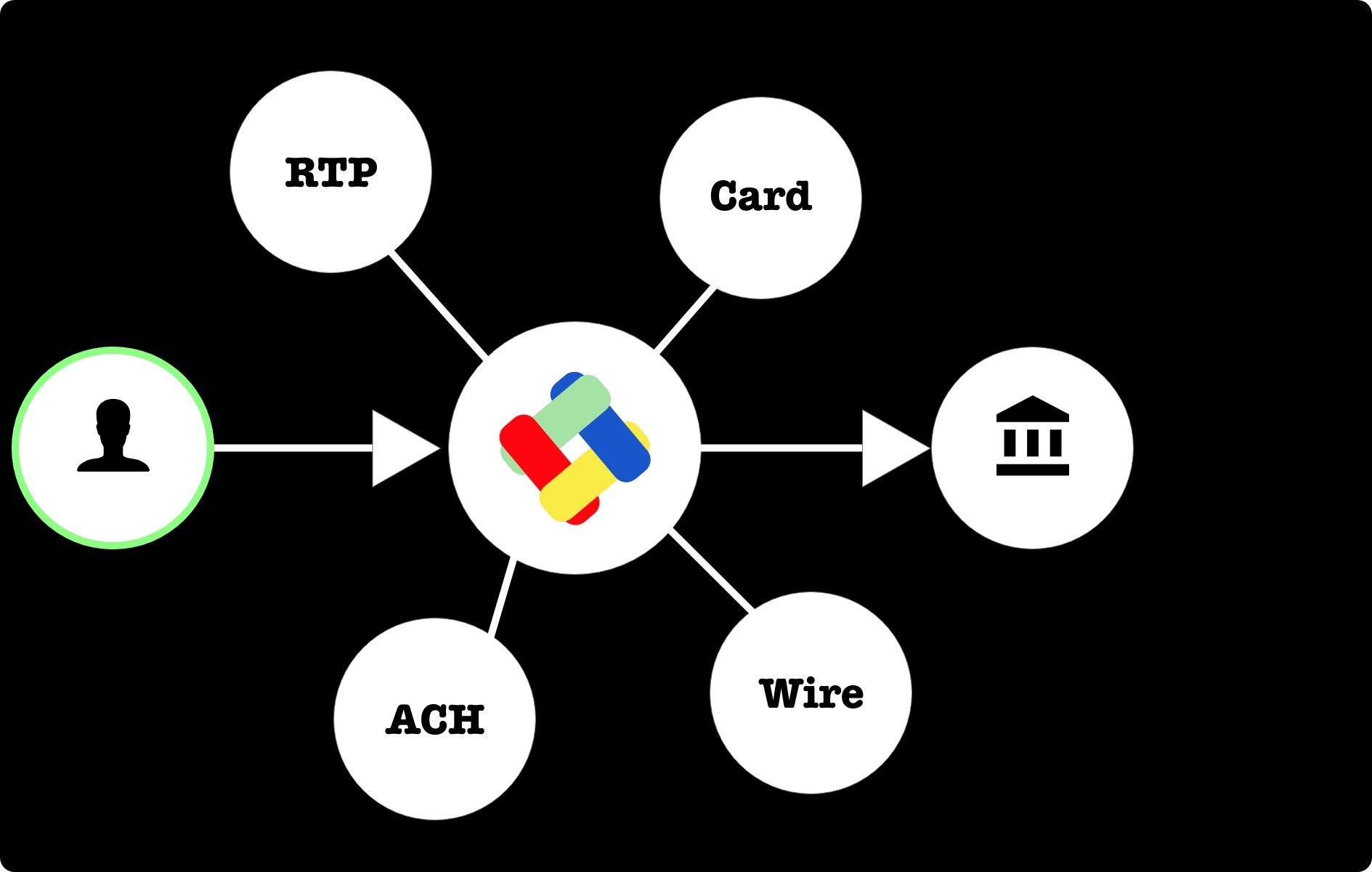

Payments startup Wafi has introduced a new payment processing platform to help ecommerce businesses accept bank transfers online.

Dubbed Wafi.cash, the platform features an application programming interface (API) to safely process bank payments.

The platform, which has been designed to remove unnecessary entities in the payment processing system, provides its users with 10 times less processing fees than its counterparts, according to Wafi.

Wafi.cash comprises three products, Wafi Checkout, Wafi Pay and Wafi Connect.

Wafi Checkout will enable ecommerce businesses to accept bank payments safely while Wafi Pay will facilitate sending and accepting bank payments.

Wafi Connect can help businesses to receive verified bank account data of their customers for processing payments.

In a post, Wafi said: “We have always had a need to transact, and transactions have evolved overtime, from a trade by barter system to exchanging goods and services for cash. As a result, a seamless payment processing system is critical to global commerce.

“While we’ve made significant progress in helping people pay for goods and services everywhere payment processing is still not great.

“Fraud, identity theft, high processing fees, and poor disparate user experiences continue to plague businesses and their customers.”

According to Wafi, the consumer spending behaviour has undergone changes in the last couple of years, with 2021 saw a 23% increase in the use of debit card.