February has been a busy month for digital currencies. In China, the Winter 2022 Olympics has led to a wider rollout for China’s official digital currency, the digital yuan. Last week also saw India announce plans to launch a central bank-run blockchain version of the rupee in 2023.

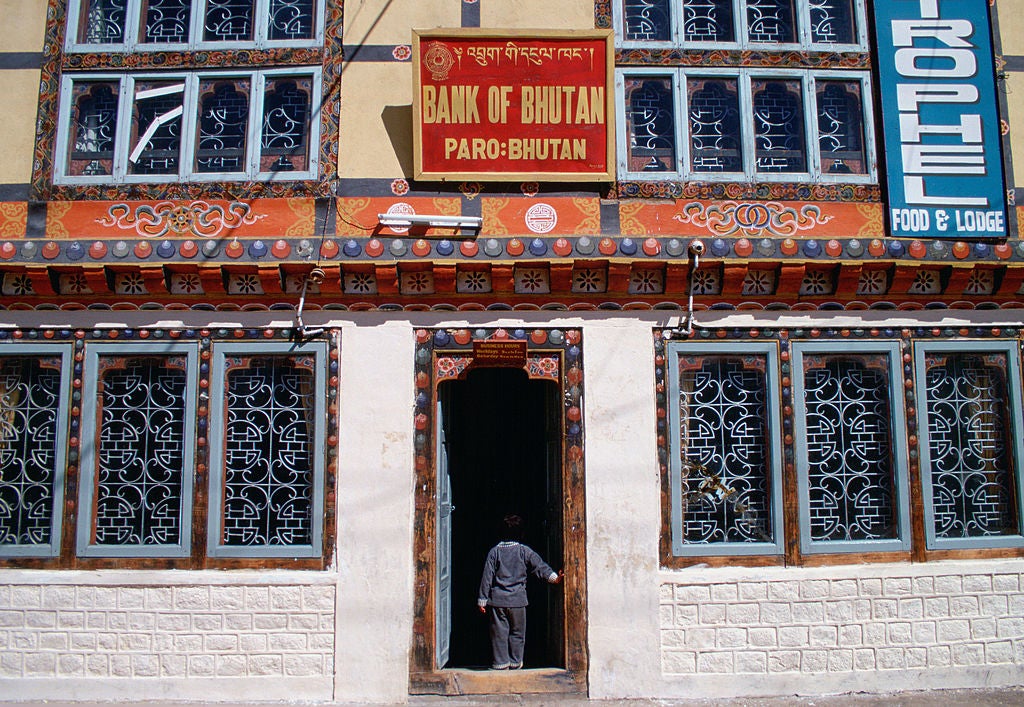

As Verdict recently reported, India is only the latest country to jump on the central bank digital currency (CBDC) bandwagon. According to a 2020 survey from the Bank for International Settlements, 60% of central banks are conducting CBDC experiments and proofs-of-concept. Aside from China and India, other countries exploring digital currencies include Sweden, Estonia, Palau, Bhutan, the Bahamas and Nigeria.

“There is growing interest from many governments in developing their own digital currency – a decision motivated by the decline of cash and the ability to create a currency that is transparent, but also due to the need to create an alternative to cryptocurrencies and stablecoins,” as noted in a recent thematic report from GlobalData.

One nation, El Salvador, has rolled out national usage of the Bitcoin cryptocurrency with less than successful results and a rebuke from the IMF. In contrast, China’s digital yuan had over 260 million individual users within a few weeks of its expanded beta in the run-up to the Winter Olympics, with 87.5bn yuan ($13.78bn) worth of transactions already racked up.

What then for the future of digital currencies, whether cryptocoin-based or otherwise? Verdict finds out with Lizette Keller, partner at RSM El Salvador, an accounting firm with a supervisory capacity on that nation’s Bitcoin project.

Also lending their views are Chris Caruana, VP of AML at financial risk management and fraud prevention provider Feedzai and Michael Kamerman, Group CEO of trading platform Skilling. Opinions also come from Kristjan Kangro, CEO and founder of cryptocurrency investment platform Change who has been heavily involved in the Estonian government’s crypto regulation, and James Wallis, VP of CBDCs & Central Bank Engagements at Ripple. Blockchain payment platform Ripple recently announced a new partnership with the Republic of Palau to explore the country’s first national digital currency and previously worked with the Royal Monetary Authority of Bhutan on its private ledger to pilot a CBDC.

