In all corners of the globe, the coronavirus pandemic is changing the ways people shop and pay their bills. Mohamed Dabo reports on the impact of covid-19 on Africa’s payments sector.

The payments ecosystem on the continent has proven resilient in the face of the pandemic. The general public continues to trust payments systems and providers, and no substantial outages of core infrastructure have been reported.

Many believe that the changing market outlook could accelerate growth in Africa’s payments industry.

The African electronics payments industry generated approximately $19.3bn in revenues in 2019, of which approximately $10bn was from domestic electronic payments (excluding remittances and cross-border payments).

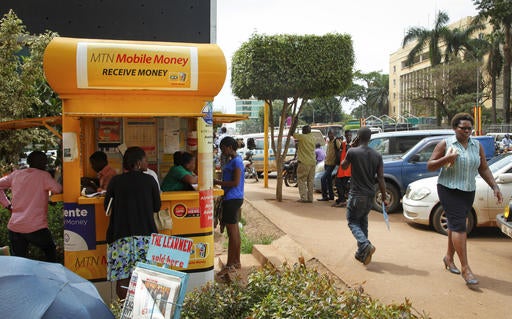

Electronic payments on the continent include card transactions (debit, credit, and ATM withdrawals), e-commerce payments, point-of-sale (POS) transactions, digital-banking payments and transfers, mobile money, as well as remittances and cross-border transactions.

Players in the payment market are primarily payment service providers, payment gateways, and card companies. However, banks are integral to the payment industry.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe payments market is intrinsically linked to the performance of the underlying economy and economic structures.

The main drivers for revenue and number and value of transactions in the electronics payments industry are: internet and mobile-phone penetration; the prevalence of account ownership—either at a traditional bank or mobile money; private consumption expenditure; and the degree to which the population is urbanised.

Survival strategies

In response to the covid-19 crisis and government measures to contain the spread of the virus (lockdowns, for example), banking and nonbanking firms across the payments industry are adapting their operating model and offerings to ensure business continuity and minimise customer disruption.

In this regard, four main activities are notable:

Promoting awareness of digital payments

Companies are making use of a range of communication platforms including websites, social media, traditional media, and text messaging, to educate customers about digital payments.

Providing relief to distressed customers

Across the continent, governments, banks, and non-bank payment companies are taking measures to encourage digital payments and ultimately reduce the burden of the COVID19 crisis on private individuals and SMEs while promoting safe practices to minimise the spread of the virus.

In Egypt, the central bank instructed other banks to cancel fees on transfers and e-payments. In Kenya, banks have waived numerous fees including fees on digital transactions, intrabank transfer fees, bank-to-wallet fees, and transaction fees for payments for utilities, fuel, and shopping.

Partnering with other industries

To expand the use of digital payments and minimise non-essential movement, payment organisations are forming partnerships with other industries to further enable digital payments.

Launching new products

To increase the options for payments and provide support during this disruptive time, organisations are expanding their offerings through innovation.

Areas of impact

In the short term, the pandemic has forced payments providers to make operating model changes, likely prioritising greater flexibility and new short-term goals.

The impact of the crisis will notably be felt in a number of key areas:

A slowdown in economic activity

A reduction in economic activity across all major industries (all of which are intrinsically linked to the payments industry) as result of lockdowns.

The level of impact may be determined by the severity of the lockdown and the transition to e-commerce, especially for services deemed to be essential.

Decline in cross-border transactions

There’s a significant drop in cross-border transactions and remittances with the closure of borders of countries like Nigeria, South Africa, and Ghana disrupting travel and tourism and supply chains, and necessitating consumption of local goods.

According to the World Bank, remittance flows to sub-Saharan Africa are expected to fall by 23.1 percent in 2020. Most African countries are also facing a serious shortfall in hard currency, which is putting pressure on local African currencies and further depressing cross-border interactions.

Acceleration of the shift from cash to digital

The migration from cash transactions to cashless or digital transactions is influenced by physical distancing.

Although the initial reflex at the beginning of the crisis was to withdraw cash, the McKinsey Banking Consumer Sentiment Survey finds that customers want to execute more electronic payments during the crisis.

Kenya and Ghana may have further increases in mobile money, mobile wallet, and bank-to-wallet transactions.

Growing use of digital by national authorities

An increase in the use of digital-payment platforms by African governments to disseminate stimulus funds to assuage the economic impact of the covid-19 crisis while deepening financial inclusion outside the traditional bank establishment.

For example, the government in Togo launched Novissi, a cash transfer program that disburses social welfare payments through mobile channels.

Slashing or waving of fees for services

A decrease in the fees for payment services driven by payments players and governments suppressing fees due to the covid-19 crisis, which could drive up volumes of transactions.

It will also possibly increase the absolute size of the African payments market. In Nigeria, PAGA waived fees for merchants, allowing merchants to accept payments with no additional costs to customers.