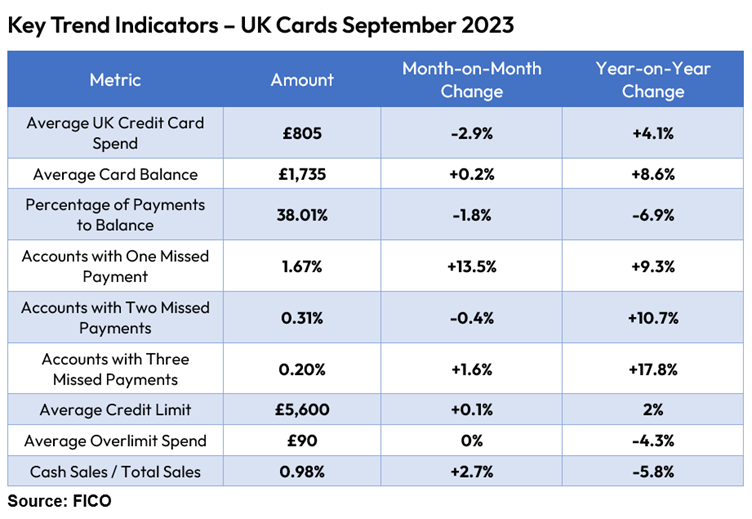

Average UK credit card spend fell slightly during September, ending at £805. This is down 2.9% on August 2023 but up 4.1% on the previous year. The figures are revealed within FICO’s UK credit card market report for September.

The average credit card balance remains relatively stable compared to August, at £1,735. But this figure continues the longer-term upward trend with a year-on-year increase of 8.6%.

After peaking at 42% in May 2022, the percentage of payments to balance has been on a downward trend. It currently stands at 38% and follows up-and-down movements since a two-year low in April 2023.

Year on year, FICO reports the percentage of customers missing one, two and three payments has continued to rise. Those customers missing two payments is 9.3% higher than in 2022 and those missing three payments is now 17.8%.

Missed card payments – position remains volatile

FICO reports that the month-on-month picture for missed credit card payments is still volatile. There was a decrease in missed payments in August, but September brought a 13.5% increase in accounts missing one payment.

“The number of accounts missing two payments remained relatively stable in September, continuing a new flat trend we have seen since July 2023, following steady increases from May 2022. For those customers missing two payments, the average balance has marginally decreased by 0.6% month-on-month at £2,605. But this has been trending upwards over the last few months.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCash use has also continued the upward trend since March 2023. In September, there was a 1.6% month-on-month increase and a 4.3% increase year-on-year.

“The continuing economic turbulence, high cost of goods and energy bills as well as the approaching festive season are set to sustain pressure on consumer finances. The steady increase in customers using their credit cards to withdraw cash that we have witnessed since March this year continued in September, with a month-on-month increase of 1.6% and an annual increase of 4.3%. This trend is another signal of financial struggle and should act as an important warning sign to lenders.”