A wide range of factors, such as successful economic performance, a young population and a well-developed payment infrastructure, make Turkey appealing to banks and card issuers

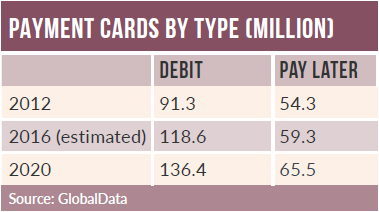

Turkey’s card penetration stands at 2.3 cards per inhabitant – the highest among peers including Poland, Russia, Romania, Ukraine, Kazakhstan and Azerbaijan. The average annual spend per card in the country is higher than for most of its peers.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

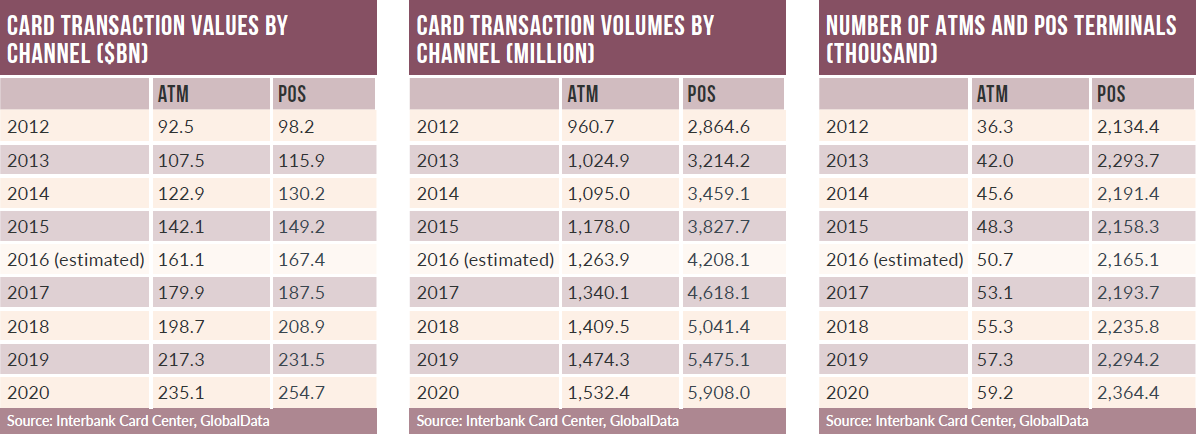

Cash remains a key part of the overall payment system in Turkey, though with time and increased financial literacy and awareness it is gradually being displaced by payment cards. With various marketing initiatives, such as the Bye Bye Cash campaign conducted by banks and the Interbank Card Center of Turkey (BKM) to create consumer awareness of the benefits of electronic payments, the share of cash-based transactions is expected by fall further over the forecast period (2016–2020).

In contrast to payments at retail outlets, most online payments are made with cards and, increasingly, alternative instruments.

Contactless technology is gradually gaining popularity in Turkey, with the number of contactless payment cards rising from 10.3m in 2012 to 29.1m in 2016; it is anticipated to rise further to 55m by 2020. The rising number of contactless cards and growing number of retailers accepting contactless payments will further drive payment card transaction values and volumes over the forecast period.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataExcessive use of credit cards and rising individual and corporate loans led to increased consumer debt during the review period. In February 2014, the Banking Regulation and Supervision Agency (BRSA) placed limits on credit card use in relation to cardholder income, and restrictions on instalment facilities for certain products. Also, the minimum monthly repayment for outstanding credit card debt was raised to from 25% to 30% of the total amount, and banks increased interest rates on credit card borrowings. These measures led to a slowdown in credit card market growth.

However, to spur consumer spending, the BRSA relaxed regulations on credit card and consumer loans in 2016. According to the new guidelines, consumer loan maturity limits rose from 36 to 48 months, and credit card purchases can be made in 12 monthly instalments, up from nine months. This is expected to provide a push to the country’s credit cards market.

However, to spur consumer spending, the BRSA relaxed regulations on credit card and consumer loans in 2016. According to the new guidelines, consumer loan maturity limits rose from 36 to 48 months, and credit card purchases can be made in 12 monthly instalments, up from nine months. This is expected to provide a push to the country’s credit cards market.

The fast-growing e-commerce market is acting as a driver for the payment cards market in Turkey. E-commerce registered a review-period (2012–2016) CAGR of 32.88%, rising from $7.8bn (TRY27.9bn) in 2012 to $24.3bn in 2016.

Conventional instruments, including payment cards, remain the preferred mode of payment for e-commerce, accounting for 85.0% of the total e-commerce transaction value in 2016. However, alternative payments are gaining prominence, with banks, mobile network operators and payment solution providers launching new products. Providers such as BKM Express, MasterPass, PayMobile and PayU are present in the country.