Through separate interviews, Verdict presents a roundtable of views on how digital currencies can be implemented and the likely future for cryptocurrencies and CBDCs.

Giacomo Lee: What experience have you had with digital currencies, and where?

Lizette Keller, partner at RSM El Salvador: Although the adoption of Bitcoin in El Salvador has been led by the public sector, RSM El Salvador took a proactive position, with one of our Partners serving as member of the Salvadoran Supervisory Board.

The Board’s primary objective, in this project, was to establish the accounting criteria when it comes to registering transactions made with cryptocurrency, together with The International Federation of Accountants (IFAC). In addition to this, RSM’s role has been to inform our clients in the country and develop our advisory capabilities to help them navigate the changes.

Kristjan Kangro, CEO and founder, Change: Regulators here in Estonia have not shied away from inviting crypto companies and experts to the table whilst developing legislation. At Change, we welcomed the opportunity to work closely with regulators; shaping amendments to financial legislation which tightened licensing rules and ultimately provided more protection for customers.

James Wallis, VP of CBDCs & Central Bank Engagements, Ripple: Our partnership with the Republic of Palau will initially focus on developing strategies for cross-border payments and a USD-backed digital currency for Palau. This could see the implementation of the world’s first government-backed national stablecoin in the first half of 2022 for which Ripple would provide Palau with technical, business, design and policy support.

Meanwhile, the Royal Monetary Authority of Bhutan will use Ripple’s CBDC solution to enhance digital and cross-border payments and expand financial inclusion efforts. Our collaboration will build atop Bhutan’s payments infrastructure and tap our CBDC solution to support seamless retail, cross-border and wholesale payment use cases for a digital Ngultrum.

What kind of background does the nation in question have in digital currencies?

Keller: The adoption of cryptocurrency in El Salvador happened very quickly and there was little opportunity for forward planning. The country’s president, Nayib Bukele, announced on June 4th 2021 that El Salvador would be adopting Bitcoin as legal tender and congress approved the law just four days later. Government consultations for looking into the implications of the change on business, accounting and the law were limited.

The government issued the equivalent of US$30 in a digital wallet to each El Salvadorian citizen, injecting an estimated US$30–40mn into local economies. It took a herculean effort from the government to set up the required financial infrastructure for the entire El Salvadorian population and this included embedding features in the digital wallet for businesses to process these transactions.

Kangro: Estonia has been building a reputation as one of the most progressive nations in the world in terms of exploring and implementing crypto and blockchain legislation. So far, one of Estonia’s biggest achievements has been ensuring a balance between letting innovation flourish and also providing everyday people safety and security in this space. The silver bullet in achieving this : cooperation.

By involving industry experts (such as myself), legislation that improves standards without creating too many regulatory burdens can be crafted.

What are the challenges when introducing digital currencies to a country?

Keller: Challenge comes from the widespread expectation that remittances to El Salvador will be made via Bitcoin in 2022. And although this is a positive step in terms of economic development, with remittances making up 20% of El Salvadorian GDP pre-crypto, the nature of Bitcoin means that banks will be bypassed. In turn, this muddies the waters for accountants.

We rely heavily on data to understand the landscape in which we operate. Without banking intermediaries, we lose a key source of reliable data. It will be critical for us to access information on Bitcoin transactions in 2022 if we are to make smarter decisions about its use.

Kangro: Regulating cutting-edge tech is no easy thing. Pair that with 2021’s crypto boom and we see regulators considering tighter rules in the industry. It’s important that Estonia’s progressive attitude to crypto remains and isn’t impacted by other countries that may take a more sceptical or hard-line stance.

Chris Caruana, VP of AML, Feedzai: In a world in which private citizens are increasingly sceptical of their governments, CBDCs amalgamate a tremendous amount of personal financial data about the individual. And let’s not forget that one of the core tenets of blockchain and cryptocurrencies is decentralization. This is the inverse.

Regulatory design will likely hone in on this point as banks and additional agencies created to facilitate CBDCs share information. Additionally, who has oversight? Similar to cryptocurrencies, there’s ambiguity around oversight responsibilities and agencies frequently find themselves at odds.

