Payment cards are used prolifically in Latvia, with its frequency of card payments higher than those in well developed payment markets such as the UK, the US and Germany.

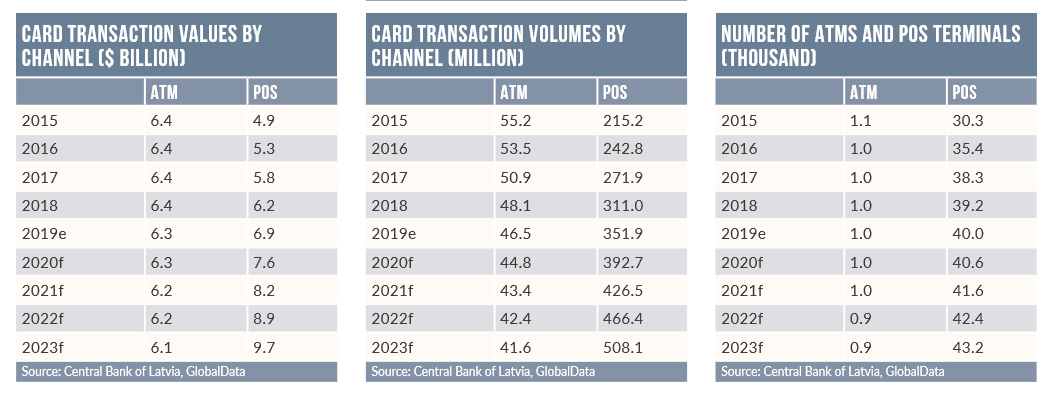

Latvian individuals mostly use cards to make payments, indicating a preference among consumers for electronic payments. The number of card payment transactions is estimated at 351.9 million in 2019 – more than seven times the number of ATM cash withdrawals.

The market also registered significant growths in both card payment transaction volume and value, with respective CAGRs of 13.1% and 8.9% during 201519, indicating a growing preference for electronic payments among Latvians.

This is mainly a result of efforts by the government, banks and merchants to promote financial awareness, as well as an increased contactless payment limit and improvements to the payment infrastructure. With growth in online shopping and the emergence of new digital solutions, electronic payments are forecast to accelerate over the period 2019-23.

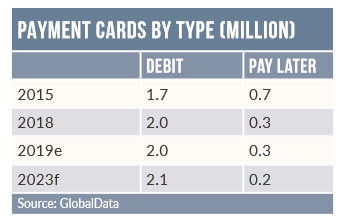

Debit cards remain the preferred type for payments, accounting for 84.7% of the total payment card transaction value in 2019. Debit card payment frequency stood at 158.9 transactions per card in 2019, up from 99.7 in 2015. Similarly, the number of debit card payments registered strong growths both in terms of volume and value, at respective CAGRs of 16.8% and 15.6%.

The cap on interchange fees led to an overall fall in card-acceptance costs for merchants, which boosted POS adoption. The growing preference for contactless payments has resulted in a shift in lowvalue transactions to debit cards.

Credit and charge cards are not very popular in Latvia, with penetration remaining low at only 15.2 cards per 100 individuals in 2019. Despite improved consumer purchasing power, these cards have been slow to take off due to consumer preference for avoiding debt and the prevailing use of cash and debit cards. However, demand is expected to rise in line with increases in household disposable income and employment.

Payroll accounts and debit cards are also offered to push debit card penetration. Swedbank offers a salary account that can be used to receive income such as salary, pensions and allowances; holders are offered a debit card. Similarly, SEB offers debit cards with its salary bank account.

Overall, the market is expected to register forecast-period CAGRs of 3.7% and 3.0% in terms of transaction value and volume respectively.

E-commerce in Latvia posted a 20152019 CAGR of 8.8%, increasing from €224m ($256.6m) in 2015 to $359.7m in 2019. This was facilitated by rising internet and mobile penetration rates, and the growing presence of online retailers. E-commerce is also driving growth in the payment card market.