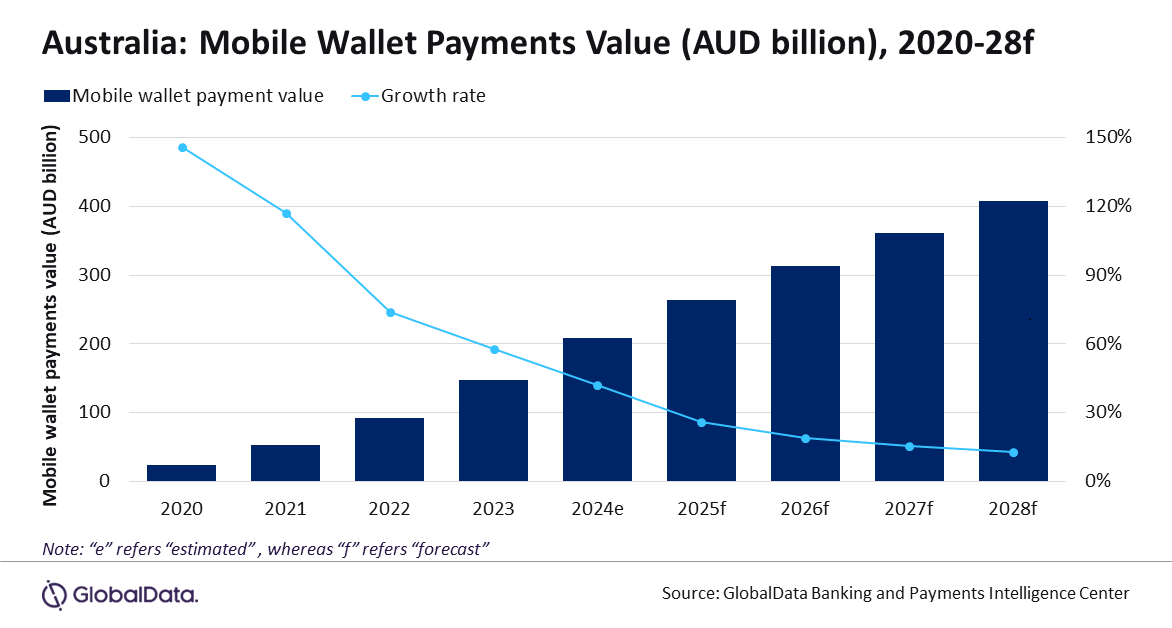

Mobile wallet adoption is growing at a fast pace in Australia with the value of mobile wallet transactions expected to grow by 42.2% in 2024 to reach A$209bn ($138.8bn), supported by accelerated consumer shift towards non-cash payment methods, forecasts GlobalData, publishers of EPI.

GlobalData reveals that the value of mobile wallet payments in Australia registered a growth of 58% in 2023 to reach A$146.9 bn ($97.6bn). In Asia-Pacific, although Australia lags its peers such as China and India in terms of mobile wallet payments size, it is still ahead of some of the other developed countries including Taiwan, Singapore, and Hong Kong.

Poornima Chinta, Senior Banking and Payments Analyst at GlobalData, said: “Mobile payments are gaining traction in Australia though it is still a long way from mass adoption. In contrast to the contactless card market, the adoption and usage of mobile wallets are comparatively low in Australia. However, rising consumer preference for mobile payments, the availability of major brands such as Google Pay, Apple Pay and Samsung Pay, and the development of QR-code payment infrastructure (eQR) are expected to drive the adoption.”

According to the Australian Banking Association, the use of mobile wallets is increasing rapidly in the country. In 2022, 15.3 million payment cards were registered to mobile wallets compared to just over two million cards in 2018. Moreover, the adoption of mobile wallets is increasing across all age groups, particularly among younger consumers. As per The Reserve Bank of Australia’s 2022 Consumer Payments Survey, mobile payments were used by nearly two-thirds of respondents aged between 18-29 in 2022, up from less than 20% in 2019.

Apple Pay, Google Pay and Samsung Wallet

The availability of international brands such as Apple Pay and Google Pay in Australia has raised consumer awareness of mobile payment technologies and encouraged their uptake. In January 2023, Samsung introduced upgraded version of its payment solution Samsung Pay called Samsung Wallet in Australia, which combines the existing features of Samsung Pay with additional functionalities such as storing and accessing digital keys, boarding passes, and essential documents such as ID cards and driving licenses.

The rising preference for contactless mobile payments is encouraging companies to launch mobile POS solutions that support mobile wallet-based payments. In May 2023, Apple launched Tap to Pay in Australia, enabling businesses to accept in-person contactless payments via compatible iPhones.

The rise of QR code-based payments

In addition to NFC-based mobile payments, QR code-based payments are also expected to gain prominence, a trend that can be seen in many Asian markets like India and China. To drive this, in May 2022, Electronic Funds Transfer at Point of Sale (EFTPOS), Australia’s domestic debit network, launched a QR code payment system “eQR” to allow consumers make payments by scanning QR codes at merchant stores. Subway was the first retailer to offer this service to customers.

Chinta concludes: “With smartphones being integral to everyday life in Australia and consumers becoming more comfortable utilising mobiles to make payments, the Australian mobile wallet market is expected to continue its upward growth trajectory. The market is forecast to grow at a compound annual growth rate (CAGR) of 18.3% between 2024 and 2028 to reach A$408.6bn ($271.5bn) in 2028.”