The 2021 survey report by Open Banking fintech Tink looks at how financial institutions have responded to the pandemic and Open Banking opportunities on the horizon. Mohamed Dabo reports

Many predict that Open Banking will be the new normal in the post-pandemic landscape. Indeed, Open Banking has emerged over the past few years as an enabler to the executive’s agenda.

In particular, the ability to enable data-driven banking processes and improve the customer experience has increased appetite for account information services.

In relation to the executive agenda, there are three key ways that financial institutions can leverage Open Banking technologies to benefit their business in the post-pandemic world:

- Increase speed of innovation

Open Banking technology platforms provide access to tools and capabilities that are easily scalable across lines of business, customers segments, and even geographies.

These platforms help maintain API connectivity across multiple banks and countries, which would otherwise be a complex endeavour for banks requiring significant investments, especially in engineering, operations and legal.

More importantly, these Open Banking technology platforms can give financial institutions the ability to recycle code and toggle different data-driven services, radically accelerating the time-to-market in the development of digital services.

- Unlock new commercial opportunities

With increased pressure on legacy revenue streams and profit lines evaporating, financial institutions are in desperate need to ensure that their digital endeavours stand their ground in the increasingly competitive digital market.

Open Banking technology has proven not only to directly improve customer value and engagement, it has also introduced opportunities to identify customer needs and enable financial institutions to deliver personalised propositions tailored to each individual.

- Enable operational efficiencies

Open Banking can be used to radically accelerate onboarding time, customer due diligence processes, and risk assessments.

Most financial executives will recognise that shift towards automation is primarily inhibited by processes that require input from the customer: identity information, transaction history, income verification, and other relevant details.

Customers are typically required to collect the relevant documents and transfer them either physically or electronically.

Since these documents need to be manually opened, reviewed, and assessed, it can be a massive productivity drain – some banks share that 50% of customers don’t provide the right information in their first submission.

During the pandemic, Open Banking has proven to be a solution that can simplify the process for the customer, while radically increasing operational efficiencies by retrieving the required information from a customer’s primary bank.

Moreover, by virtue of the data being fetched in real time and in a machine-readable format, financial institutions can onboard quicker and with lower risk, reducing the cost of customer acquisition.

Open Banking is higher on the agenda in the post-pandemic world

The appetite towards leveraging Open Banking technology is accelerating and climbing higher up on the agenda for banks than ever before.

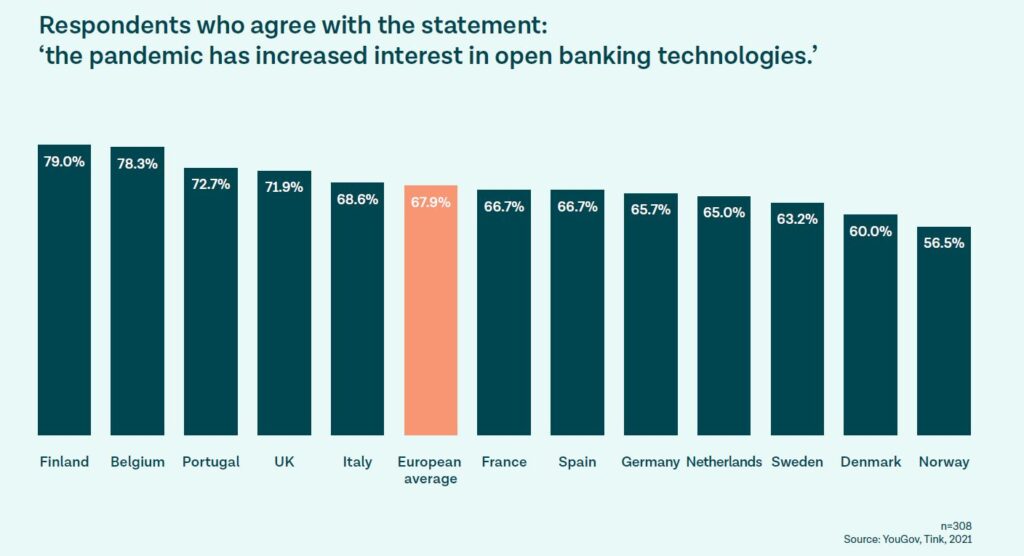

More than two-thirds (68%) of financial executives surveyed across Europe indicate that their interest in Open Banking has increased during the pandemic.

Financial institutions have now seen that Open Banking technologies enabled by the EU’s revised payment services directive (PSD2) and the UK’s Open

Banking legislation presents opportunities to lower risk, anticipate financial distress and even increase sales – all while improving the customer experience.

Clearly, more financial institutions are looking at Open Banking as a potential solution to the challenges presented by the pandemic.

Have your contingency plans ready

Despite the optimistic sounds coming from governments, the Covid-19 crisis has resulted in a substantial weakening of the economic outlook.

The increased capital in the market points towards an artificial and temporary drop in the ratio of NPLs and business bankruptcies.

These signals suggest that the pandemic has not revealed its entire hand yet.

Based on the findings presented in this report, here are a few suggestions for executives to consider as the industry transitions into the post-pandemic world.

Over 40% of executives anticipate a long-lasting or even permanent impact on the industry, as they have transitioned towards digital services, improving customer experiences and restoring profitability.

However, there are also many who are expecting things to go back to normal.

These executives risk sleepwalking their business into a future that may have a severe impact on their customers as they may become exposed to increased financial distress.

Executives need to put together plans on how to respond and where to focus when the tide starts to turn.