Mastercard’s pilot of a pay-by-palm biometrics payment scheme in Uruguay could prove successful if it can further streamline the checkout process. Findings from GlobalData’s 2023 Financial Services Consumer Survey show that over half of consumers in South and Central America (SCA) value simplicity and speed above all else in the in-store checkout process.

The use of biometrics to validate payments is by no means a new concept. Fintechs have promoted their viability for many years, but it seems the market was insufficiently ready for the evolution, instead encouraging consumers onto mobile payments from card-based solutions.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

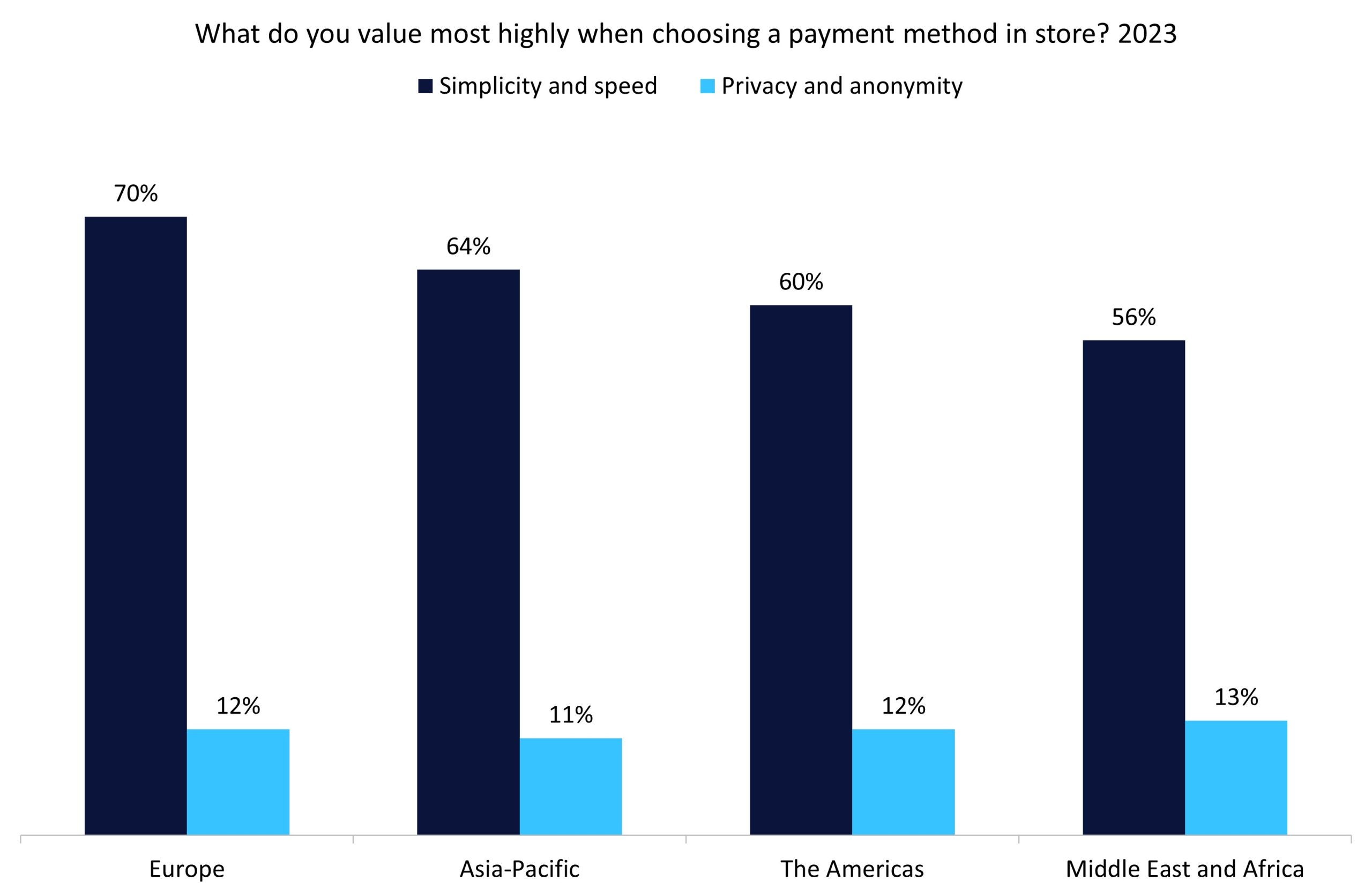

By GlobalDataSmartphone manufacturers’ integration of biometrics into phone security measures has driven awareness of biometrics in consumers’ eyes. Now, with consumer acceptance of biometrics’ reliability and security, the payments market is ready to integrate the solution into its systems. If the palm scanner can prove to be a seamless and straightforward validation method, then it is likely to take off in SCA due to consumers’ strong demand for simplicity and speed. If successful, more opportunities could await the scheme in Europe and Asia-Pacific, given that customers in these regions favour simplicity and speed even more than in the Americas.

GlobalData 2023 Financial Services Consumer Survey

Note: Alternative options for respondents to select were: Earning rewards and benefits and being able to repay the amount later or pay in installments.

Source: GlobalData

Palm payments offer a more ergonomic payments solution than other methods and are more viable in a range of different circumstances. That is, voice recognition is difficult to pick up in loud atmospheres (such as shopping centers or arenas), while positioning oneself in front of an iris scanner can be cumbersome for some people and invariably takes more time compared to a palm scan—valuable in cutting down the length of queues in stores.

Mastercard’s adoption of palm payments follows the path of Amazon One (used in Amazon Go stores), launched in 2021, and WeChat’s system used in subway networks and convenience stores. Visa similarly showcased its proof-of-concept at its Innovation Center in Singapore in February 2024, citing its revolutionary potential in payments. If Mastercard’s pilot can prove successful, it seems likely that palm-scan biometrics will be coming to a store near you soon.

Benjamin Hatton is a banking and payments analyst at GlobalData