Capital One Q2 2019 earnings are resilient and beat forecasts despite a 15% fall year-on-year in net income.

For the quarter to end June, Capital One posts net income of $1.63bn compared with $1.91bn in Q2 2018.

On the other hand, there are a number of Capital One Q2 2019 positive metrics.

Net interest income in the second quarter rises by almost 4% y-o-y. Total deposits rise by 3% y-o-y to $254.5bn.

Meantime, Capital One’s net interest margin improves by 14 basis points to 6.80% from the year ago quarter.

“In the second quarter, Capital One continued to post solid results as we invest to grow and to drive our digital transformation,” says Richard D. Fairbank, Founder, Chairman and Chief Executive Officer.

“As the benefits from our digital transformation continue and increase, we are well positioned to succeed.

Capital One Q2 2019: less positive metrics

Operating expenses rise by 7% from the year ago period with marketing expenses up a whopping 28% y-o-y.

This contributes to a rise in the Capital One cost-income ratio from 47.6% a year ago to 53%.

At the same time, net charge-offs are on the rise. The net charge-off rate of 2.48% in Q2 2019 is up by 6 basis points from a year ago.

The 30+ day delinquency rate is also on the rise from 3.05% a year ago to 3.35% in Q2 2019.

Capital One Q2 2019: consumer banking unit positives

There are a number of highlights within Capital One’s consumer banking unit in the second quarter. Net interest income rises by 6% y-o-y, helping total net revenue to increase by 5% y-o-y.

Meantime, provisions for credit losses are down by 40% y-o-y.

Lending highlights include a 5% rise in auto-loan originations y-o-y.

Capital One currently operates a branch network of around 600 outlets in the US. The Capital One branch network peaked at 991 branches in 2010.

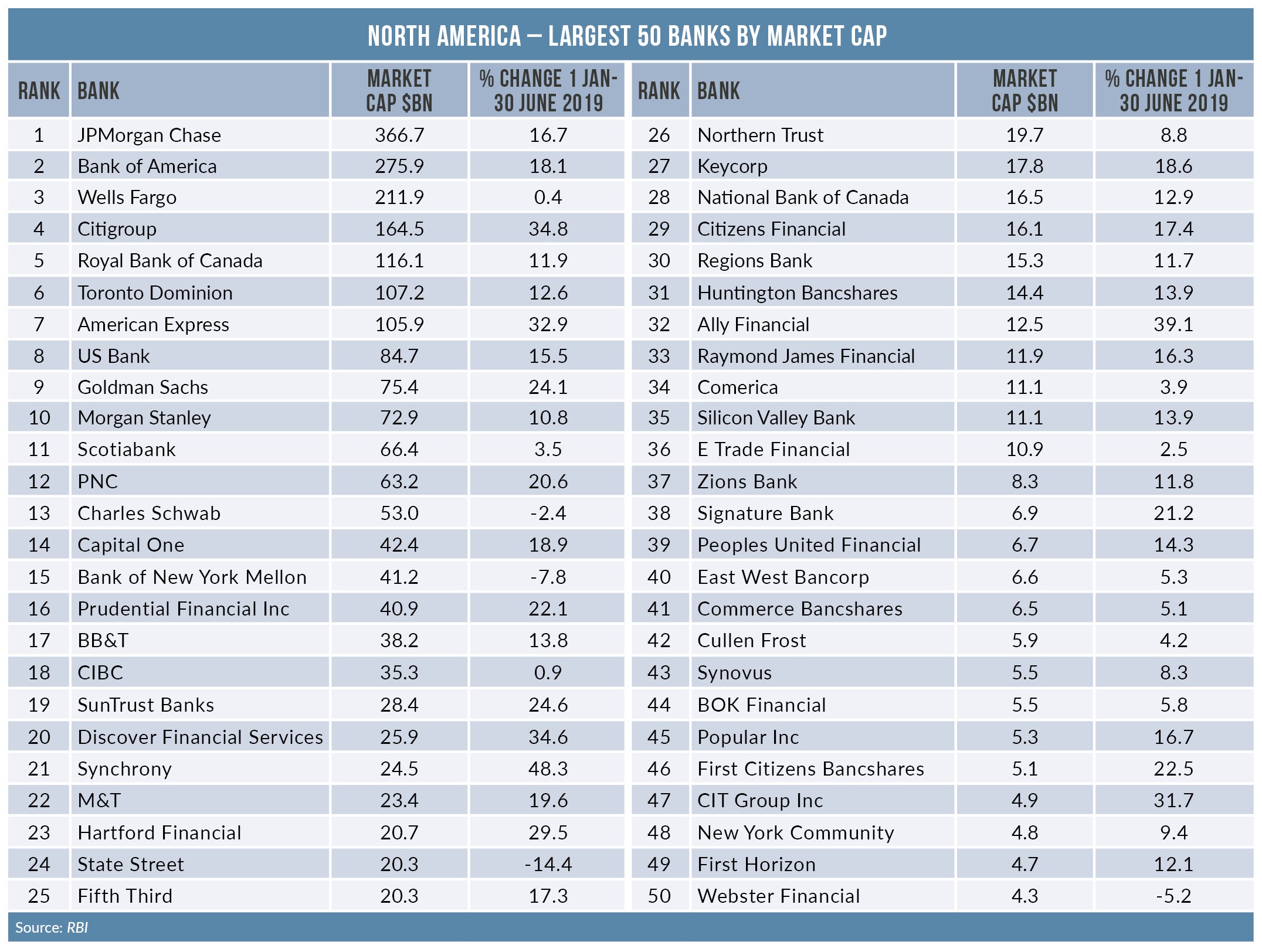

For the period 1 January to 30 June, the Capital One share price is up by around 18% (see table).