A daunting new age of mega fraud is upon us. Not content to just inflict financial loss, the new breed of scams can cause fatal damage to a brand, drive customers away, and the target out of business. Mohamed Dabo reports.

As business evolves, so do those who seek to profit illegally from it. For every new tactic companies adopt to combat fraud, there are countless bad guys exploring new ways to wreak havoc, often with ramifications that go far beyond the balance sheet.

A study by SourceMedia Research and PaymentsSource conducted on behalf of Accertify, Inc. (a wholly-owned subsidiary of American Express), shows that while credit card fraud and financial loss remain key issues to contend with, we have entered a new era when it comes to fraud.

Businesses across all industries are more focused than ever on creating frictionless, customized experiences for clients that are both simplified and more secure.

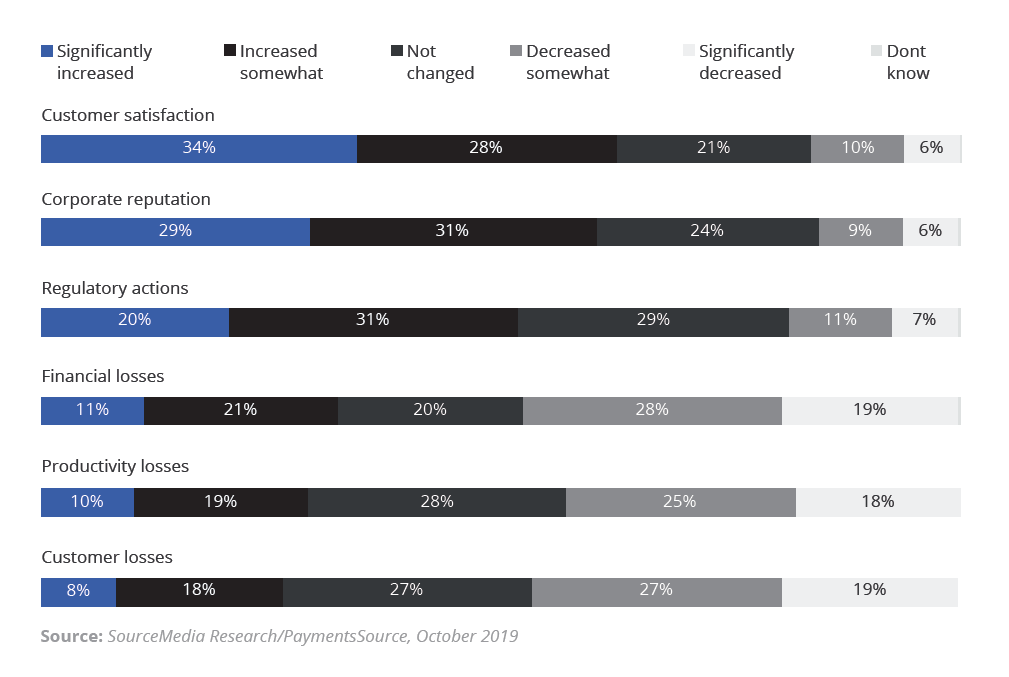

The research reveals why: A survey of employees at airlines, casino/gaming companies and retailers shows that what companies fear most from fraud is no longer purely financial loss, but customer attrition and damage to corporate reputation.

Consider the following statistics, which illustrate this point:

- Risk to customer satisfaction from payment fraud jumped 62% compared to 12 months ago—the biggest increase of any risk factor respondents were asked to rate. Corporate reputation was next highest, with an increase of 60%.

- When asked to rate their companies’ overall vulnerability, 41% of respondents say they feel just as or more vulnerable to fraud than they did 12 months ago.

