Points, miles, and perks are losing favour with US credit cardholders. In their place, consumers are focusing more on cashback rewards and lower fees amid a strain in consumer financial health and a rise in the average interest rate charged to customers. The JD Power US Credit Card Satisfaction Study reveals that a majority of customers have migrated to cashback cards.

The annual study measures customer satisfaction with credit card issuers by examining seven factors. These are, in alphabetical order, account management; benefits; customer service; new account; rewards earning; rewards redeeming; and terms) across six segments.

Financial health affects customer satisfaction

The latest data shows how financial health affects customer satisfaction, but in hugely varied ways. While overall satisfaction declines just 2 points (on a 1,000-point scale) this year (610 vs. 612 in 2023), cardholder perception of credit cards varies widely based on financial health. Satisfaction improves 2 points among cardholders without revolving debt. But it declines 5 points among those with revolving debt. Overall satisfaction scores are 61 points lower among cardholders carrying debt (580) than among those without debt (641).

Revolving debt continues to be an issue for a majority of customers. Specifically, only 46% of cardholders are now classified as financially healthy and 51% carry revolving debt on their cards.

Cashback cards are king

The use of points/miles cards by financially unhealthy cardholders drops significantly in 2024 (27%) from 2023 (31%). Meantime, there is concurrent growth in the use of cashback and value cards. A majority (58%) of cardholders use cashback cards. Just 31% are using points/miles cards and 11% are using value cards (e.g., credit-building cards with no rewards). A reason provided more often for moving to cashback and value cards is to incur lower/no annual fee. Cashback cardholders also say they redeem rewards more often for a statement credit (21% vs. 9% for points/miles).

The average recalled interest rate on new purchases has climbed to 15.6%. It rises to 16.9% among financially unhealthy cardholders in 2024, up from 14.6% in 2023. Cardholders are spending $103 less per month, on average, than they were in 2023. The percentage of cardholders saying the overall perks of their card improve their lifestyle declines in 2024 to 25% (18% among financially unhealthy cardholders).

This all combines to create a tenuous environment for cardholders and card issuers. And it comes amid a broader, ongoing discussion of a potential economic slowdown or even a recession.

Automated customer service fails to connect with consumers

Automated phone and virtual assistant channels significantly underperform personal interactions with live representatives and digital engagement via email, online chat, mobile app messaging, text and social media. The overall satisfaction score for automated customer service is 609. This is 40 points lower than the study average for customer service satisfaction.

“Cardholders are facing mounting day-to-day financial pressures. This is showing up in the form of high levels of revolving credit card debt, declining levels of financial health and a migration away from points/miles cards,” said John Cabell, MD, payments intelligence at J.D. Power.

“These pressures tend to be associated with higher annual fees. This is a tough marketplace for card issuers to navigate, however, because even though overall credit card customer satisfaction scores are largely flat, the customer base has really become bifurcated into one subset that is feeling squeezed by economic pressures and one that is not. Card issuers need to be able to offer options that resonate and deliver value for both segments.”

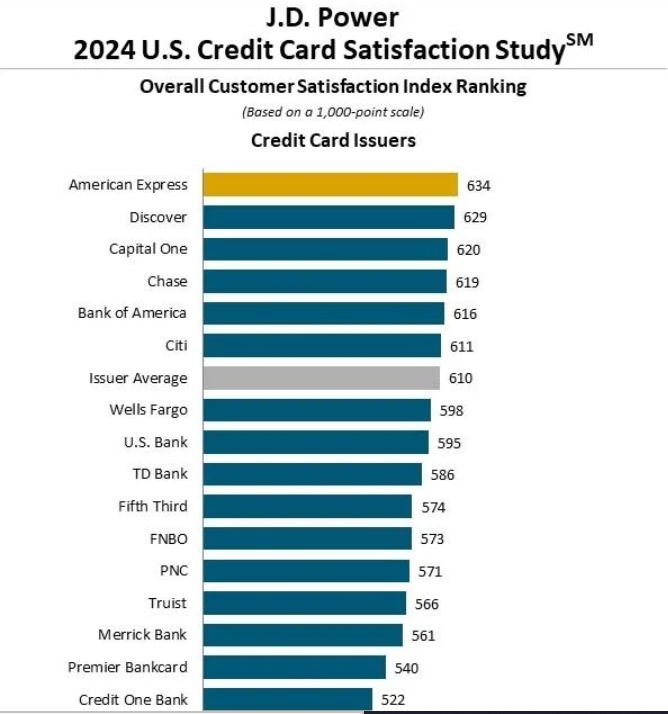

2024 JD Power US credit card satisfaction study rankings

American Express ranks highest in customer satisfaction among credit card issuers, with a score of 634. This is the fifth consecutive year in which American Express receives a segment award. Discover (629) ranks second and Capital One (620) ranks third. Capital One SaverOne Rewards Card ranks highest in customer satisfaction among bank rewards credit cards with no annual fee for a second consecutive year, with a score of 679. Chase Freedom Flex (670) ranks second and Discover It Student Cash Back credit card (657) third.

Bank of America Premium Rewards Elite ranks highest in customer satisfaction among bank rewards credit cards with an annual fee for a second consecutive year, with a score of 692. Blue Cash Preferred Card (American Express) (680) ranks second and Chase Sapphire Reserve (669) ranks third.

Capital One Platinum Mastercard ranks highest in customer satisfaction among bank credit cards with no rewards or annual fee, with a score of 619.

Southwest Rapid Rewards Premier Card (Chase) ranks highest in customer satisfaction among airline co-branded credit cards, with a score of 658. Southwest Rapid Rewards Priority Card (Chase) (649) ranks second and Delta SkyMiles Platinum American Express Card (627) ranks third.