With major US bank PNC joining the growing list of banks that belong to RippleNet, Ripple’s blockchain technology is increasingly achieving mainstream legitimacy. Robin Arnfield reports

Convenience is touted as the major advantage of virtual banking, but it is not the only one: there are many reasons to bank online, from 24/7 service and a speedy process.

In September 2018, Ripple said PNC Treasury Management is to participate in RippleNet, the US fintech’s inter-bank blockchain network, enabling PNC’s commercial clients to receive real-time crossborder payments via Ripple.

“Leveraging Ripple, a PNC commercial client in the US receiving a payment from an overseas buyer will receive payments against their invoices instantly, transforming the way they manage their global account receivables and allowing them to better manage their working capital,” a Ripple press release noted.

“PNC is an early adopter of a lot of payments and banking technology,” says senior Aite Group analyst Talie Baker. “For example, in August 2018, PNC said it would allow clients to originate payments to corporate or consumer receivers via The Clearing House’s RTP [real-time payments] network, so it isn’t surprising that PNC is involved with Ripple.”

Evolution

“We’ve seen an evolution from the original idea of just using cryptocurrency to the concept of using blockchain platforms separately from cryptocurrencies to address problems in the payments industry – specifically B2B and P2P transfers – especially for smaller businesses and enterprises,” says senior Celent analyst Alenka Grealish.

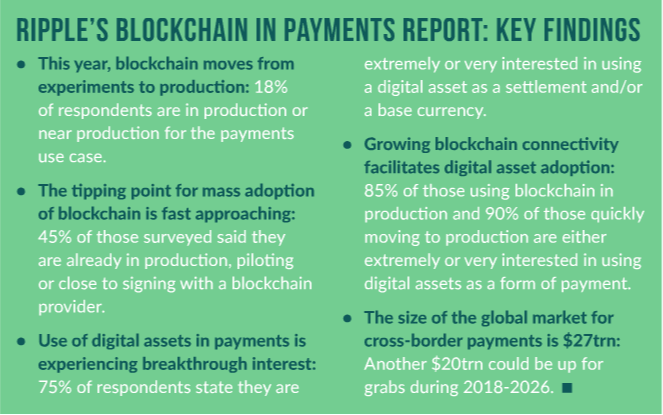

“In Ripple’s case, this has resulted in the firm developing enterprise-level software to facilitate a variety of cross-border transfers, not just B2B. We’re now at the tipping point in terms of enterprise and bank use of the blockchain, with early-mover banks and other enterprises moving into production and fast followers moving into pilots, which begins fuelling the network effect. The recent announcement of PNC joining RippleNet is an indicator of this phenomenon.”

Speaking at Ripple’s October 2018 Swell conference in San Francisco, Cory Johnson, Ripple’s chief market strategist, said: “The world is used to getting things, right now, on demand. They aren’t waiting for anything. When we look at blockchain and the solutions it offers in cross-border payments, we have an opportunity to address their needs.” A survey of nearly 700 global payments professionals across multiple industries and in 22 countries for Ripple’s Blockchain in Payments report found that 18% of respondents are in production or near production for blockchain-based payments. The report, released at the Swell conference, said that a further 27% of those surveyed are in pilot with or are close to signing with a blockchain-based payments provider. Other payments-related blockchain initiatives include the IBM Blockchain World Wire, the JP Morgan Interbank Information Network, Visa B2B Connect, and the Stellar Development Foundation.

Bridging fiat currencies

As use of blockchain for cross-border payments moves into production, the next step change will be the use of cryptocurrencies to enable real-time settlement. The cryptocurrency will act as a bridge between two fiat currencies, Grealish says.

However, senior Aite Group wholesale banking analyst Erika Baumann warns that using a cryptocurrency as the bridge between two fiat currencies introduces extra FX risk, due to the volatile nature of cryptocurrencies.

Traditionally, financial institutions (FIs) provide liquidity for cross-border transfers by pre-funding Nostro accounts on each side of a transaction in each country’s native currency. According to a 2016 McKinsey Global Payments report, there is approximately $5trn dollars sitting dormant in these accounts around the world.

