As of October 2024, Chase in the US will stop allowing its credit cards to pay for buy now pay later (BNPL) instalment plans. The move is a bid to prioritise its own Chase Pay Over Time solution, which launched at the end of 2020 as the market started to take off. After recording 156% and 200% year-on-year growth in value in 2020 and 2021 respectively, GlobalData’s Buy Now Pay Later 2024: What Comes Next? report forecasts US BNPL market value to continue expanding at an average annual rate of just 21% between 2023 and 2028.

As a natural consequence of the previously rapid BNPL expansion, new entrants emerged in the forms of BNPL startups, traditional and digital banks, and other FS providers, before the high inflation and interest rate environment suddenly hit in 2022. A slowing market combined with an increased number of competitors mean that competition for a share of the BNPL pie is becoming more tough, and banks are losing out.

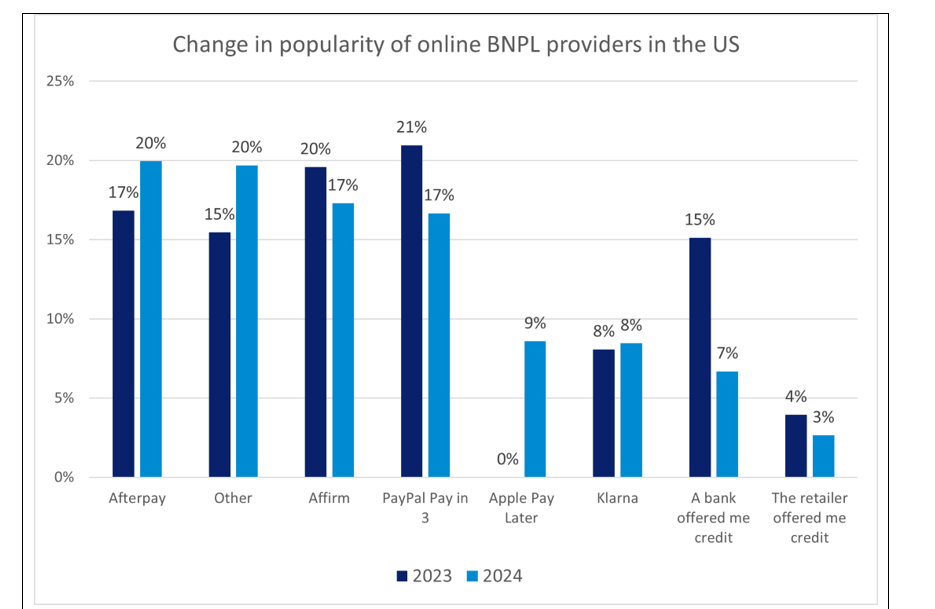

GlobalData 2024 Financial Services Consumer Survey

GlobalData’s 2024 Financial Services Consumer Survey (conducted in Q2 2024) shows an 8-percentage point drop in the market share of instalment credit products offered by banks in the US compared to 2023. This is despite banks’ BNPL solutions’ popularity growing globally by 2 percentage points. Chase is now the first bank with an in-house instalment offer to implement such measures against all third-party BNPL solutions, with the aim of driving its customers to Chase Pay Over Time instead.

As the only other bank with similar measures, Capital One introduced the same ban in 2020, advocating for responsible borrowing instead of deferring BNPL instalments to a credit card. Meanwhile, Afterpay has overtaken PayPal’s Pay in 3 to become the most popular online BNPL provider in the US, as the preferred provider of the fifth of BNPL users.

As opposed to market leader Afterpay, which offers free credit with fees only applicable for late payments, Chase Pay Over Time operates with a fixed monthly fee of up to 1.72% of the bill, depending on the purchase amount and number of instalments. With a variety of alternative and potentially less costly BNPL solutions available on the market, Chase risks driving away some of its credit card customers. Especially at risk of churn are credit card holders who also use BNPL services—a market segment where Chase’s share is already lagging behind its main credit card competitors, Bank of America and Capital One.

Blandina Hanna Szalay is an analyst in Banking & Payments at GlobalData