Past, present or future, the heart of a payment is the processing of a transaction (an exchange of funds for a good or service). In the modern era, the majority of transactions have been card-based; the card acting as the token that is used (together with a PIN) for identification, authentication and authorization. However, today we’re seeing alternative methods, payment instruments and various tokens entering the market with accelerated pace. What’s so exciting about these new alternatives is the way they break rank with an entire process built around the card.

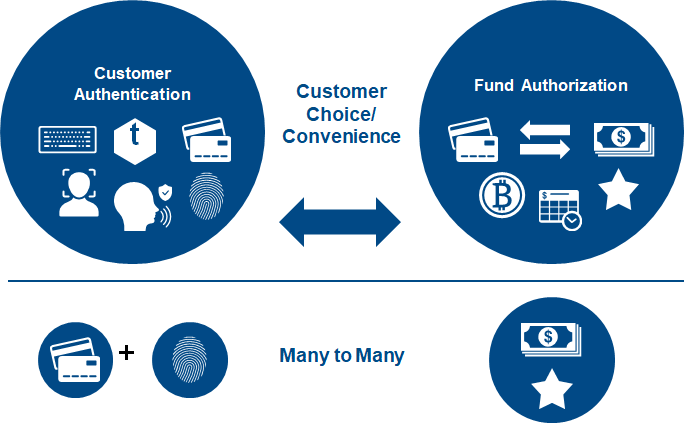

Although the result is the same, these new mechanisms are giving consumers new ways to engage with their bank and remove friction and restrictions that might be tied to the card itself. To support this new, more flexible approach to alternative payment methods, and to be able to offer the option to freely combine any (or even many) customer authentications to start a transaction, the payment business process needs to change.

Separating the authentication leg from the funding and settlement leg can free financial institutions (FIs) from current dependencies and restrictions on consumer flow and networks—and open the doors for better and more seamless customer experiences, greater loyalty and additional revenue opportunities.

It’s time to offer new methods of customer authentication

Validating customer information and ensuring that a transaction is genuine are important steps in the payments process. Although card-and-PIN has proved reliable and secure for years, it’s no longer the only way:

- ID and passwords get you safely into numerous on-line accounts

- Biometrics open your mobile applications and wallets

- And tokenization is becoming mainstream in many other applications

Giving consumers a choice allows them to “do it their way” and not worry about the backend. Unfortunately, this flexibility disrupts the current linear process and some FIs may be left behind. Future-proofing the authentication process now requires the ability and agility to handle multiple technologies, offer encapsulated services, and add on to—or combine—functions that allow the implementation of a best-in-breed solution.

Unbundle fund authorization

Providing the ability to authorize—that is, giving authority to fund—as a function separate from authentication allows your organization to use a variety of different payment rails rather than traditional card rails. Unbundling the two also helps reduce your dependency on international card schemes, and lays the groundwork for things like instant-, real-time- and split payments. And, it facilitates support of alternative funding models such as buy now, pay later, crypto and loyalty program points. Each one of these new options helps you disrupt the payment process and change the steps of transaction funding, clearing and settlement.

Many fintechs are already mastering this ability to juggle different funding sources and are providing merchants with plug-ins to be able to accept these different payment options. If FIs want to stay in the game, they need to modernize their payments systems to become flexible enough to derive value from the new API-driven ecosystem.

Future-proof your payments environment

DN Vynamic™ Payments is a cloud-native platform designed for the next generation of payments. Our singular focus in development of this new solution has been to empower our customers to meet their most pressing payments challenges, and prepare them for whatever comes next. We have approached payments with a fresh perspective, directing our efforts to the areas where innovation can make the biggest impact and offer the greatest opportunities to help our customers face the future with confidence.

Vynamic Payments has already been adopted by one of the biggest banks in the world—and we’re just getting started.