet and smartphone usage as well as the rising number of online shoppers.

Prepaid cards have registered consistent growth

Prepaid cards are gradually gaining traction, with the number of prepaid cards in circulation rising from 449,630 in 2015

to 561,641 in 2019 at a CAGR of 5.7%.