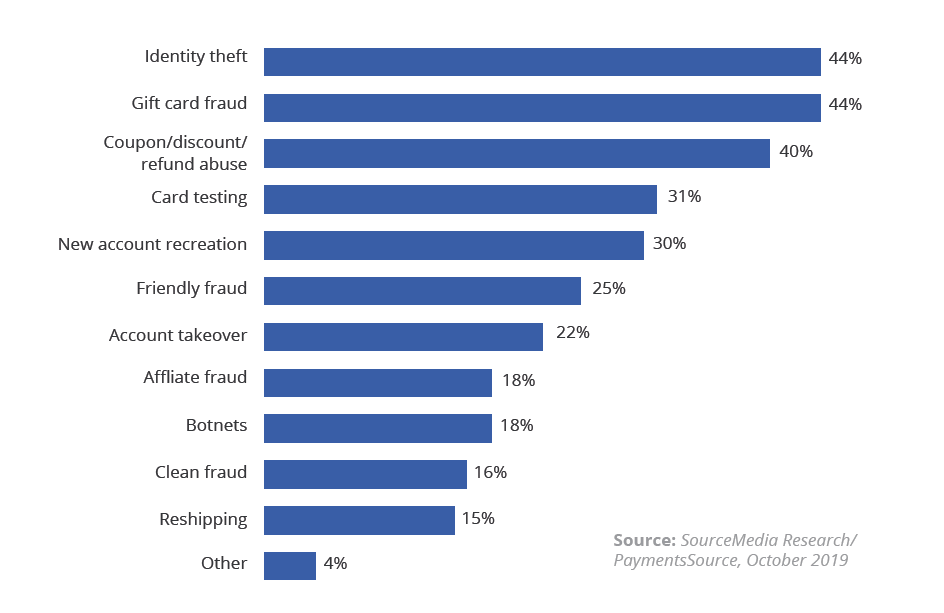

- Non-traditional fraud is on the rise, with identity theft and gift-card fraud seeing the biggest jumps, having increased 44%, followed by coupon/discount/refund abuse, at 40%.

This report takes a look at these and other pressing trends, how companies are coping and what they can do to further fraud-proof their businesses while simultaneously improving customer experience.

Fraud through the Eyes of Today’s Businesses

Fraud isn’t what it used to be. The latest attacks—account takeovers, data breaches, coupon/ discount fraud—are very damaging to brands and may drive consumers to take their business elsewhere.

“The bad guys are moving further back in the chain, they’re not just attacking at checkout, they’re trying to get into your accounts,” says Andrew Mortland, Vice President of Product at Accertify.

The reason is that fraudsters have moved beyond making fraudulent payments and are now fixated on the enormous financial value locked up in consumer accounts, including loyalty points, rewards, stored payment methods, gift cards and coupons.

Data from the study shows that some companies are aware of this shift and the need to evolve fraud-fighting tactics.