One item not spoken about too loudly is what this all means for settlement systems and the traditional banking space. Expect the global players whose lives will be impacted as this question gets about to then make some noise about the negative aspects of CBDCs until governments have invited them to the table to discuss design and execution.

Why is the digital yuan taking off in China?

Keller: The digital yuan has been on the cards for years. With this comes a highly considered regulatory framework and monetary policy based on continuous analysis. This logical approach, led by pilot tests, means the adoption has every chance of success.

Caruana: First, The People’s Bank of China (PBOC) is primarily focused on adoption in the payments sector, a tremendous industry in China. Secondly, historically speaking, when there’s this hard of a push, desire from the PBOC and Chinese government to accomplish its goals is not a matter of if but when.

Why and where are cryptocurrencies being taken seriously?

Keller: For the LatAm continent’s socialist countries, Bitcoin is attractive because it reduces a governments’ reliance on domestic currencies, which are typically weaker.

Bitcoin is also synonymous with foreign investment to many of these nations, which increases its appeal. The recent supply chain crisis has also underlined the more attractive features of Bitcoin, namely its speed. If these issues continue in 2022, we will likely see further governmental interest in crypto. The next challenge will be to close the loopholes the currency creates, for instance in its enabling of tax base erosion and cheap labour.

Michael Kamerman, Group CEO, Skilling: Countries that have a history of financial stability and are within the developing world continue to demonstrate a significant appetite for crypto, causing traditional financial powerhouses such as Germany, the UK and the US to sit up and take note. Particularly in countries where barriers to accessing traditional financial products remain high, both the ‘buzz of crypto’ and its trading use are becoming commonplace.

For the last two years Vietnam has led the way in crypto adoption worldwide (according to Chainalysis data). Across Europe, Ukraine has been establishing deep roots as a crypto trading hub due to the surging popularity and openness to crypto trading within the country. By introducing legislation to increase regulation in response to this shift in the current trading landscape, crypto businesses can trade and pay taxes legally, which will go a long way to attracting future investment.

Are citizens in any way ready for digital currencies?

Keller: Despite the swift introduction in El Salvador, people and businesses have adapted very fast, even in small and remote towns. The adoption of cryptocurrency in El Salvador marked an important step for financial inclusion in a country where 70% of the population has limited or no access to regular financial services. Currently, more people in El Salvador own Bitcoin than have bank accounts. In 2022, there could be multiple benefits if the government focused on expanding mass access to, and the understanding of, FinTech.

The El Salvadorian government is placing all its bets on Bitcoin as the ticket to financial inclusion and prosperity. The foundation of Bitcoin City, an entirely new settlement in a remote area with relatively low development levels, further signalled the dedication to a crypto-led future.

Wallis: Specifically thinking about Bhutan, CBDCs can provide non-bank participants with greater access to core payments systems and infrastructure, bringing them into the financial system. For example, while only 64% of the population in Bhutan has a formal bank account, over 93% are mobile phone users, suggesting that there is almost one phone per citizen.

Our collaboration with Bhutan to pilot a retail CBDC using our CBDC solution can support governments to meet the needs of this segment of the population that is currently underserved by traditional financial institutions.

How do we best educate on cryptocurrency use?

Keller: Covid-19 has demonstrated that governments can deploy successful educational campaigns at speed and scale. (It has also made) governments, businesses and individuals reflect on how we can use a considered pandemic recovery as an opportunity to build a new and improved world. Crypto can and should be a part of that.

Although the purposes, means of implementation and tax treatment of crypto in each country will invariably differ, the education of businesses, legal professionals and the general population will be key to mass crypto adoption in all countries.

What is your forecast for digital currencies in 2022?

Keller: Most ordinary El Salvadorians are not yet using Bitcoin to make day-to-day transactions. Rectifying this should be the government’s priority for 2022 because a better understanding of the currency will strengthen the legitimacy of the tender amongst the population. Transparency, education and involvement will ensure that even the most far-removed sections of society are brought into a new digital landscape of financial inclusion.

While the government has incentivised Bitcoin adoption in a consumer context, the next step for 2022 is to consider perks for businesses. We envisage the most prominent impact on clients to be the volatility of Bitcoin’s value. Meanwhile, the government and regulators must develop their plans to close tax loopholes and bring crypto into the light. Only then will businesses feel they are in safe hands.