“The big benefit is that real-time settlement eliminates the need for pre-funded accounts at correspondent banks,” says Grealish.

“Blockchain’s use case in cross-border payments is meeting two of the three requirements for success: customer value and technological viability. The third, economic viability, is still a work in progress and hinges on at least one of the contenders achieving the network effect.”

According to Grealish’s Celent report, Blockchain in Action in Corporate Banking:

Contenders out of the Blocks, Ripple “is the only blockchain technology provider to FIs that offers the entire stack from the protocol and network to the applications and a native digital asset (XRP).” Grealish wrote that Ripple “is striving to connect not only banks but also other payment providers and companies, in particular new economy companies. It is solving end users’ cross-border payment pain points and FIs’ internal challenges (e.g. legacy systems, the need to de-risk and retrench correspondent banking relationships, and liquidity constraints).”

Ripple has three products addressing key issues related to payments:

- xCurrent: A messaging and settlement platform that allows FIs to communicate information about a payment with each other in real time, and settle the payment instantly;

- xVia: A protocol that standardises connections between different payment networks, so service providers such as money network operators (MNOs), banks and corporates can send payments via any RippleNet-participating FI. The advantage of using Ripple’s protocol is that it makes integration with other FIs and payment services companies much easier than integrating with multiple different companies’ APIs, and

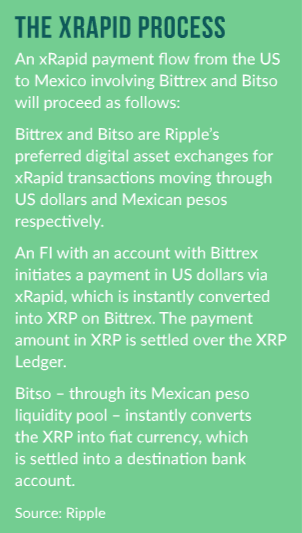

- xRapid: A liquidity management system enabling businesses to source liquidity on demand using Ripple’s XRP cryptocurrency and its XRP Ledger. This involves exchanging fiat money for XRP and then instantly into the desired fiat currency. Ripple says on-demand liquidity means quicker payments, no more tied-up capital, and no more reliance on big banks to handle foreign exchange.

After being in pilot phase with several money-transfer firms, including MoneyGram and Western Union, xRapid was commercially launched in October 2018 and is live with three companies:

London-based MercuryFX, US-to-Mexico remittance service Cuallix, and wholesale cooperative financial firm Catalyst Corporate Federal Credit Union, which serves 1,400 US credit unions.

So far, Ripple has not publicly announced that any banks are piloting xRapid, and according to Reuters, said that major banks are unlikely to be the first to test or use it.

“PNC Bank will not be using XRP or xRapid to carry out payments for now,” Asheesh Birla, Ripple’s senior vice-president for product management, told Reuters. In May 2018, Birla said that for payments in the US-Mexico remittance corridor, companies using xRapid saved 40-70% compared to normally FX broker fees.

“An average xRapid payment took just over two minutes, compared to today’s average of two to three days when sending cross-border payments,” Birla wrote in a blog.

“The portion of the transfer that relies on the XRP Ledger takes two to three seconds, with the additional processing time attributed to movement across the intermediary digital asset exchanges and local payment rails.”

Deployments

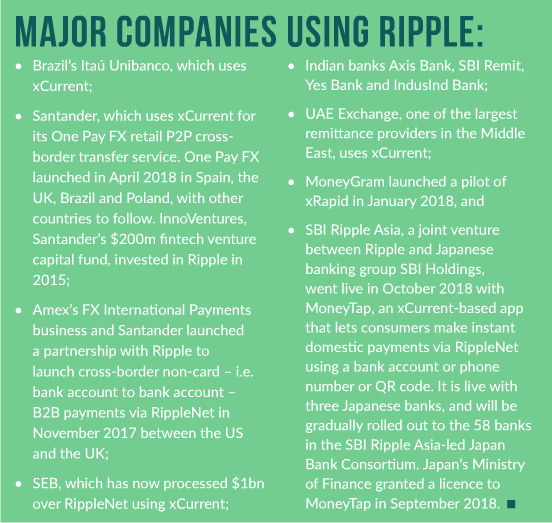

Ripple CEO Brad Garlinghouse announced at Swell that, between quarter three of 2017 and quarter three of 2018, Ripple’s customer base grew by 100% to over 120.

