As the leading cryptocurrency, Bitcoin’s ‘halving’ will impact not only its price but the wider crypto asset ecosystem.

Bitcoin halving refers to a decrease in the reward received per block mined – the process by which complex problems are solved to allow new bitcoins into circulation.

The upcoming halving, which occurs roughly once every four years, is expected to occur in mid-April 2024 and will see the reward for successfully mined blocks drop from 6.26 to 3.125 bitcoins (which currently translates to a range of around $411,400 to $205,400).

Philippe Bekhazi, CEO of XBTO, a platform for digital asset services, tells Verdict that the event will have “profound implications” across the broader crypto asset ecosystem.

Why and how do Bitcoin halvings occur?

Halving is built into Bitcoin’s core code as a means of maintaining the currency’s value by controlling inflation.

“The halving mechanism ensures the gradual distribution of Bitcoin, ultimately capping the supply at 21 million units, thereby preserving its scarcity and value over time,” explains Bekhazi.

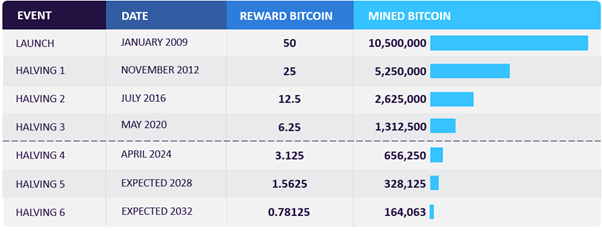

“The process of Bitcoin halving involves a programmed reduction in the rewards awarded to miners for each block they successfully add to the blockchain. Initially set at 50 Bitcoins per block, this reward is halved at predetermined intervals of 210,000 blocks, or approximately every four years.”

Expanding on this, Bryan Daugherty, global public policy director at Switzerland-based blockchain organisation The BSV Association, notes four key critical purposes in the economic model of bitcoin that halving serves: controlling supply, preventing inflation, developing network security and infrastructure and maintaining long-term economic viability.

Of this final aim, Nicklas Nilsson, thematic consultant at GlobalData, explains: “This scarcity is designed to mimic the extraction of precious metals like gold, a method aimed at preserving value by controlling supply… These halving events will occur until the last bitcoin has been mined, anticipated around the year 2140. At each halving, the reward for mining bitcoin transactions is cut in half, meaning miners receive 50% fewer bitcoins for verifying transactions.”

“In theory, and so far in practice, the reduction in the pace of bitcoin issuance means that the price will increase if demand remains the same. A significant portion, almost 94%, of the total supply has already been mined. Additionally, it is estimated that a substantial share, approximately 20%, of these mined bitcoins has been lost due to factors such as lost private keys and discarded storage devices, further exacerbating the scarcity” continued Nilsson.

How does a halving affect the price of bitcoin?

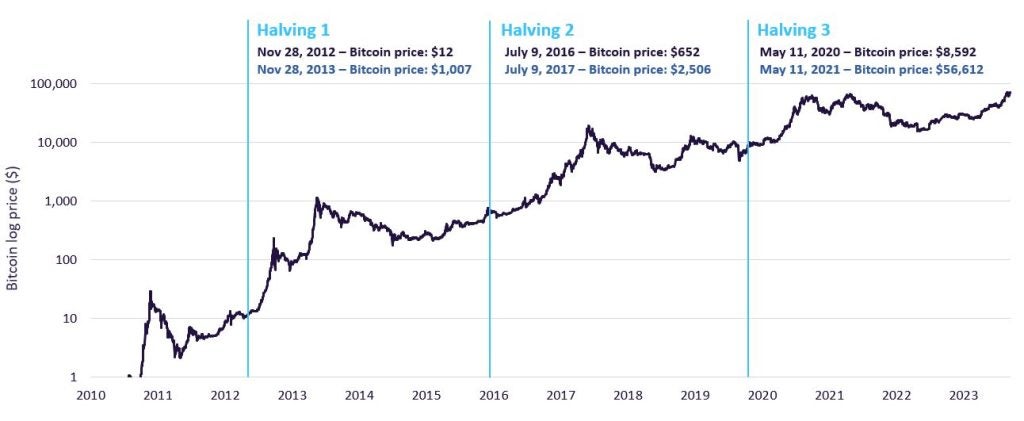

Historically, halving events have seen the price of Bitcoin increase, but Daugherty notes that there are more factors at play.

“This outcome is influenced by a myriad of factors, including market demand, investor sentiment, and macroeconomic variables,” he says. “The underlying principle is straightforward: if the supply of bitcoin becomes more scarce – due to the halving – while demand remains the same or increases, the price is likely to rise.”

