American Express has introduced a new digital solution, particularly aimed at helping small businesses in the US carry out B2B transactions in a secure manner.

Dubbed American Express Global Pay, the new offering facilitates both domestic and cross-border payments.

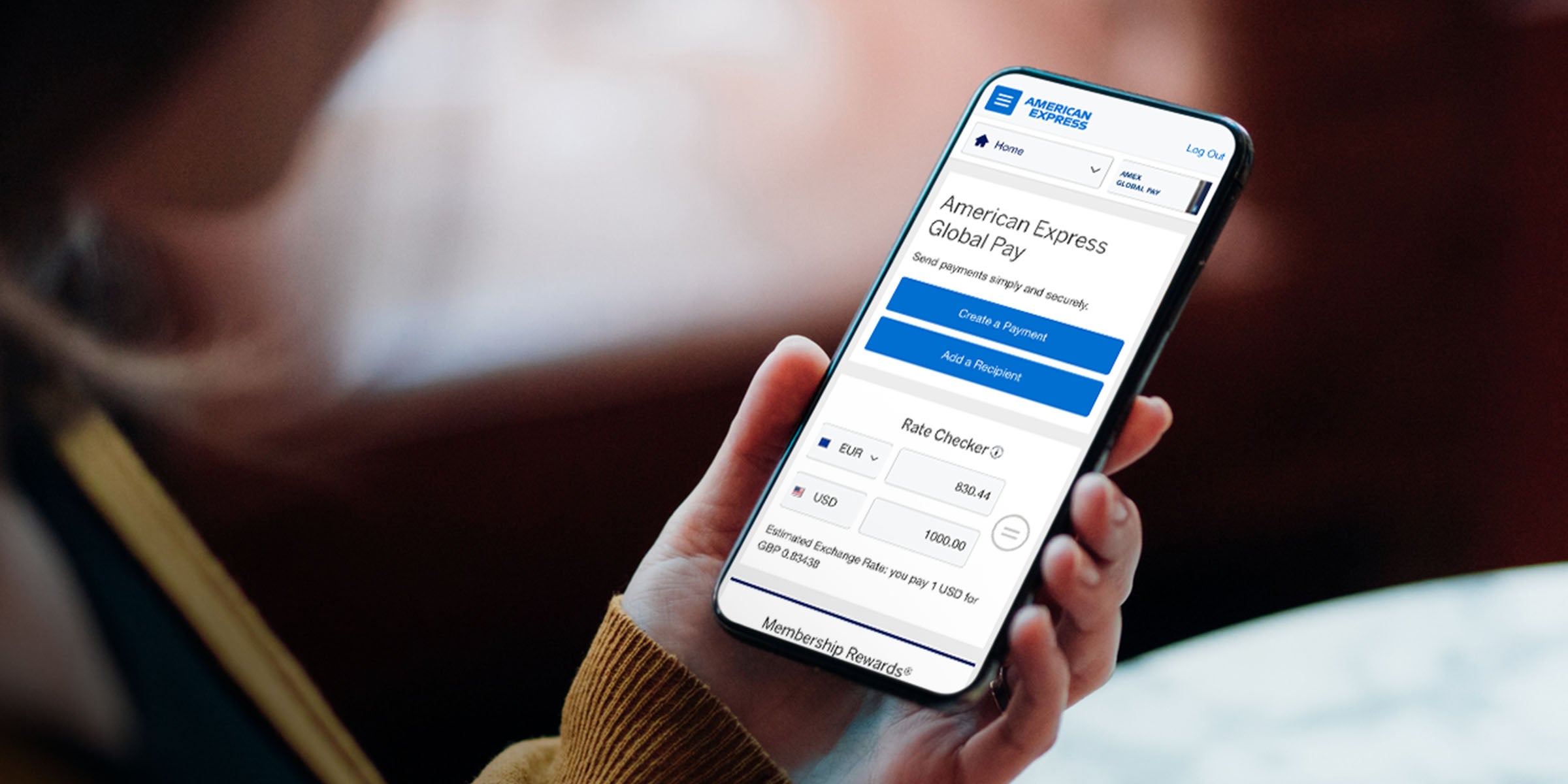

Claimed to be a mobile-friendly platform, it enables businesses to send money from their bank accounts to their dealers in over 40 countries worldwide.

It also enables transactions in various currencies.

American Express Global Pay, which can be accessed by the US American Express Small Business Card holders, offers Membership Rewards points to selected clients for their foreign exchange transactions.

In addition, the solution facilitates payments within a single business-day. Business can also watch and accept the appropriate exchange rate before making any transactions.

American Express Global Commercial Services executive vice president Dean Henry said: “Businesses today start, grow and compete on a global scale.

“Our US Small Business Card Members told us they want an international payment solution focused on simplicity, convenience and the chance to earn rewards – so we built American Express Global Pay to enable these businesses to easily and effectively manage their B2B payments globally on a secure platform, backed by the trusted service and unique benefits of American Express Membership.”

A survey, conducted by American Express in June this year, showed that 64% of small and mid-sized businesses in the US wished to grow their toral transaction volume with their counterparts from abroad in the next six months.

Besides, 27% of the businesses expressed complexity of the process as a major hurdle while conducting cross-border transactions.

Meanwhile, 48% of the businesses consider transparent fees and rates as important parameters for cross-border payments, while 44% viewed simple user experience as a major feature for such transactions.

In July last year, American Express announced an alliance with Bangkok Bank to enhance the acceptance of its cards in Thailand.

The partnership was intended to help Bangkok Bank become a comprehensive payment service provider.