Spending on credit cards across the globe continues to drop while debit card spending reaches record high, as pandemic accelerates growth in online shopping.

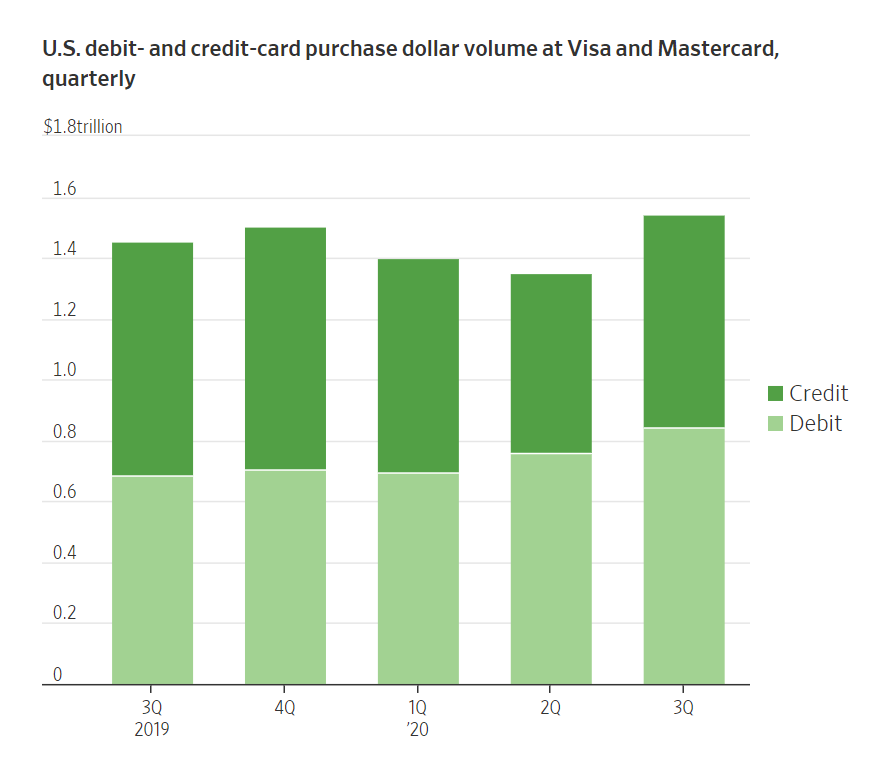

At Visa and Mastercard, US debit-card dollar payment and purchase volume collectively rose 23% year over year in the quarter ended in September. This was more than double the pre-Covid-19 growth rate; the same measure for credit cards was down 8%.

Card networks as well as acquirers that handle payments for merchants have reported similar trends.

For one, payment firms are reporting that people are more often using contactless tap-to-pay when they shop in stores, perhaps to minimize touching amid the coronavirus pandemic.

These are often purchases for relatively smaller dollar amounts, which tend to be put on debit cards.

There is also more card use in online shopping for everyday things like groceries, which likewise are often debit purchases.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSource: company reports

The role of economic stress

Some consumers may have been cut off from credit by lenders tightening their underwriting. Others simply like to use credit less during times of economic uncertainty.

Government stimulus is also a factor: Many stimulus payments in the US are made via prepaid cards that work on debit rails.

What’s more, stimulus payments pad people’s checking accounts, which can lead to more debit usage.

Since credit’s stronghold—cross-border travel—isn’t coming back anytime soon, strength in debit will be vital for volumes.

Visa and Mastercard are trying to push debit into more realms, for example by linking their instant-payment debit networks with apps such as PayPal, Venmo, and Square’s Cash App, to help move money faster between digital accounts.

New habits “are here to stay”

If no additional stimulus arrives, and there is no major rebound in card-based travel-and-entertainment spending, debit-volume growth could come under pressure.

One key will be the stickiness of contactless, which helps drive debit’s share gains versus cash.

“We’re not going backwards to more cash usage,” said Autonomous Research analyst Craig Maurer, suggesting it is likely that “the majority of new habits will stick.”

Debit card spending in the UK reached a record high of £59.1 billion in July, while spending on credit cards fell 24.8 per cent compared to last year.