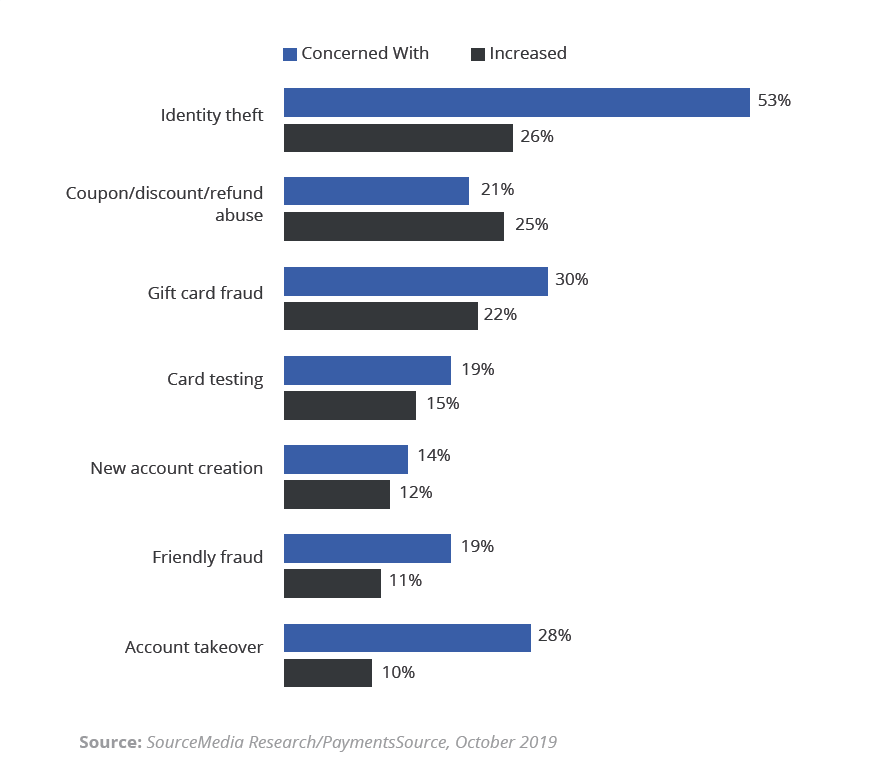

Consider that when asked which three types of fraud increased the most at their company over the past 12 months, respondents cited identity theft (26%), coupon/discount/refund abuse (25%) and gift card fraud (22%).

These businesses are aware of the need to be vigilant as attacks are expected to increase.

Fraud Types Increasing/Concerned With

“It’s a very complex, ever-changing space” Mortland says. “So, the problems you’ll see this year probably won’t be the same next year and many of the new attacks are very different than what we saw five years ago.”

“It’s a very complex, ever-changing space” Mortland says. “So, the problems you’ll see this year probably won’t be the same next year and many of the new attacks are very different than what we saw five years ago.”

While traditionally, fraud prevention has been an exercise in saving money, it is morphing into one of saving face.

This is evident in the data, which points to customer satisfaction and corporate reputation as the greatest pain points for companies when it comes to fraud.

Meanwhile, financial losses, traditionally a top concern, ranked fourth.

Impact of Payments Fraud

“Now, if I get a hold of your account, and I drain your loyalty points, or I ship a bunch of goods to an address you don’t know, you don’t feel safe doing business with that company,” Mortland says. “You might decide you’re going to take your business elsewhere. From a corporate reputation perspective, whether it’s a data breach, people’s accounts being taken over or it took me two weeks to set things right with my airline, those are big problems that are different than just a financial loss.”

“Now, if I get a hold of your account, and I drain your loyalty points, or I ship a bunch of goods to an address you don’t know, you don’t feel safe doing business with that company,” Mortland says. “You might decide you’re going to take your business elsewhere. From a corporate reputation perspective, whether it’s a data breach, people’s accounts being taken over or it took me two weeks to set things right with my airline, those are big problems that are different than just a financial loss.”

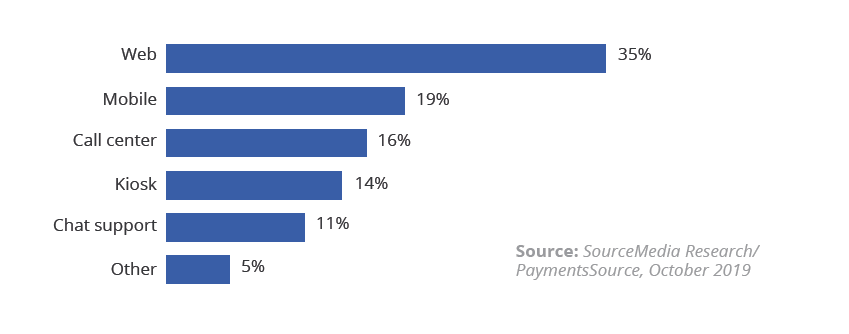

One consistent trend is that the web continues to be the avenue of choice for fraudsters, accounting for 35% of total financial losses companies experienced in the past 12 months.

Also a risk, but less so: mobile (19%), call centers (16%), kiosks (14%) and chat support (11%).

Payment Fraud Channel Origination

A crucial change is that today’s fraudsters do more than just steal credit card numbers.

In terms of fraud types, those related to identity theft (44%), gift cards (44%) and coupon/discounts/ refunds abuse (40%) are the most prevalent.

Fraud Types Experienced

“It’s rather easy for a bad guy just to go set up fake account after fake account after fake account for certain types of abuses,” Mortland says.

In so doing, fraudsters can take advantage of promotional offers and discount codes that many companies offer.

