The eternal question for banks is “how do we attract and retain customers?” Some are hoping that open banking is the silver bullet. However, research from Bain suggests that it will not be smooth sailing for incumbent institutions and there are still many factors to consider. Patrick Brusnahan reports

Banking in the UK is regaining some of the health it had pre-2008. The big 5 banks all reported profits for the first three quarters of 2017 that were 50% higher than the same period in the previous year.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Profits remained for the banks in their full year results as well.

However, there are still challenges. Average net interest margins remain below 3.5% for the industry. UK banks have low net promoter scores (NPS) and average at 15. Beloved tech companies, such as Amazon and Apple, are consistently in the 60s and 70s.

None of this comes close to the level of damage Brexit could cause to the UK banking market.

However, one immediate problem that needs to be resolved is open banking.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Open banking

Open banking’s desired effect is to increase competition in the market and encourage innovation. Banks need to disclose performance and fee data, making it easier for customers to compare offerings.

Customers, thanks to open APIs, can now share their financial information with other providers if they so wish. This makes it easier to transfer accounts, manage payments, and conduct transaction through other banks and non-banks.

Bain’s report, Coping with the Challenge of Open Banking, states: “Open banking is good news for consumers, who are likely to gain easier access to a broader array of financial services offered by a larger selection of providers.

“Analysts estimate that 10% to 20% of current UK banking business is at risk of being disintermediated as a result of these changes in the industry.”

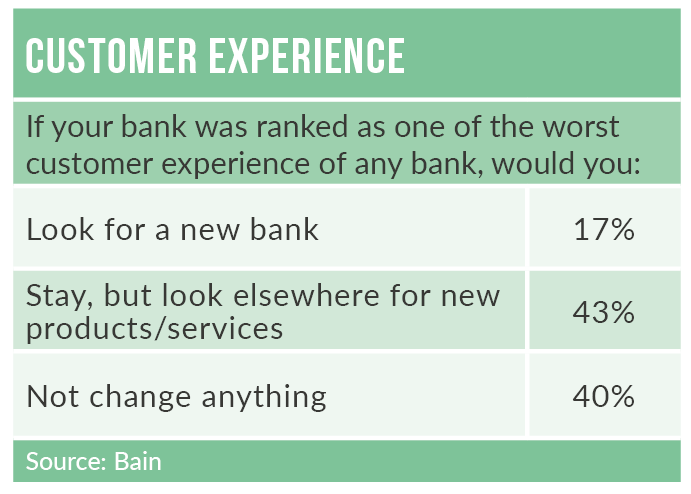

Are customers likely to immediately jump ship? Switching rates in the UK, despite the introduction of the seven day switching service, are still incredibly low.

Total switches in 2017 amounted to 931,956, down a whopping 8% from 1,010,423 in 2016. Even worse: the rate of decline in total switches has increased. The figure for 2016 represented a decline of 2.3% from the 1,033,939 switches in 2015. In 2014, there were 1,156,838 switches.

Ciaran Dynes, SVP Products at big data and cloud integration company Talend, says: “As adoption of services based on the Open Banking initiative become more widespread and consumer confidence grows attitudes will change over time. If consumers see a benefit in sharing their financial data more will be inclined to do so.

“When it comes to issues such as data breach or fraud – data security teams operate on a “not if but when” mentality when it comes to cyber-attacks. They must be handled swiftly, with the customers’ needs put front and centre.

“If the customers are protected and it is demonstrated that should the worst happen they have legislative protection, more are likely to use the new services that Open Banking enables.”

The big five banks still hold 80% of the retail banking market and new players haven’t been adopted on a wide scale. The exceptions are PayPal, Apple Pay and Android Pay which are used by 65%, 16% and 10% of the UK respectively.

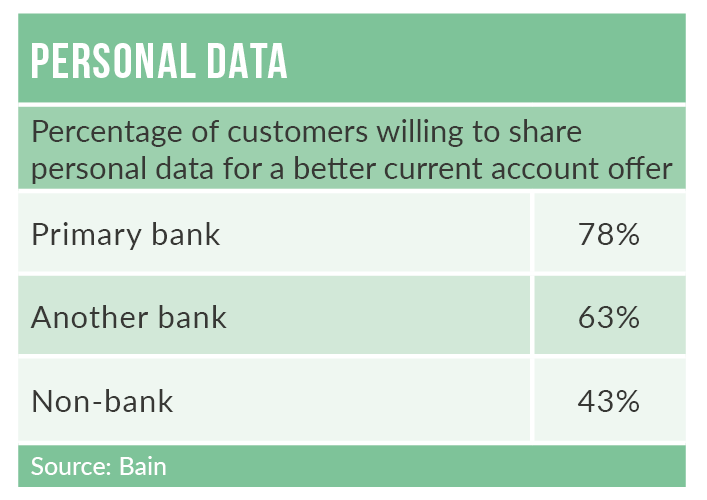

However, this situation could change quite suddenly; 63% of consumers are willing to share financial information concerning their accounts with a competitor for a better offer. Open banking is set to increase UK banking customers’ acceptance of disruptors.

In addition, the report shows consumers’ loyalty has been overestimated. 32% of consumers say they have two or more current account, 57% are in the market for new products every year and nearly every respondent held a financial product with a competing provider.

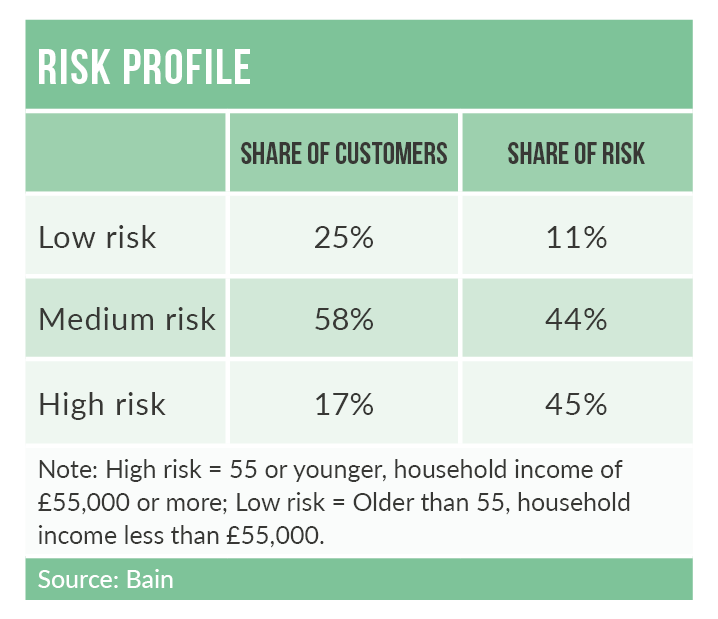

The report concludes: “Whole segments of UK bank customers are primed for change and willing to experiment with new ways to manage their money, borrow and protect their wealth. Industry leaders have an opportunity now to get ahead of the curve by redefining their battlegrounds and their strategies around key customer segments.

“Banks that do not prepare now will inevitably be forced to react when changes do arrive, which for some may be too late.”