The company is signing up an average of two production customers per week across its suite of products, he said. According to Garlinghouse, Ripple now has customers in over 40 countries in six continents, including new corridors in Africa, North America, South America, Europe and Asia.

“Ripple has achieved a record ‘in production’ number, because it has put in place the critical building block for success in implementing blockchain-based technology and scaling it,” Grealish wrote in her report.

“Ripple’s standard applications and the RippleNet agreement enable relatively fast onboarding. Through RippleNet, Ripple has overcome the challenges of forming a consortium blockchain: governance, standards and scale. Ripple establishes an agreement with network participants to use the same technology – such as xCurrent for banks – and adhere to a consistent set of rules and standards to ensure operational consistency and legal clarity.

“Its rulebook was developed in partnership with the RippleNet Committee. On the tech side, a RippleNet member needs only to plug in once to transact with any other RippleNet member; on the commercial side, members wishing to transact with each other need to establish liquidity accounts.”

Remittance companies partnering with Ripple include RationalFX, Xendpay and InstaReM for transfers from the UK to Malaysia, Vietnam, Indonesia, Sri Lanka and Bangladesh; Remitr and FlutterWave from Canada to Nigeria; and Beetech and InstaReM from Brazil to Spain, Italy, Germany, France and Portugal.

In September 2018, London-based TransferGo began using Ripple for real-time transfers to its Indian banking partners for the Europe-to-India corridor. TransferGo said it saw initial transfers over RippleNet take just six minutes. It is offering instant transfers via RippleNet to India for a fee, and free RippleNet-based transfers that take two to three days at a mid-market inter-bank exchange rate.

“It is notable that, so far, the banks and other companies using Ripple haven’t provided much information on their success or their cost-savings with the platform,” says Baumann. “But I think Ripple is strategically positioned in terms of the partnerships it has established.”

“The blockchain is a great solution for digital remittance firms like TransferGo or Remitly, as it helps them save costs on infrastructure,” says Baker.

“But for established MNOs likeMoneyGram and Western Union, the blockchain’s real benefit is taking infrastructure costs out of their business.

“The remittance business is now so price competitive due to the advent of digital-only players. So, because the MNOs are being squeezed on their margins, they aren’t passing on cost-savings from the blockchain to customers.”

Swift’s response

In response to blockchain initiatives such as Ripple and Visa B2B Connect, and to nonbank competitors in the cross-border space, SWIFT has developed SWIFT gpi (global payments innovation).

Elizabeth McQuerry, who heads Glenbrook Partners’ global payments practice, described SWIFT gpi “as the next generation of traditional correspondent banking, implementing enhancements to make the sector more competitive through payment tracking, greater transparency, and same-day value delivery within the network of users”.

New technology offered in SWIFT gpi includes a cloud-based tracker service that uses APIs to monitor the process of all payments.

SWIFT gpi has a strong service level between the banks involved, so not only are gpi payments tracked and monitored, but they move faster as they must be processed within a certain timeframe. According to SWIFT, with gpi, payments are credited within 24 hours from initiation – and most within a few hours, or even minutes.

“SWIFT is going through its second evolution through gpi, and worked with some big US financial technology vendors, including ACI Worldwide, on gpi to really try to solve the cross-border issues involved in using SWIFT,” says Baker.

“With gpi, there are finally real-time capabilities for payments. The problem for corporates is that there is ambiguity in the market as to what solution will become the standard for cross-border transactions – for example the card networks’ platforms, SWIFT or Ripple.”