Every year, the holiday season brings a wealth of spending, and experts predict that it could be the biggest yet. But are people enjoying the holiday sales, or being more cautious? Patrick Brusnahan reports

Once again, consumer spending saw an increase this year compared to 2017. Overall consumer spending grew 5% year on year (YOY) over the holiday weekend. In addition, there was 3.9% growth YOY in retail spend.

One of the surprising aspects of First Data’s research was how well bricks-and-mortar operators fared. Bricks-and-mortar total spending increased by 5.3% YOY with retail spending in bricks and mortar also rising, this time by 4.4%.

Physical stores totalled 65% of spending on Thanksgiving and Black Friday, as well as 67% over the weekend if extended through to Cyber Monday.

Speaking to CI, Glenn Fodor, senior vicepresident and head of First Data Insights, notes: “Bricks and mortar and e-commerce both had fairly strong sales this season. In the three weeks leading up to Thanksgiving, e-commerce grew to 37% of total spend.”

Fodor continues: “In-store sales during Thanksgiving through Cyber Monday drove a bit more spending at bricks and mortar, but e-commerce is firmly north of 30% of all spending now.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“More specifically, e-commerce consistently fetched the higher average ticket size across retail, with the average ticket size being 68% higher than average tickets in-store. Bricks and mortar fared better within industries such as the sporting goods, hobby, book and music categories, and in electronics and appliances, where average tickets were over $100 higher.”

Overall, total spending across all channels between Thanksgiving and Black Friday grew by 7.1% compared to 2017. E-commerce spending grew 10.8%, but retail e-commerce spending grew by a grander 18.1%. Small and medium-sized businesses (SMBs) had a strong festive period.

According to First Data, from Thanksgiving to Cyber Monday, they saw 5.5% YOY spending growth – higher than the 5% YOY growth experienced by the market as a whole. The growth was attributed to increased average ticket sales, which grew by 4.3% compared to 1.4% for the market.

“Our report found that to start the holiday season, SMB spending growth has outpaced the total marketplace, and while SMBs are driving transaction growth, they have also figured out how to encourage customers to spend more per visit,” Fodor explains.

“While affordable items may still remain king, our data found the higher spend per visit at SMBs has helped drive successful spending growth, particularly in highcustomer- service-oriented retail categories, such as building materials (22.8%) and small electronics (17.8%).”

Has spending slowed?

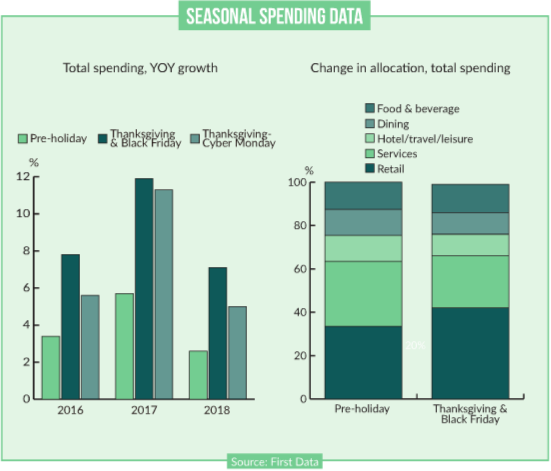

While this year saw growth, 2017 recorded greater growth compared to 2016. Preholiday spending grew by 5.7% between 2016 and 2017, but only by 2.6% the following year.

Thanksgiving and Black Friday spending grew by 11.9% YOY in 2017, but only 7.1% in 2018. Similarly, spending growth across the entire holiday weekend fell from 11.3% to 5%.

Fodor concludes: “Considering the strong 2017 holiday season overall, the start to this year’s season was relatively solid and the pre- and post-Thanksgiving and Black Friday trends are directionally in line with historical norms.

“While it is difficult to forecast overall growth expectations, we can see from government data that US consumer sentiment and employment markets remain intact, further evidenced by our initial readings of holiday season growth.”