UK average credit card spend and average balances are at their highest levels since 2006 when FICO first analysed credit card use and payments.

The FICO UK credit card market report for December 2023 reflects the usual season trends in spending and payments. It also reflects the impact of continued high prices on outstanding card balances.

Average credit card balance rises to £1,780

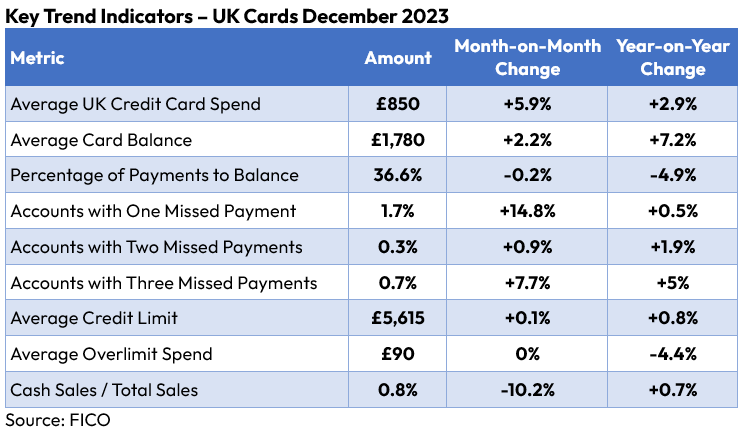

The report notes that average spend increased by 5.9% on the previous month, to £850. Average balances rose by 2.2% month-on-month and 7.2% year-on-year. This results in an average balance of £1,780

Some 14.8% more customers missed a credit card payment month-on-month. That is 0.5% more compared to the same month in 2022. And there has been a 1.3% decrease in the average balance for those customers missing one payment.

FICO expects the current trend of increasing balances will fall post-Christmas. But with prices remaining high, lenders will want to monitor closely how much it will fall. And for how long it will remain lower.

Another pattern typical of December was the amount paid off card balances as shoppers focussed their cashflow on Christmas spending. In December 2023 the average balance paid off dropped slightly, by 0.16%, month-on-month. However, this measure has been trending down since July.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataPre-COVID, the average payment compared to the overall balance was approximately 30%. But with lockdown and increased savings this rose to 42%. The FICO data now shows this dropping back, although it is currently still 6% higher than before the pandemic.

Missed payments on the rise

Another sign of pressure on finances is the number of customers missing one, two and three payments. This increased from November to December 2023, with the largest increase seen for those missing one payment: a 14.8% increase month-on-month and a 0.5% increase compared to 2022. Again, seasonality influences results with similar volumes expected in January as a result of the post-Christmas spending hangover. Lenders will also want to be mindful that higher numbers of customers missing one payment in December are likely to roll over into two payments in January.

FICO advises issuers to note that established customers – those who have had their credit card between one and five years – are the most likely to miss payments. This group contains customers whose 0% offers have expired. They are now paying off balances at the standard rate.