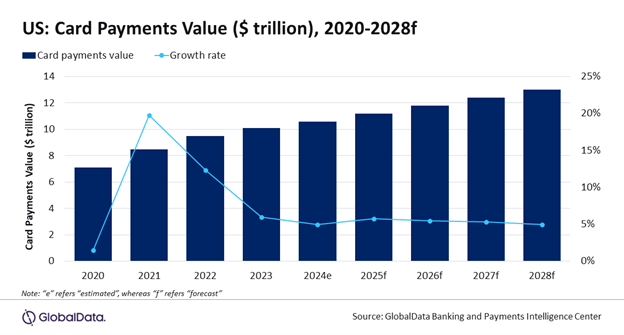

The US card payments market is forecast to grow by 5% in 2024 to reach $10.6trn, supported by high consumer preference for electronic payments, according to GlobalData, publishers of EPI.

GlobalData’s Payment Cards Analytics reveals that card payment value in US registered a growth of 12.3% in 2022, driven by the rise in consumer spending. However, the value is estimated to have registered a slow growth of 6.0% in 2023 to reach $10.1trn, on account of slowdown in economy.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, commented: “The US has a highly developed payment card market, supported by a high level of awareness of electronic payments, combined with a well-developed payment acceptance infrastructure. The market is highly mature and arguably even overserved by its financial institutions, with 4.2 cards per individual. Ready access to formal financial services has resulted in a population that is very comfortable using debit, credit, and charge cards for payments.”

Credit and charge card cards lead the US payment card market, accounting 58.1% of total the card payment value in 2024

Banks in the country are offering various value-added benefits to increase the use of credit cards, such as rewards, discounts, and cashback. Moreover, amid economic uncertainty some consumers are relying on credit cards to meet their daily expenses.

On the other hand, debit cards account for 41.9% of the total card payment value in 2024. While the share is slightly less compared to credit and charge, with frequency of debit card payments in the US standing at 194.1 in 2024, up from 176.7 in 2020. The rising use of debit cards is mainly due to the growing consumer preference for cashless payments. In addition, rising adoption of contactless debit cards is supporting debit card payment growth, especially for low-value transactions.

Contactless cards have also been a key driver of card-based payments for low-value, day-to-day transactions. The US contactless card payment market though has been slow to take off compared to its peers, the UK, Canada, and Australia, contactless payments have gained traction over the recent years, due to major banks offering this technology and retailers adopting supporting infrastructure. The COVID-19 pandemic has also provided the much-needed push for contactless payments in the US.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to GlobalData’s 2023 Financial Services Consumer Survey, 65% of the respondents indicated holding contactless cards in the US in 2023.

Furthermore, the expected reduction in interchange fees is also anticipated to drive card acceptance among merchants. Merchants in the US are set to gain from Visa and Mastercard’s interchange rate cut. In March 2024, both companies agreed to reduce their credit card interchange rates for retailers for a period of at least five years. The settlement is currently awaiting final approval and all changes to rules will occur post-settlement approval, anticipated to take effect in late 2024 or early 2025.

Sharma concludes: “The transition to card payments is expected to continue over 2024-28 supported by expanding payments infrastructure, rising digitalisation of payments, the growing ecommerce market, and expected cut in interchange fees. However, high inflation and interest rates, economic slowdown, and geopolitical uncertainty present challenges, impacting consumer spending which can lead to slower growth of the payment card market in the coming years as well.”