The above graph from GlobalData’s Cryptocurrencies report shows that Bitcoin tends to peak in price around 12 months after a halving.

What effect halving have on bitcoin mining?

In addition to affecting the price of Bitcoin halving can also increase efficiency and promote market consolidation within mining of currency.

“The immediate effect of a halving on mining operations is a decrease in revenue for miners, as they earn fewer bitcoins for the same amount of computational work,” explains Nilsson. “This can lead to increased pressure on less efficient miners, potentially pushing them out of the market if they can’t cover operational costs. Over time, the reduction in supply can lead to an increase in bitcoin’s price, potentially offsetting the reduced block reward.”

“In response to the upcoming halving, larger miners are refurbishing older machines that might become unprofitable in the US due to high electricity costs post-halving and reselling them to countries with lower electricity costs, such as Ethiopia and Paraguay. This strategy allows these machines to remain viable and continue generating returns despite the reduced rewards.”

“Additionally, larger mining companies, such as Riot Platforms, have recently announced the purchase of newer and more efficient mining machines, while others, such as Marathon Digital and Hut 8, have prepared significant capital to acquire smaller miners, highlighting a focus on efficiency and market consolidation in anticipation of the halving events.”

Daugherty refers to halving events as “critical junctures” that test the resilience and adaptability of miners, adding: “Miners’ responses to these changes are crucial, as they must adapt to the new economic landscape. The adjustments could include seeking greater operational efficiencies, investing in more effective mining technology, or relying more heavily on transaction fees as a source of revenue.”

How will this halving impact the crypto asset ecosystem?

Of the wider effects of the upcoming halving, Bekhazi comments: “It may enhance bitcoin’s appeal as a deflationary asset, potentially leading to increased investment and higher valuations. The halving could influence the valuation and market dynamics as investors recalibrate their portfolios in response to shifting supply dynamics in bitcoin, for example, with the advent of the spot Bitcoin ETFs, investors may prefer to gain exposure through that rather than Bitcoin miners.”

Nilsson adds: “Bitcoin halvings tend to significantly impact the broader crypto asset ecosystem primarily through their potential to drive up bitcoin’s price. Such an increase normally has a knock-on effect on investor sentiment and market activity across all cryptocurrencies, attracting more attention and boosting investment in the sector.”

“As Bitcoin’s value climbs, it leads to increased media coverage and public interest, drawing new participants into the crypto markets. This attention creates a virtuous cycle where rising prices fuel more innovation and development within the sector. Entrepreneurs and developers, seeing a growing audience and capital inflows, launch new projects and explore novel blockchain use cases. Concurrently, venture financing in crypto projects tends to increase, further stimulating the ecosystem’s growth.”

However, Nilsson also notes: “It’s important to recognise that not all effects are positive. The surge in interest and investment following a halving also fuels the launch and promotion of less credible projects. The promise of quick profits attracts opportunistic players, leading to a proliferation of projects with questionable value or sustainability. This underscores the need for diligence and critical evaluation among investors and participants in the crypto space.”

When was the last Bitcoin halving, and what effect did it have on the crypto market?

The last Bitcoin halving occurred in May 2020 and saw the mining reward drop from 12.5 to 6.25.

“Subsequent to the 2020 halving, the cryptocurrency market witnessed a significant upsurge,” explains Bekhazi. “While the next halving, expected to be around mid-April this year, suggests continued market strength, it is interesting to note bitcoin’s price appreciation has been accelerated as compared to the prior market cycle, in large part due to the optimism around spot ETFs. This may signal a fundamental shift in market dynamics.”

Nilsson also highlights the effect bitcoin ETFs is having on the market, adding: “The approval of several spot bitcoin ETFs in the US in January 2024 has already led to significant capital inflows into the market, boosting prices and setting a different starting point for the halving’s impact. This could, for instance, propel the market to peak earlier than during previous cycles.”

Another major difference between now and four years ago is the economic climate.

“During the last halving, low-interest rates and pandemic relief funds buoyed markets,” says Nilsson. “Currently, we face high-interest rates and an uncertain economic climate, posing challenges for risk-on assets like bitcoin. However, bitcoin’s achievement of new all-time highs in such a climate speaks volumes about its progress. With interest rate cuts anticipated in the near future, most consider it more likely that an improving economic outlook will further bolster the market.”

He adds that it is important to also take into account the maturation of the bitcoin market, asserting that, while it’s likely the halving will have a positive effect on the price, it may be less dramatic than previous halvings.

Of that maturation and the broader set of factors at play, Daugherty concludes: “While past halvings have shown a tendency for price appreciation, the unique conditions of today’s market – including the current high hash rate and the potential for negative profitability post-halving – suggest that the outcome of the next halving could differ in its specifics, even if the overall bullish trend continues.”