Fraud of this type often flies under the radar because what the bad guys are doing isn’t typically viewed as a high-risk event,” Mortland says. “No money is changing hands, somebody is just setting up an account. But actually, there are some big risks there for merchants.”

For this reason, it’s imperative that companies take a more holistic approach to fighting fraud.

Evolving Fraud Detection and Prevention

The most effective way of solving these new types of attacks is to regularly assess a user’s actions and behaviors beyond just the transactions being made.

“Businesses should be alert to all account-related interactions, watching for sudden changes or anomalies,” Mortland says. “Learn which users to trust and which to turn away by taking advantage of modern fraud-fighting technology—machine learning, user behavioral analytics and device intelligence.”

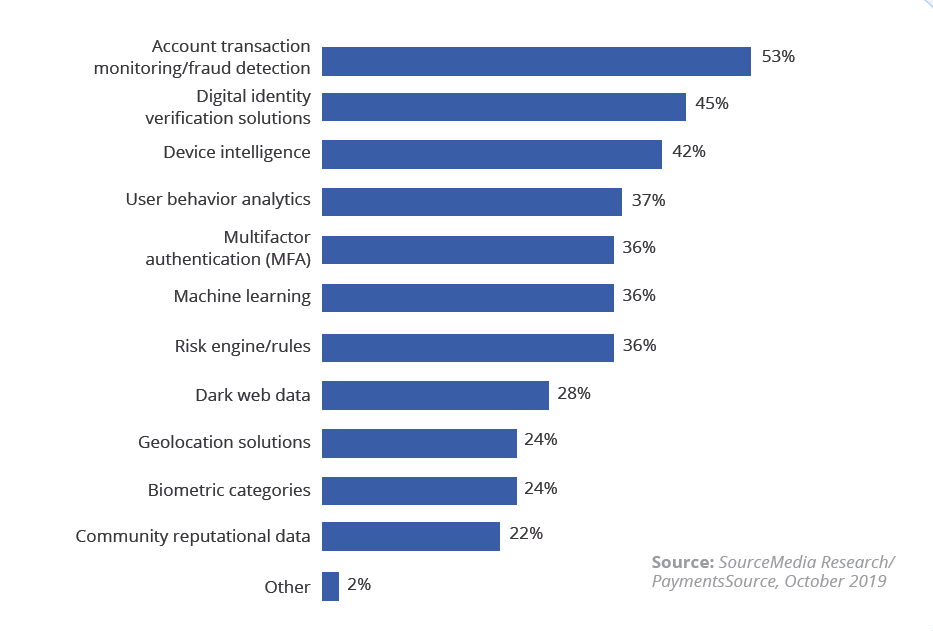

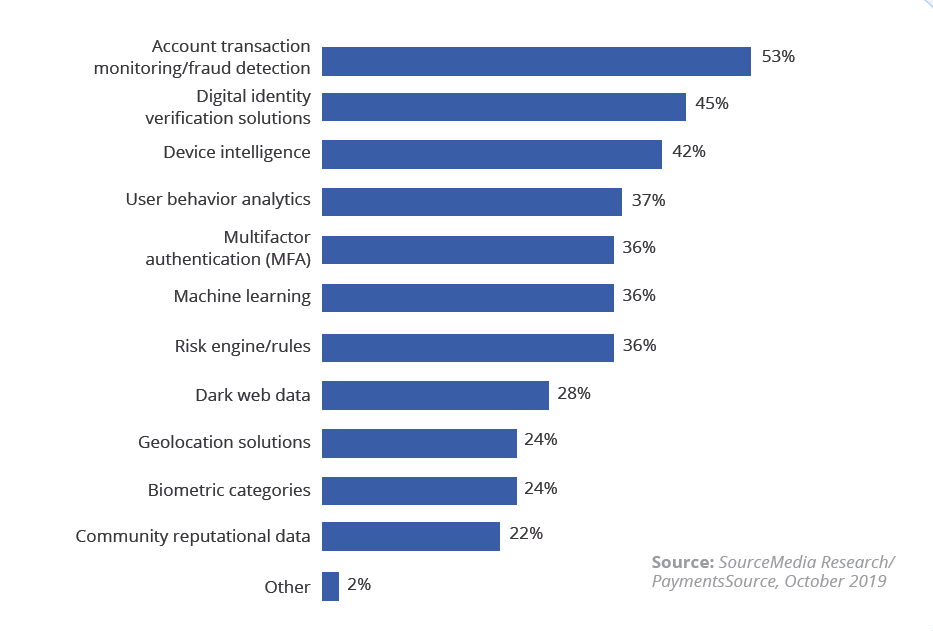

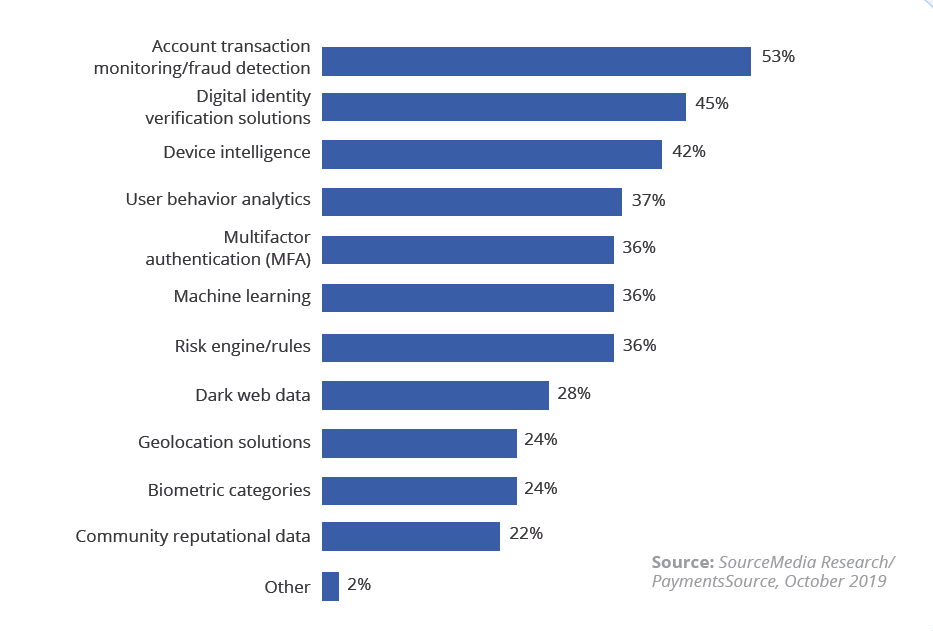

Survey data shows that companies are on the right track. Account transaction monitoring is the most used fraud prevention solution, used by 53% of respondents.

Digital identity verification (45%), device intelligence (42%), user behaviour analytics (37%), multi-factor authentication (36%) and machine-learning technology (36%) are also in play, but should be even more so, Mortland contends.

Fraud Prevention Solutions Being Used

“There’s no silver bullet—there’s no one way to stop bad guys and take good care of your customers—so what you want is an approach that is multifaceted,” Mortland says.

In terms of what they think is working best to prevent fraud, respondents see account monitoring/fraud detection, digital identity verification solutions and device intelligence as the top three, with strategies like multi-factor analysis not far behind.

Technology Solutions Considered Strongest

And companies are putting their money where their mouth is, with 48% of respondents planning to increase fraud monitoring over the next 12 months, among other investments planned.

Given the somewhat “cat and mouse” nature of fraud attacks/fraud prevention, as one survey respondent notes, it stands to reason that companies see an ongoing need for investments in anti-fraud solutions.

Anti-fraud Investments Planned

“If you don’t watch what is happening at the front door, it’s much more difficult to detect the problems once somebody’s in,” Mortland says.

“And so, when I look across different kinds of industries, there’s a rather simple message: Pay attention to what’s happening on your site, not just at the checkout.”

Be vigilant when customers are setting up accounts and logging in, and when changing personal information like shipping addresses or passwords.

“It’s just really a message about early warning,” he says.

Ultimately, one thing is clear from the research: the issue of payments fraud will continue to be relevant to industry professionals.

Staying abreast of the latest developments, ideally with the help of an industry partner, will remain key to success.