Wirecard has partnered with Swedish neobank Personal Finance Co. (PFC) to deliver next generation banking services.

Formerly Betalo, PFC is introducing a digital banking proposition aimed at hundreds of thousands of Swedish consumers. Working with Wirecard means PFC can launch what it claims to be Sweden’s first neobank.

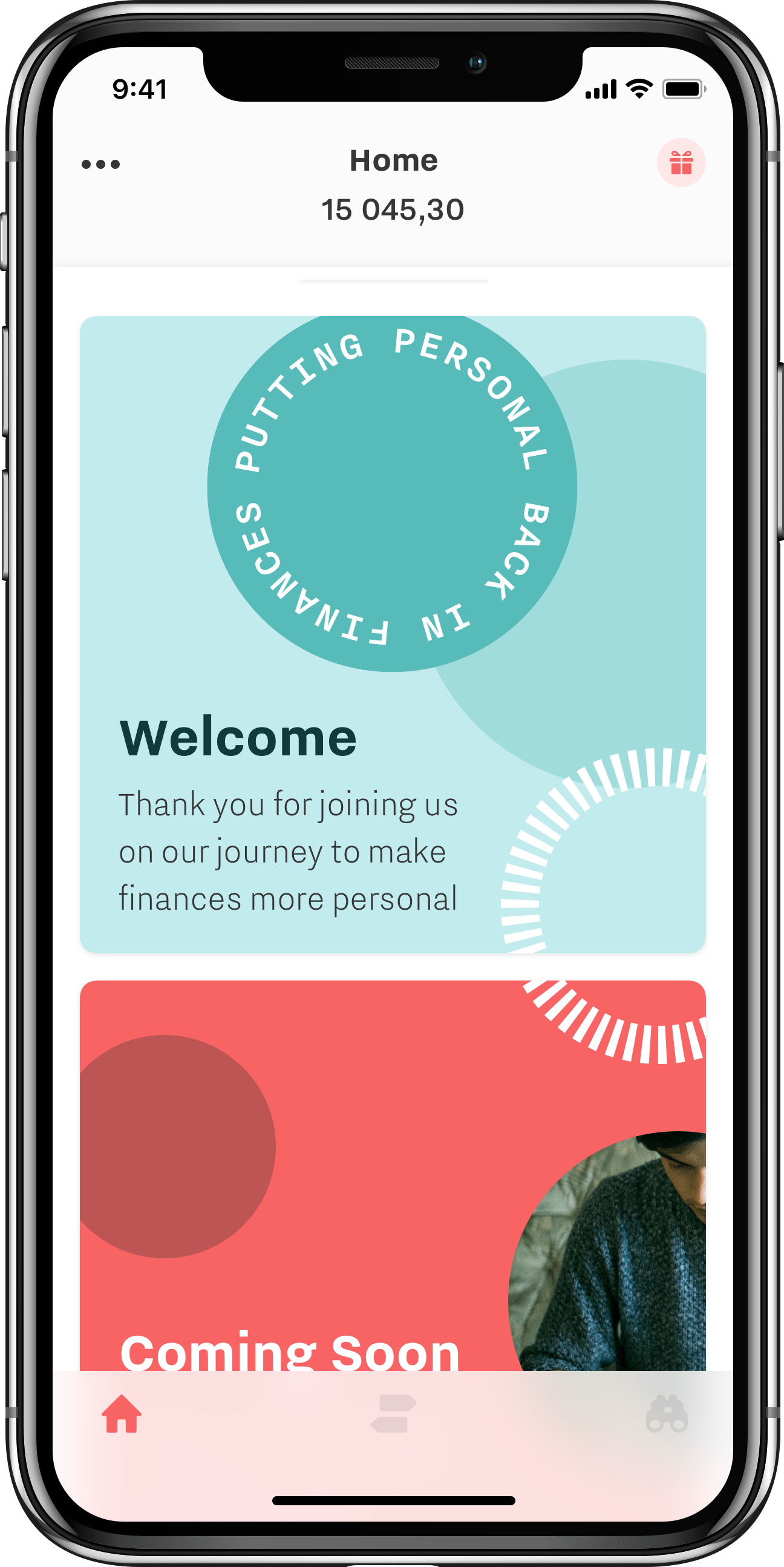

The Swedish neobank will be a mobile-first service which combines a Mastercard debit programme and a personalised app. Furthermore, the app is designed to help customers manage their personal finances.

In addition, the app is available on both Android and iOS. It enables users to set budgets, make purchases, track expenses, and build savings goals. PFC is also licensed in Sweden as a payment institution and is under the supervision of the country’s Financial Supervisory Authority.

Eli Daniel Keren, founder and CEO of PFC, said: “Today, people expect financial services to be personal, transparent and simple. We want to do just that with P.F.C. We rely on strong partners like Wirecard to bring our products to market. In the long run, the solution that P.F.C. and Wirecard provide enables people to gain financial health, and that’s no small feat.”

Julian Weste, vice president sales, financial institutions and fintech Europe, at Wirecard, added: “The fully digital Mastercard debit card programme issued by Wirecard helps users of P.F.C. to keep tabs on their everyday financial life. In addition, the mobile wallet solution will be enhanced to a real multi-currency card program in the near future. Together with P.F.C. we guarantee an innovative and comfortable way of financial management and are looking forward to further digitalising processes globally.”

Swedish innovation

Scandinavia is no stranger to innovation and might be the new hub for wearables.

Wearable technology is all the rage, and with Fitbit Pay and Garmin Pay available across multiple markets, payments have entered the space – not to mention smart watches from Apple, Samsung and other tech giants. Danske Bank has decided to enter the ring: FastPay, the lender’s new payment solution, lets the user wear a payment chip in a wristband, keyring or watchstrap.

Danske Fastpay allows contactless payments without the customer having to rummage through their pockets to find their card. Launched in Denmark, Norway and Sweden from October 2018, it wants to be a supplement to Danske’s other solutions, such as MobilePay.