Although a prominent Western European economy, consumer adoption of electronic payments in Italy is lower than many might expect, with cash still holding sway in terms of the overall payment volume. Debit card use is growing, however, with a gradual migration of low-value payments to contactless cards.

Despite being the fourth-largest economy in Europe in terms of nominal GDP, Italians have remained relatively slow adopters of electronic payments.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Cash is used for the substantial majority of transactions, and accounted for 82.4% of the country’s total payment transaction volume in 2016.

The frequency of use per card stood at 39.8 transactions per card in 2016, which is low when compared to Germany (44.2), Spain (56.5), the US (77.4), the UK (103.0), Canada (110.6) and France (147.5).

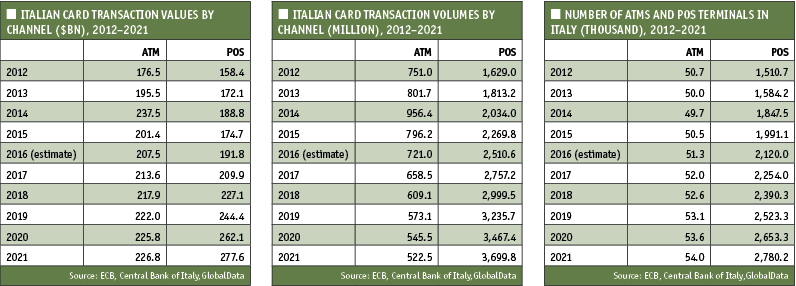

The government’s drive to promote electronic payments through a cap on cash transactions, and the implementation of interchange fee regulations led to a gradual increase in the payment card transaction volume during the review period.

Payment cards accounted for 8.8% of total payment transaction volume in 2016, increasing from 5.5% in 2012.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataEU regulations on capping interchange fees for credit and debit cards at 0.3% and 0.2% respectively were implemented in December 2014. While merchants benefited from lower transaction costs, banks saw their revenues on payment cards decrease, and this affected their overall profitability.

With the new EU interchange fee in place, payment card transaction volumes and values are forecast to grow.

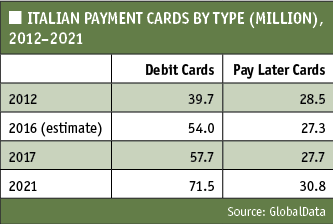

Debit cards maintain dominance

High banking penetration, the debt-averse nature of Italians and the combined efforts of banks and government bodies to promote electronic payments have led to the adoption of debit cards.

Debit cards accounted for 83.1% of the total payment card transaction value in 2016. The gradual migration of low-value cash payments to debit cards, and the rising adoption of contactless technology in debit cards have led to increased use of debit cards at POS terminals.

Government initiatives to increase overall levels of financial inclusion also supported growth in the debit cards market.

In addition to local residents, the government is focusing on bringing the immigrant population into the formal banking system. According to the Italian Banking Association, 2.5m current accounts were held by immigrants as of December 2015.

Growing adoption of contactless

Contactless cards are gradually gaining prominence in Italy. The number of contactless cards rose from 3.1m in 2012 to 20.1m in 2016, and will post a forecast-period (2017–2021) CAGR of 19.24% to reach 53.2m by 2021.

According to Mastercard, the number of contactless POS terminals that accept Mastercard rose by 225% in 2015 compared to 2014. Mastercard’s contactless transactions grew by 360% between January and July of 2016 compared to the same period in 2015. All major Italian banks offer contactless cards.

Alternative growth

Italian e-commerce is one of the fastest-growing markets in Western Europe. In terms of transaction value, the e-commerce value registered an annual growth of 22.3%, to reach $22.4bn (€20bn) in 2016. Consumers in Italy mostly use payment cards to make online purchases.

Payment cards accounted for 74% of the total e-commerce transaction value in 2016. Uptake of alternative payments among Italians is gaining traction due to the availability of solutions such as PayPal, MySi, Paysafecard, JiffyPay and MasterPass.

Emerging payments, including mobile and digital wallets and carrier billing, are also gaining prominence, accounting for 21% in 2016, up from 18.1% in 2012.