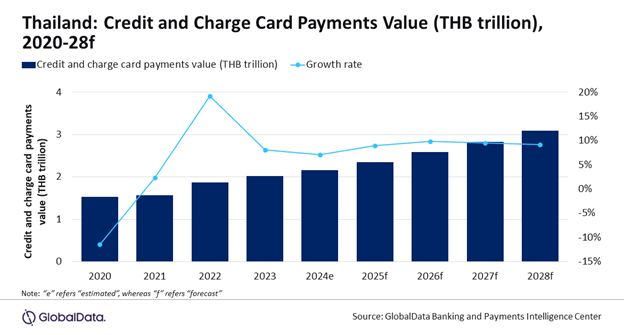

Thailand’s credit and charge card payments market is on a growth trajectory and is forecast to grow by 7.1% in 2024 to reach THB2.2 trillion ($62.1bn), supported by growing consumer preference for electronic payments and developing payment infrastructure, according to GlobalData, publisher of EPI

GlobalData’s Payment Cards Analytics reveals that credit card payment value in Thailand registered a strong growth of 19.2% in 2022, driven by an increase in consumer spending. However, the economic slowdown forced consumers to cut down on unnecessary spending, adversely affecting the credit card market in 2023. The market registered a slow growth of 8.1% in 2023 to reach THB 2 trillion ($58bn).

Poornima Chinta, Lead Banking and Payments Analyst at GlobalData, comments: “Credit and charge cards are the most preferred payment cards in Thailand, accounting for 92.8% of total card payment value in 2023. This is mainly driven by the rewards, discounts, cashback, and interest-free installment facilities offered with these cards, as well as developing payment infrastructure and a growing e-commerce market.”

Thai consumers are increasingly using credit and charge cards for payments, with the frequency of payments per card standing at 36.4 times in 2024, much higher compared to just 3.1 times for debit cards. This is driven by banks offering flexible repayment options and value-added benefits such as cashback, reward points, discounts, and installment facilities. Krungthai Bank offers the KTC World Rewards Mastercard credit card, which allows card holders to make purchases in interest-free installments over up to 10 months.

Growing POS terminalisation has been another key driver for the rise of credit and charge cards in Thailand. The number of POS terminals per million inhabitants in Thailand stands at 13,507 in 2024, which is higher compared to its peers such as Indonesia (8,142), India (6,964), and Taiwan (5,391), though there is significant room for further expansion of POS infrastructure.

Rising e-commerce payments are also contributing to the growth in credit and charge card usage. According to GlobalData’s 2023 Financial Services Consumer Survey, credit and charge cards are one of the most preferred payment methods for online payments, with 16% share in 2023.

Moreover, the central bank of Thailand has been taking initiatives to help consumers repay credit card debt, which will further help boost usage. One such initiative is the Debt Clinic program, which is designed to help credit card and personal loan customers manage their debt and avoid default by offering lower interest rates and extended repayment terms.

Chinta concludes: “The Thai credit and charge card market is poised for sustained growth over the next five years, driven by economic recovery, growing consumer preference for electronic payments, a rising middle class and young working population, and growth in e-commerce payments. The market is projected to register a compound annual growth rate (CAGR) of 9.3% between 2024 and 2028, to reach THB3.1 trillion ($88.8bn) in 2028.”